Customers Bancorp (CUBI): Taking Stock of Valuation After Strong Recent Share Price Gains

Customers Bancorp (CUBI) has been quietly rewarding patient shareholders, with the stock climbing about 20% over the past month and more than 60% this year. This performance is prompting a closer look at what is driving the move.

See our latest analysis for Customers Bancorp.

At around $77.91 per share, Customers Bancorp’s strong recent 1 month share price return sits on top of an already impressive multi year total shareholder return record. This may indicate that momentum is still building as investors reassess its earnings strength and risk profile.

If this kind of sustained rerating has your attention, it might be a good moment to explore fast growing stocks with high insider ownership for other under the radar names showing similar conviction behind the numbers.

With earnings still growing in the double digits and the share price already near analyst targets, the key debate now is simple: is Customers Bancorp still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 8.7% Undervalued

With the narrative fair value near $85 per share against a $77.91 close, the storyline leans toward upside, hinging on aggressive growth and margin expansion.

The rapid digitization of commercial banking and payments is driving institutional clients to seek tech-focused, 24/7 banking solutions. This shift is one that Customers Bancorp capitalizes on through its proprietary cubiX platform. With payments volume of $1.5 trillion in 2024 and accelerating growth, ongoing regulatory clarity around digital assets and stablecoins positions Customers as the leading provider, supporting significant potential for deposit and fee income growth.

Curious how this payments engine, rising margins, and a very different future earnings base all connect to that fair value estimate? The surprising assumptions sit inside the narrative.

Result: Fair Value of $85.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained growth depends on digital asset markets staying orderly and competition not eroding cubiX economics faster than analysts currently anticipate.

Find out about the key risks to this Customers Bancorp narrative.

Another Lens on Valuation

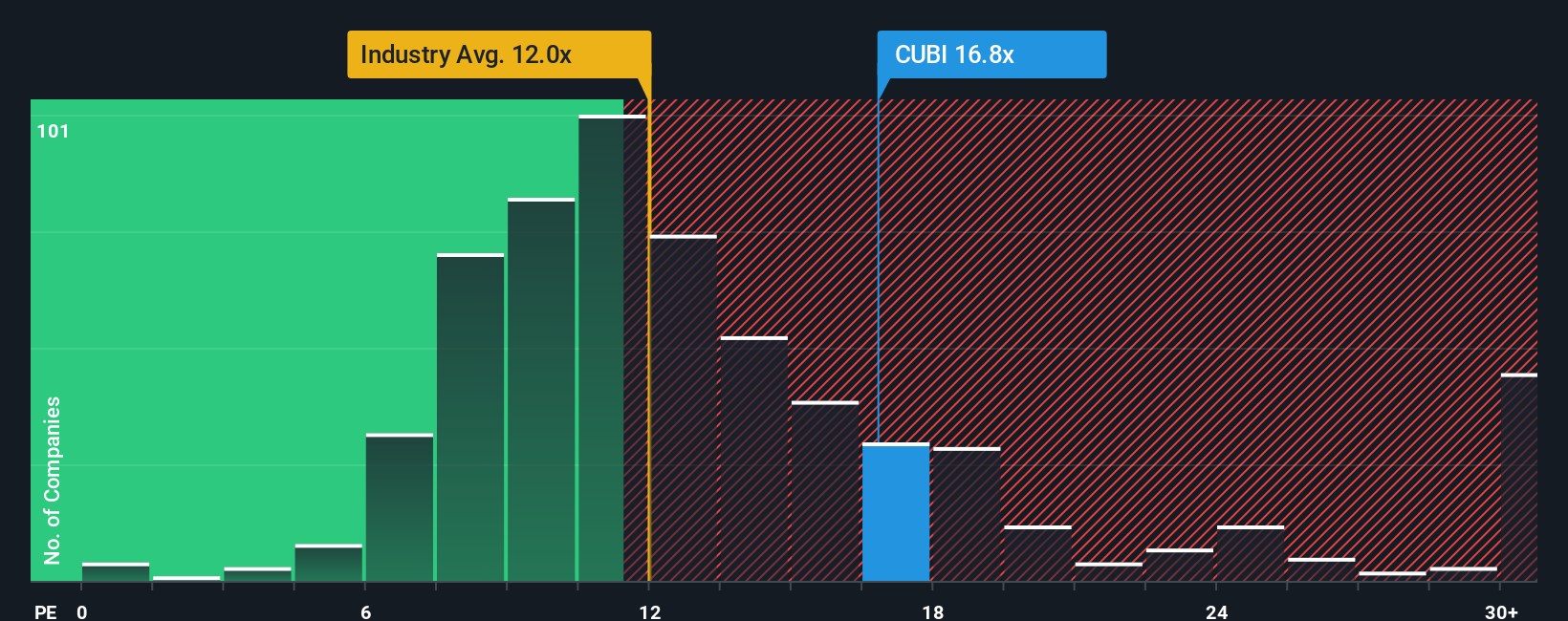

On earnings based valuation, Customers Bancorp looks a lot less clear cut. The stock trades on a price to earnings ratio of 16.4 times, richer than both US bank peers at 12.6 times and the wider industry at 12 times, but roughly in line with its 16.5 times fair ratio.

That mix suggests some downside risk if sentiment cools toward growth banks. It also indicates that the current multiple is not wildly stretched versus where the market could settle, leaving investors to decide whether the premium is still worth paying for cubiX driven growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Customers Bancorp Narrative

If your view differs or you prefer testing the numbers yourself, you can build a personalized thesis in just minutes with Do it your way.

A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity when you can quickly scan other promising setups tailored to your strategy using the Simply Wall Street Screener.

- Capture potential mispricings by running through these 917 undervalued stocks based on cash flows that may offer stronger upside than widely followed names.

- Supercharge your growth watchlist by targeting innovation leaders using these 24 AI penny stocks that are shaping tomorrow’s technology landscape.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that combine yield potential with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报