Has Global Payments Share Price Slide Created a Long Term Value Opportunity?

- Wondering if Global Payments at around $82 a share is a beaten down opportunity or a value trap? You are not alone, and this article is going to unpack exactly what the market might be missing.

- After sliding a hefty 26.6% year to date and 24.9% over the last year, the stock has recently bounced about 14.0% in the last month, with only a modest 0.2% move over the last week, hinting that sentiment may be at a turning point.

- That shift has come as investors refocus on Global Payments strategic push in integrated payments and software led solutions, alongside ongoing partnerships with major merchants and technology platforms. Together, these developments have helped reframe the narrative from pure macro worry to a more balanced view of long term growth versus risk.

- Right now Global Payments scores a solid 5 out of 6 on our valuation checks, which suggests the market might be underestimating its worth. Next, we will walk through the different valuation lenses investors use, before finishing with an even more powerful way to think about what this business is really worth.

Find out why Global Payments's -24.9% return over the last year is lagging behind its peers.

Approach 1: Global Payments Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate over and above the return investors require on their equity, then capitalizes that stream into an intrinsic value per share.

For Global Payments, the analysis starts with a Book Value of $95.80 per share and a Stable EPS of $13.21 per share, based on weighted future return on equity estimates from 7 analysts. With an Average Return on Equity of 13.36% and a Cost of Equity of $8.88 per share, the company is expected to generate Excess Return of $4.32 per share on its equity base.

This return is projected on a Stable Book Value of $98.87 per share, using weighted future book value estimates from 4 analysts, to estimate the value of Global Payments ability to create value beyond its funding cost. On this basis, the Excess Returns model arrives at an intrinsic value of about $174 per share, implying the stock is roughly 52.9% undervalued versus the current price near $82.

Result: UNDERVALUED

Our Excess Returns analysis suggests Global Payments is undervalued by 52.9%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

Approach 2: Global Payments Price vs Earnings

For a consistently profitable company like Global Payments, the price to earnings ratio is a practical way to gauge how much investors are paying for each dollar of current earnings. Higher growth and lower perceived risk usually justify a higher PE, while slower growth or elevated risk should pull that multiple down.

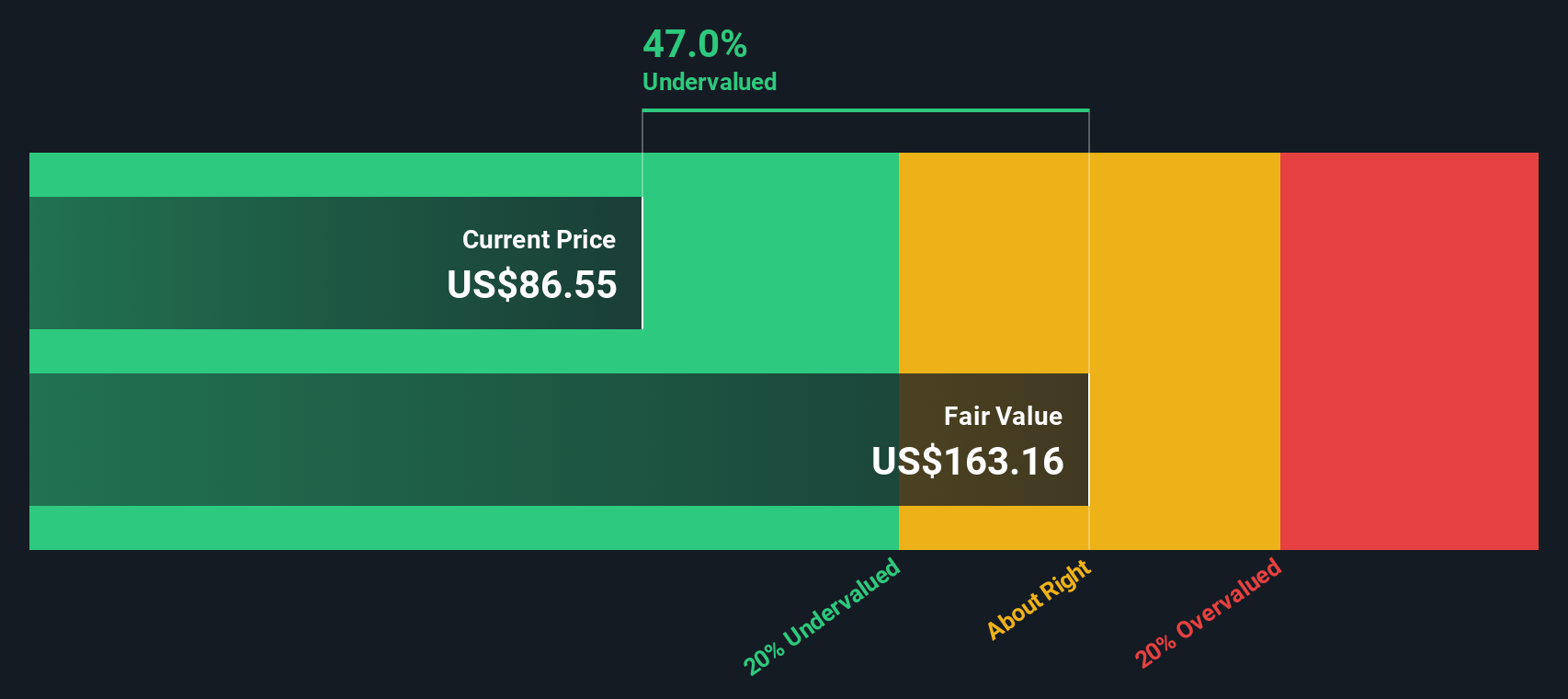

Global Payments currently trades at about 11.88x earnings, which is below both the Diversified Financial industry average of roughly 13.71x and the broader peer group average of around 79.94x. This suggests the market is applying a discount. Simply Wall St takes this further with its proprietary Fair Ratio, which estimates what a reasonable PE should be once factors like earnings growth, profit margins, industry, market cap and specific risks are fully accounted for.

In Global Payments case, the Fair Ratio is calculated at 17.41x, notably above the current 11.88x. Because this approach is tailored to the company’s own fundamentals rather than broad peer comparisons, it offers a more nuanced view and indicates that the shares look undervalued on a multiple basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Global Payments Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy way to connect the story you believe about Global Payments with a structured forecast and a clear fair value estimate on Simply Wall St’s Community page, used by millions of investors.

A Narrative is simply your own storyline for the company, where you spell out how you think revenue, earnings and margins will evolve, and then turn that story into numbers that flow through to a fair value per share.

Because a Narrative directly links the company’s qualitative story to a quantitative forecast and then to a fair value, it becomes a practical decision tool, helping you compare that fair value to today’s share price to decide whether Global Payments looks like a buy, a hold or a sell.

These Narratives are dynamic, automatically updating when new information like earnings releases, guidance changes or major news hits. You can see in real time how optimistic investors with a higher fair value near $194, versus more cautious investors closer to $65, are effectively telling very different stories about Global Payments future.

Do you think there's more to the story for Global Payments? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报