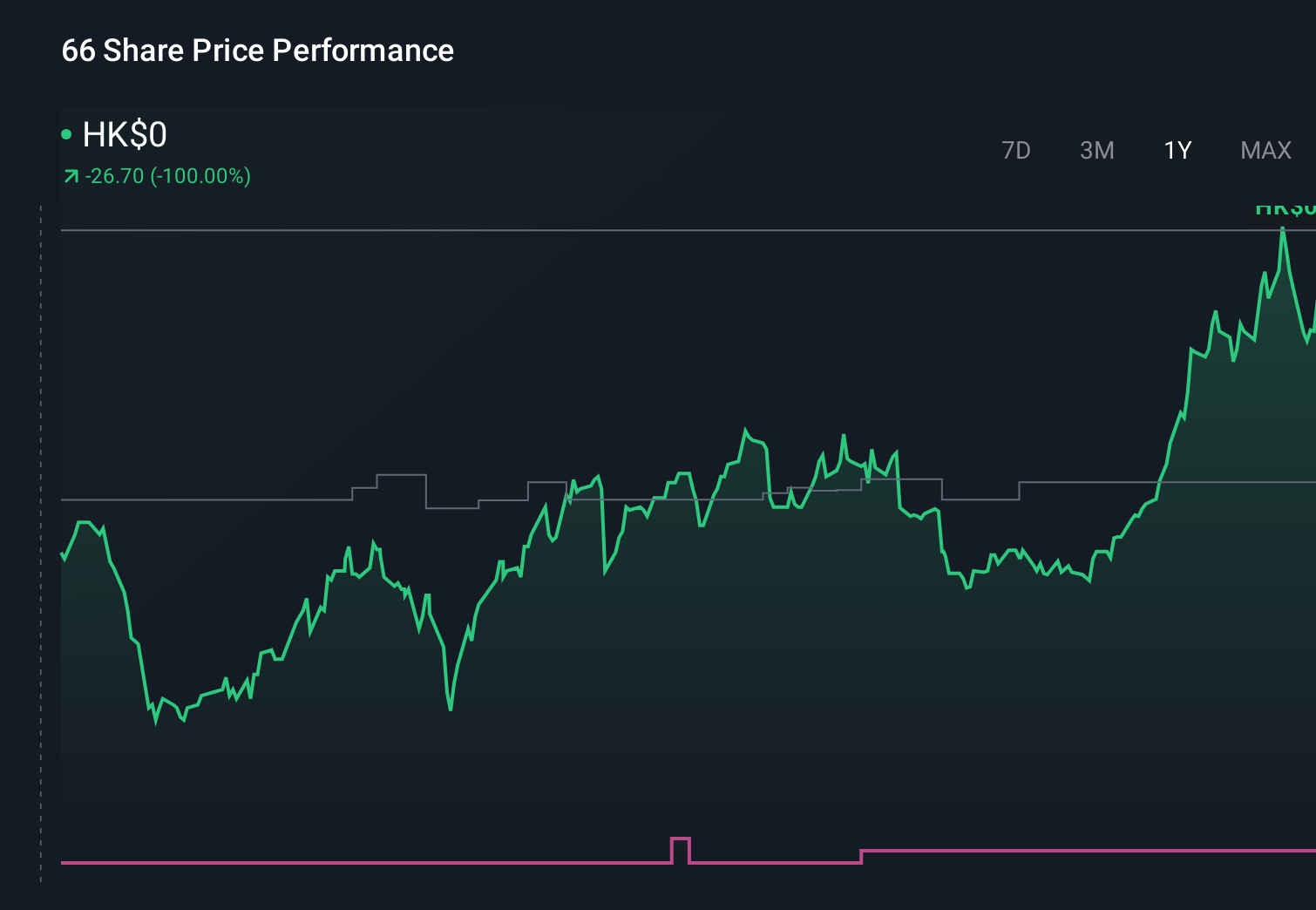

How Qube’s Two IFC Lease Will Impact MTR (SEHK:66) Investors

- Global hedge fund Qube Research & Technologies has agreed to lease 146,000 sq ft at MTR-owned Two International Finance Centre from 2027, becoming the tower’s largest private tenant and underscoring continued appetite for Grade A offices in Central despite earlier market softness.

- The deal reinforces MTR’s position as a major commercial landlord in Hong Kong’s core financial district, adding visibility to future rental income and highlighting the railway operator’s property-driven earnings mix.

- We’ll now explore how securing Two IFC’s largest private tenant could influence MTR’s investment narrative, particularly its property earnings resilience.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MTR Investment Narrative Recap

To own MTR, you generally need to believe that its mix of regulated rail operations and recurring property income can offset Hong Kong’s cycles in demand and housing. The Qube lease at Two IFC slightly supports the short term catalyst around property earnings resilience, but does not materially change the key risk that heavy planned rail and maintenance spending might outpace future passenger and rental growth.

The recent H1 2025 results, with HK$27,360 million in revenue and HK$7,733 million in net income, are a useful backdrop here, as they show how property and transport earnings currently combine ahead of that large HK$140 billion rail investment pipeline. Against this earnings base, signing one of Central’s largest office leases helps illustrate how incremental rental visibility can partially cushion the impact if future transit demand or the housing market underperform expectations.

Yet while the lease strengthens the story around rental visibility, investors should still be alert to how rising capex and funding costs could interact with...

Read the full narrative on MTR (it's free!)

MTR's narrative projects HK$64.0 billion revenue and HK$12.0 billion earnings by 2028. This requires 3.3% yearly revenue growth and an earnings decrease of HK$5.5 billion from HK$17.5 billion today.

Uncover how MTR's forecasts yield a HK$27.86 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates sit between HK$17.68 and HK$27.86, underscoring how far apart individual views can be. You can weigh those against the risk that MTR’s large rail capex cycle may strain future margins if passenger growth and property income do not keep pace.

Explore 2 other fair value estimates on MTR - why the stock might be worth as much as HK$27.86!

Build Your Own MTR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MTR research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MTR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MTR's overall financial health at a glance.

No Opportunity In MTR?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报