Nitro Games Oyj And 2 Other European Penny Stocks To Consider

European markets have recently shown mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower and varied results across major stock indexes. Amid these fluctuations, investors often turn their attention to smaller or newer companies, where penny stocks—despite their somewhat outdated name—remain a relevant investment area. These stocks can offer a blend of affordability and growth potential when they possess strong financial foundations, making them an intriguing option for those seeking to explore promising opportunities in the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.75 | €1.64B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.70 | €83.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.06 | €64.91M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.10 | SEK188.6M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.315 | €381.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.77 | €25.79M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 291 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nitro Games Oyj (OM:NITRO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nitro Games Oyj develops and publishes mobile games across the European Union, North America, the United Kingdom, and internationally with a market cap of SEK36.84 million.

Operations: The company's revenue is primarily derived from its Service Business, which accounts for €8.62 million, while the Games Business contributes €0.68 million.

Market Cap: SEK36.84M

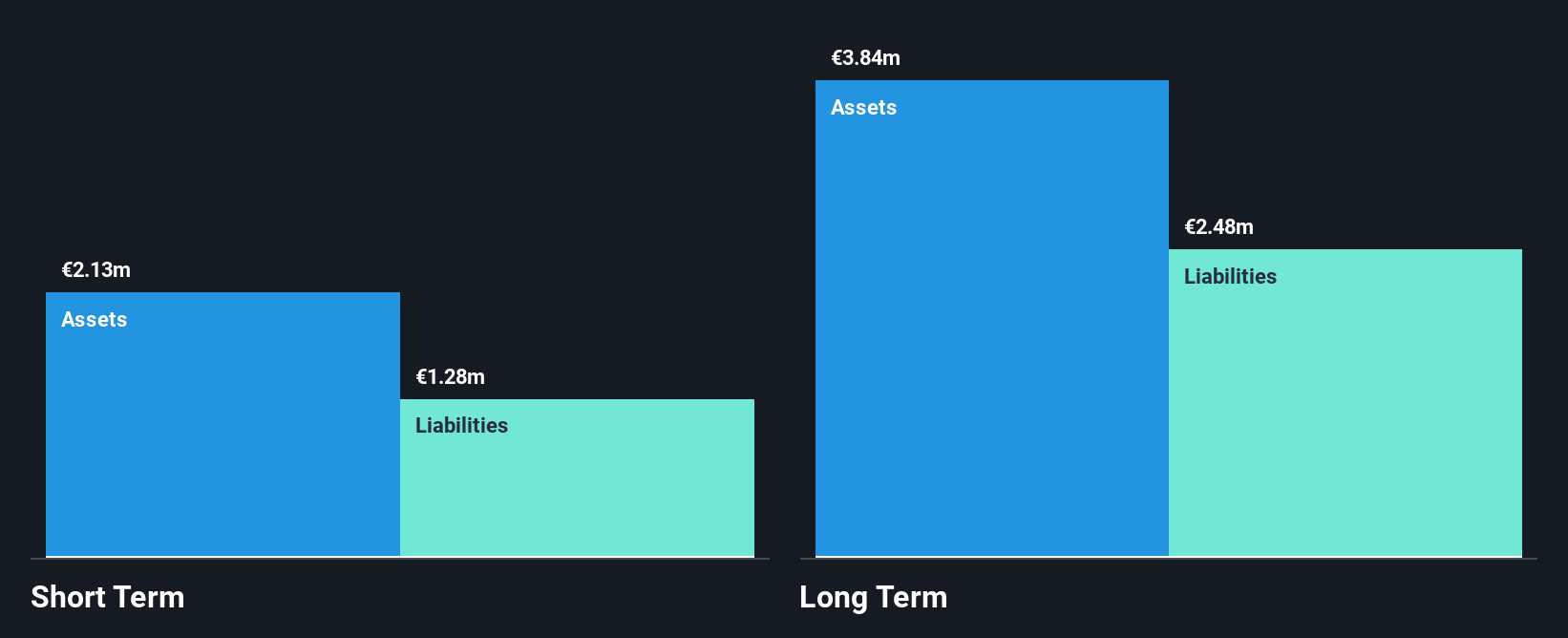

Nitro Games Oyj, with a market cap of SEK36.84 million, is navigating the challenges typical of penny stocks. Its revenue primarily stems from its Service Business (€8.62 million), while the Games Business contributes marginally (€0.68 million). Despite being unprofitable, Nitro has reduced losses over five years and maintains a sufficient cash runway for more than three years due to positive free cash flow growth. Recent earnings show a decline in sales and net income compared to the previous year, yet an expanded agreement with Starbreeze signals potential for sustained service revenue amidst high debt levels (net debt to equity ratio at 70.4%).

- Jump into the full analysis health report here for a deeper understanding of Nitro Games Oyj.

- Evaluate Nitro Games Oyj's prospects by accessing our earnings growth report.

onesano (WSE:ONO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Onesano S.A. is involved in research and development focusing on dietetics, animal nutrition, bioremediation, and agrotechnological processes in Poland with a market cap of PLN52.44 million.

Operations: Onesano generates revenue of PLN11.52 million from its Vitamins & Nutrition Products segment.

Market Cap: PLN52.44M

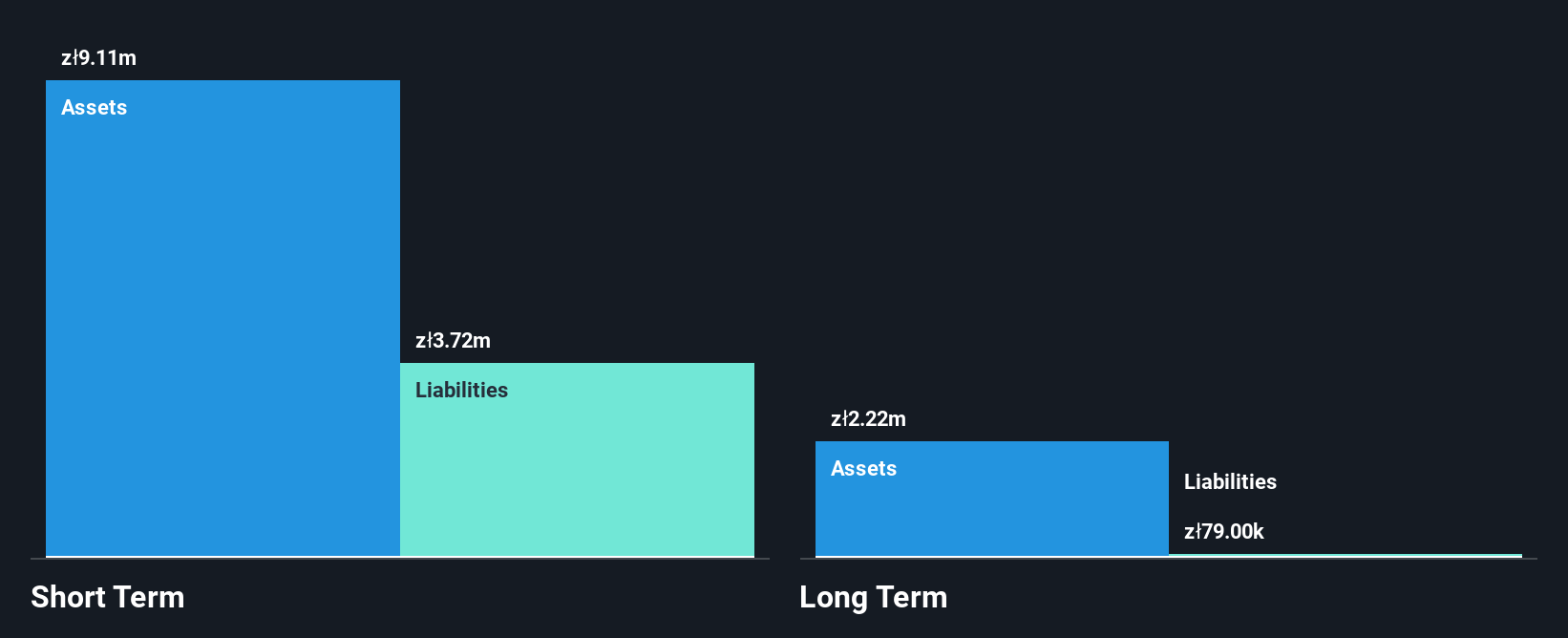

Onesano S.A., with a market cap of PLN52.44 million, faces typical challenges associated with penny stocks. Despite generating revenue of PLN11.52 million from its Vitamins & Nutrition Products segment, the company remains unprofitable and has a limited cash runway of less than a year. Recent earnings for Q3 2025 show slight revenue growth to PLN3 million but sustained net losses at PLN1.34 million compared to the previous year. Short-term assets exceed liabilities, indicating some financial stability, though long-term profitability remains uncertain amidst declining earnings over five years and negative return on equity at -81.61%.

- Navigate through the intricacies of onesano with our comprehensive balance sheet health report here.

- Assess onesano's previous results with our detailed historical performance reports.

Starhedge (WSE:SHG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Starhedge S.A. is an investment company operating in the power industry, financial sector, commodities and real estate markets, and new technologies both in Poland and internationally, with a market cap of PLN30.94 million.

Operations: Starhedge S.A. does not report specific revenue segments.

Market Cap: PLN30.94M

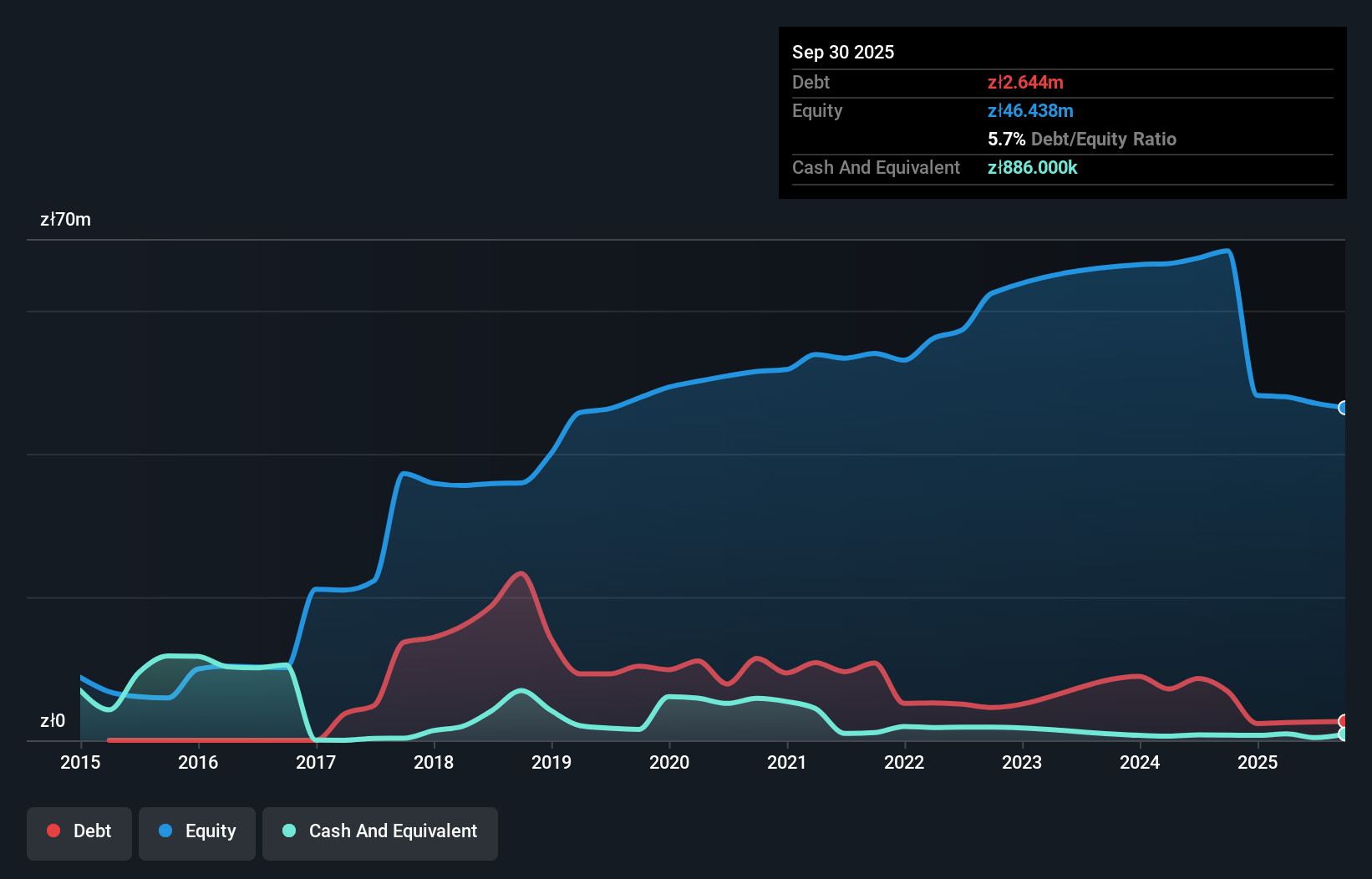

Starhedge S.A., with a market cap of PLN30.94 million, operates across diverse sectors but remains pre-revenue, indicating early-stage operations typical of penny stocks. Recent Q3 2025 results show a net loss of PLN0.594 million compared to a profit last year, highlighting ongoing financial challenges. Despite this, the company's debt management is commendable; its debt-to-equity ratio has decreased significantly over five years to a satisfactory level of 3.8%. Short-term assets comfortably cover both short and long-term liabilities, providing some financial stability while maintaining positive free cash flow and an extended cash runway exceeding three years.

- Click to explore a detailed breakdown of our findings in Starhedge's financial health report.

- Learn about Starhedge's historical performance here.

Turning Ideas Into Actions

- Explore the 291 names from our European Penny Stocks screener here.

- Ready For A Different Approach? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报