Has Etsy’s Long Slide Created a 2025 Opportunity for Patient Investors?

- Wondering if Etsy is a hidden bargain or a value trap at its current price? You are not alone; this stock has been puzzling a lot of thoughtful investors lately.

- After a bruising multi year slide, with the share price still down about 72% over 5 years and 58% over 3 years, Etsy has been treading water more recently, roughly flat over the last week and up about 1.1% over the past month and year to date.

- That sideways action comes as investors digest a mix of macro headwinds for discretionary e commerce and company specific updates around product initiatives and marketplace efficiency. All of these influence how much growth investors are willing to price in. At the same time, shifting sentiment toward online platforms and changing expectations for consumer spending have kept volatility and risk perception elevated.

- On our framework, Etsy scores a 3 out of 6 on undervaluation checks, suggesting there are some genuine value signals but also clear areas of concern. Next, we will walk through the main valuation approaches investors are using today, and then close with a more powerful way to think about Etsy’s value in the context of its long term narrative.

Find out why Etsy's -5.5% return over the last year is lagging behind its peers.

Approach 1: Etsy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back into todays dollars. For Etsy, this means looking at the cash the business can return to shareholders over time and adjusting it for risk and the time value of money.

Etsy currently generates about $645 million in Free Cash Flow, and analysts expect this to rise steadily based on both near term forecasts and longer term extrapolations. By 2029, annual Free Cash Flow is projected to reach roughly $784 million, with further growth implied out to 2035 as the marketplace scales and monetization improves.

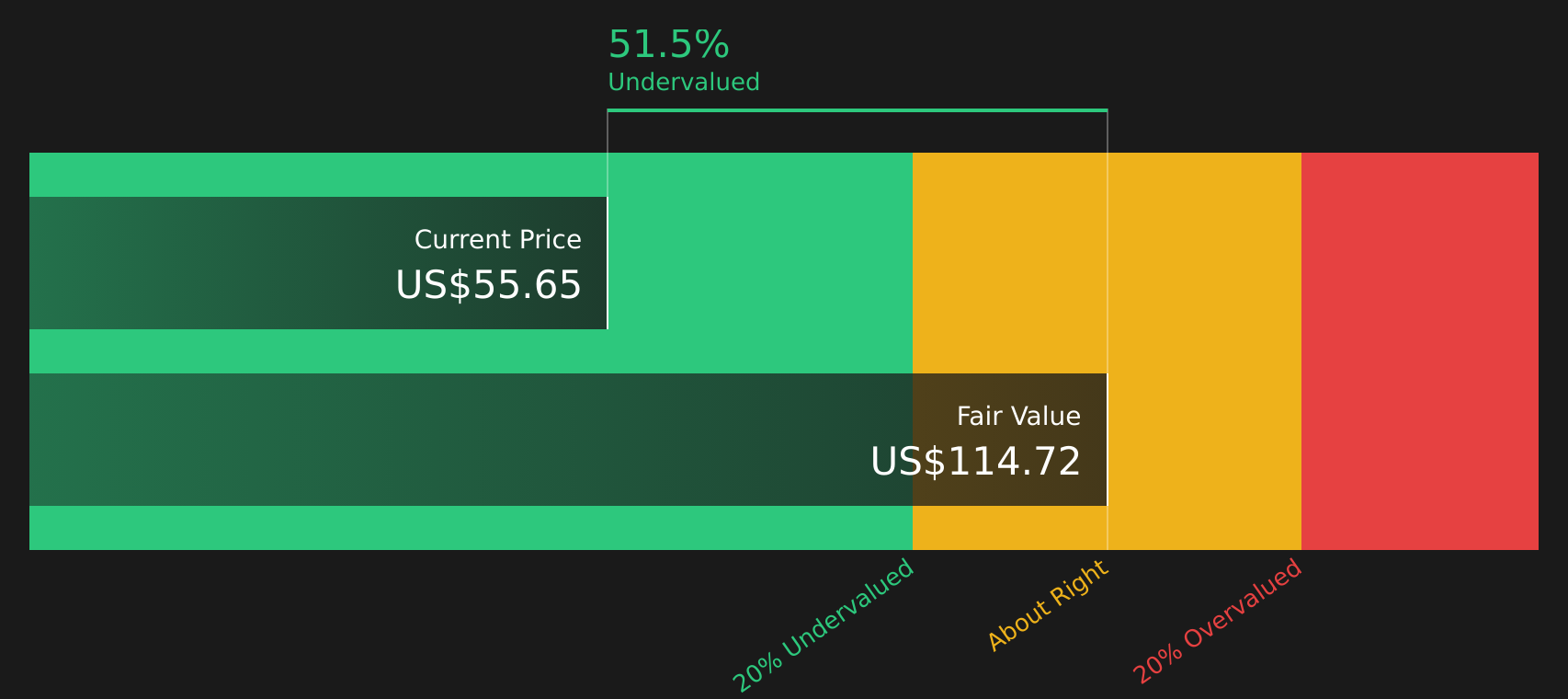

Using a 2 stage Free Cash Flow to Equity model, these cash flows translate to an estimated intrinsic value of about $110.11 per share. Relative to todays market price, the model suggests the stock trades at roughly a 51.2% discount, indicating that investors may be pricing in a far more pessimistic future than the cash flow outlook implies.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Etsy is undervalued by 51.2%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

Approach 2: Etsy Price vs Earnings

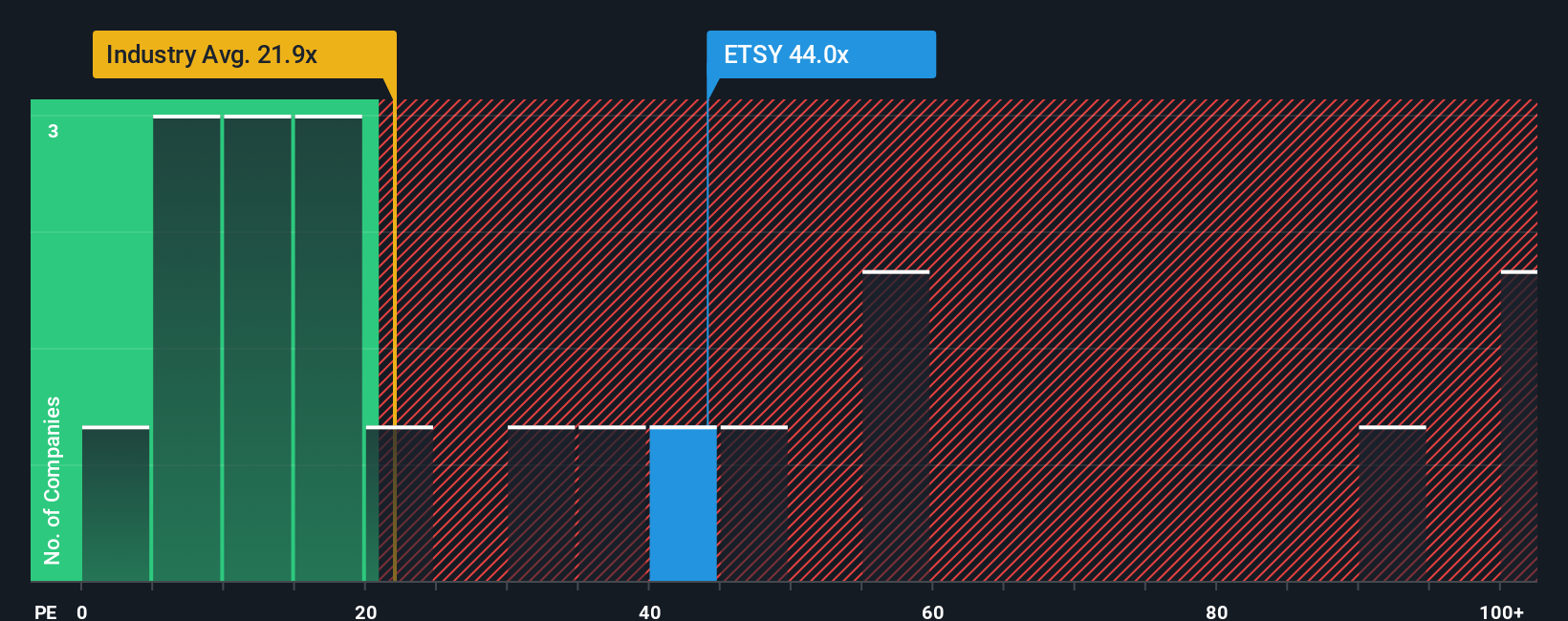

For profitable companies like Etsy, the Price to Earnings ratio is a practical way to gauge how much investors are willing to pay today for each dollar of current earnings. It ties the share price directly to the bottom line that ultimately supports long term returns.

What counts as a fair PE depends heavily on growth expectations and perceived risk. Faster, more resilient earnings growth can justify a higher multiple, while cyclical or uncertain profits usually warrant a lower one. Etsy currently trades on a PE of about 29.1x, which is richer than both the Multiline Retail industry average of roughly 19.2x and the peer group average of about 17.9x.

Simply Wall St estimates a Fair Ratio for Etsy of around 22.8x, a proprietary view of what its PE should be after adjusting for factors like earnings growth, profit margins, industry, market cap and risk profile. This is more tailored than a simple peer or sector comparison, which can miss company specific strengths and weaknesses. With Etsy’s actual PE sitting meaningfully above the Fair Ratio, the stock looks modestly expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Etsy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you pair a clear story about Etsy’s future with your own numbers for revenue, earnings and margins. It automatically links that story to a financial forecast and a Fair Value that you can compare with today’s share price to decide whether to buy, hold or sell. It then dynamically updates as new news or earnings arrive. You can see, for example, how a bullish investor expecting AI driven personalization to push earnings toward the higher end of analyst estimates and justify a Fair Value in the mid 80s might reach a very different conclusion from a more cautious investor who focuses on buyer churn, margin pressure and tougher competition, and therefore sees Fair Value closer to the high 40s.

Do you think there's more to the story for Etsy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报