Assessing Premium Brands Holdings (TSX:PBH)’s Valuation After Its Recent Share Price Run-Up

Premium Brands Holdings stock moves

Premium Brands Holdings (TSX:PBH) has quietly delivered a solid run this year, with the share price climbing about 26% year to date and roughly 12% over the past month.

See our latest analysis for Premium Brands Holdings.

That climb has come with some real momentum, with a 12.15% one month share price return building on a 26.37% year to date share price gain and a 33.79% one year total shareholder return. This hints that investors are steadily warming to its growth profile.

If this kind of steady compounding appeals to you, it could be worth scanning other food and consumer names through fast growing stocks with high insider ownership for fresh ideas with similar upside potential.

With earnings expanding far faster than the share price and analysts still seeing upside to current levels, is Premium Brands quietly trading at a discount, or has the market already baked in the next leg of growth?

Most Popular Narrative Narrative: 12.5% Undervalued

With the most followed narrative placing fair value above the CA$101.50 last close, the story centers on whether rapid earnings scaling can sustain that gap.

The ramp-up of several new production facilities and the launch of significant new programs, particularly in the U.S. market, is expected to drive strong organic growth over the next few quarters and years. By leveraging rising demand for convenience and ready-to-eat foods, this is expected to accelerate revenue growth and improve operating leverage, with a positive impact on both top-line and EBITDA.

Curious how sustained double digit revenue growth, sharply higher margins and a lower future earnings multiple can still add up to upside from here? Unlock the full valuation blueprint behind this narrative and see which long term assumptions really drive that fair value call.

Result: Fair Value of $116 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could unravel if volatile protein input costs persist or major facility ramp ups and acquisitions stumble, which could delay expected margin gains.

Find out about the key risks to this Premium Brands Holdings narrative.

Another Lens on Valuation

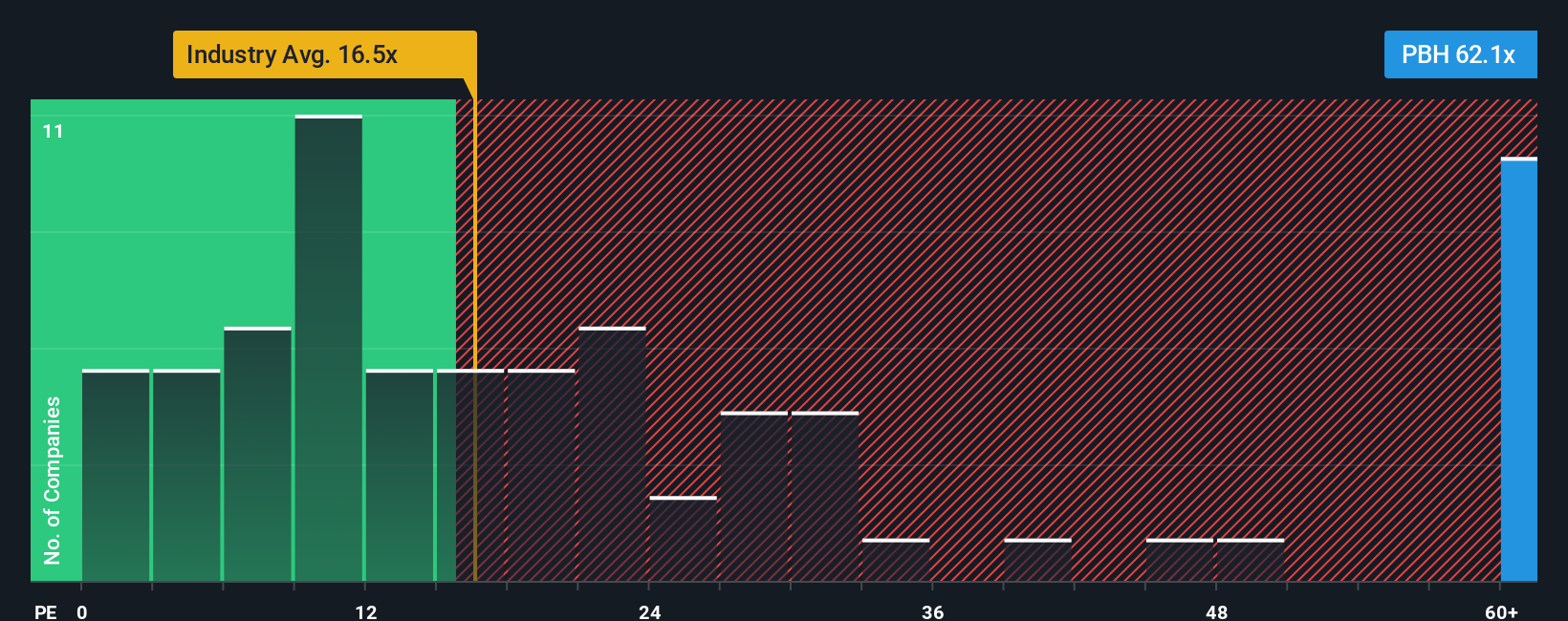

Our valuation checks suggest a very different picture. Premium Brands is trading at a rich 68.6 times earnings, compared with about 17.2 times for the North American food sector and 10.9 times for peers, and is even above our fair ratio of 58.6 times. Is the market overpaying for the growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Premium Brands Holdings Narrative

If this perspective does not quite fit your view and you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your Premium Brands Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Set yourself up for the next opportunity by using the Simply Wall St Screener to uncover fresh stocks that match your strategy before the crowd catches on.

- Capture capital growth potential by scanning these 3628 penny stocks with strong financials that already show strengthening balance sheets and improving business momentum.

- Position ahead of the next tech wave through these 24 AI penny stocks with real products, growing revenues and meaningful exposure to artificial intelligence trends.

- Lock in quality at a discount by reviewing these 916 undervalued stocks based on cash flows where strong cash flows and conservative pricing work in your favor, not against you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报