Envista (NVST) Valuation Check After Recent Share Price Gains

Envista Holdings (NVST) has quietly put together a solid run, with the stock climbing over the past month and year as investors warm to its improving earnings picture and steady dental equipment demand.

See our latest analysis for Envista Holdings.

That upswing is not just a blip, with a roughly mid teens year to date share price return and a high teens 1 year total shareholder return hinting that investors are warming back up, even as longer term total shareholder returns remain in the red.

If Envista has you rethinking the healthcare space, it might be worth exploring other opportunities across healthcare stocks to see what else fits your portfolio goals.

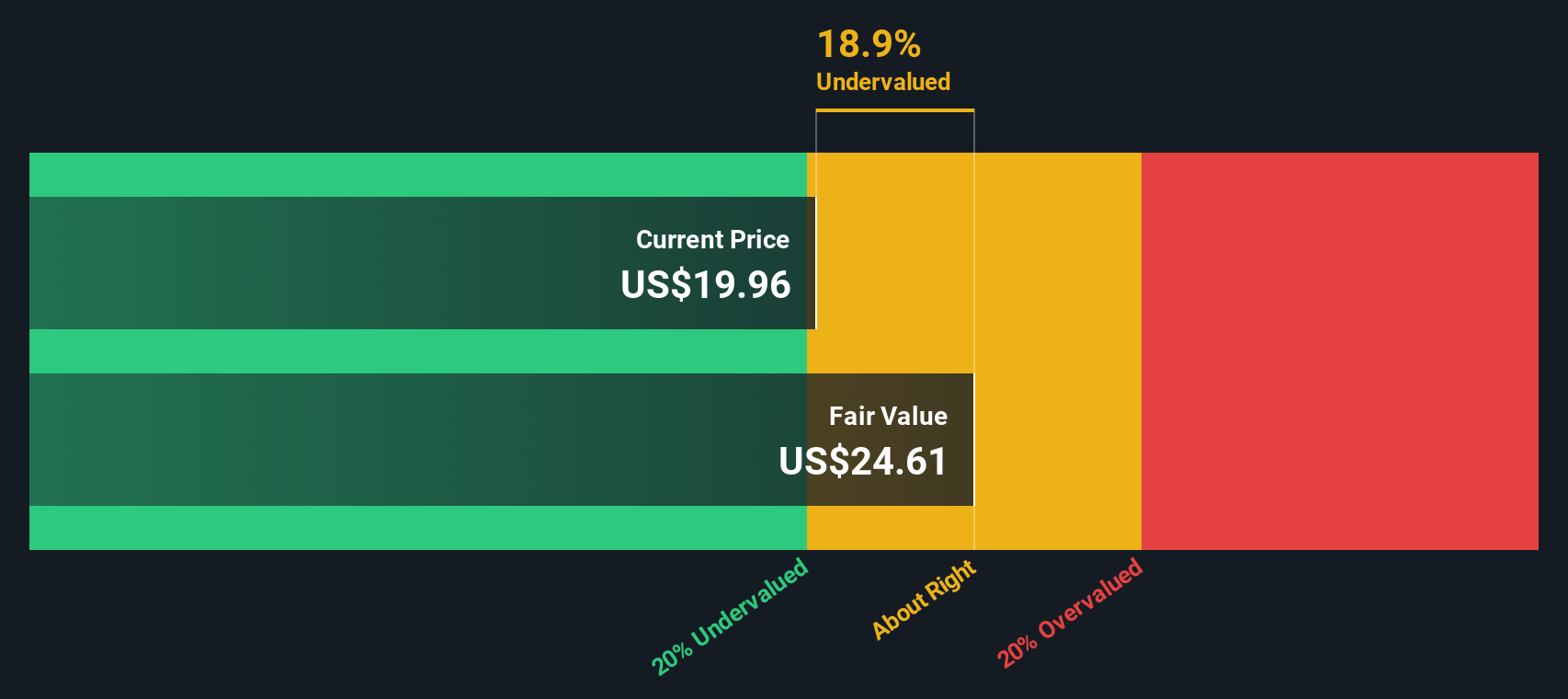

But with earnings accelerating while the share price now hovers near analyst targets and only a modest intrinsic discount, is Envista quietly undervalued or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 0% Overvalued

With Envista trading just above the narrative fair value of about $22.15, the story hinges on how far margins and earnings can really stretch.

Ongoing cost reductions (notably 15% G&A reduction in the first half), coupled with operational optimization and unit cost reductions (especially within Spark), are catalysts for sustained margin improvement and future EPS growth, as scale and digital adoption continue.

Curious how modest top line growth can still back an ambitious earnings ramp and richer multiple over time? The narrative leans on bolder margin upgrades, cash flow resilience, and an earnings bridge that may surprise you. Want to see exactly which assumptions power that fair value math and how they stack up against today’s price?

Result: Fair Value of $22.15 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Chinese pricing reforms and rising trade barriers could still squeeze margins and derail the carefully constructed earnings and valuation narrative.

Find out about the key risks to this Envista Holdings narrative.

Another Angle on Value

While the narrative fair value pegs Envista at about its current price, our DCF model points to a small upside, with the shares trading roughly 2.5 percent below its fair value. It is not a screaming bargain. However, does a modest safety margin make the volatility worth it?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Envista Holdings Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a custom view in minutes: Do it your way.

A great starting point for your Envista Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Turn today’s Envista insights into a smarter portfolio by actively choosing your next ideas with the Simply Wall St Screener before the market moves on without you.

- Target income potential with reliable payouts by reviewing these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

- Ride powerful secular themes by backing these 24 AI penny stocks positioned at the forefront of intelligent automation and productivity gains.

- Identify potentially mispriced opportunities by searching through these 916 undervalued stocks based on cash flows where current prices may not fully reflect the strength of underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报