Exploring Électricite de Strasbourg Société Anonyme And 2 Other Promising Small Caps in Europe

As European markets navigate mixed signals with some indices like Germany's DAX showing gains while others such as France’s CAC 40 Index face declines, investors are keeping a close eye on economic indicators and central bank policies that could influence small-cap performance. In this environment, identifying promising small-cap stocks requires a keen understanding of how these companies can leverage current market conditions to their advantage, particularly in sectors poised for growth amidst economic resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme is involved in supplying electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of approximately €1.29 billion.

Operations: Revenue primarily comes from the production and marketing of electricity and gas, contributing €1.02 billion, followed by distribution activities at €329.54 million. The company has a market cap of approximately €1.29 billion.

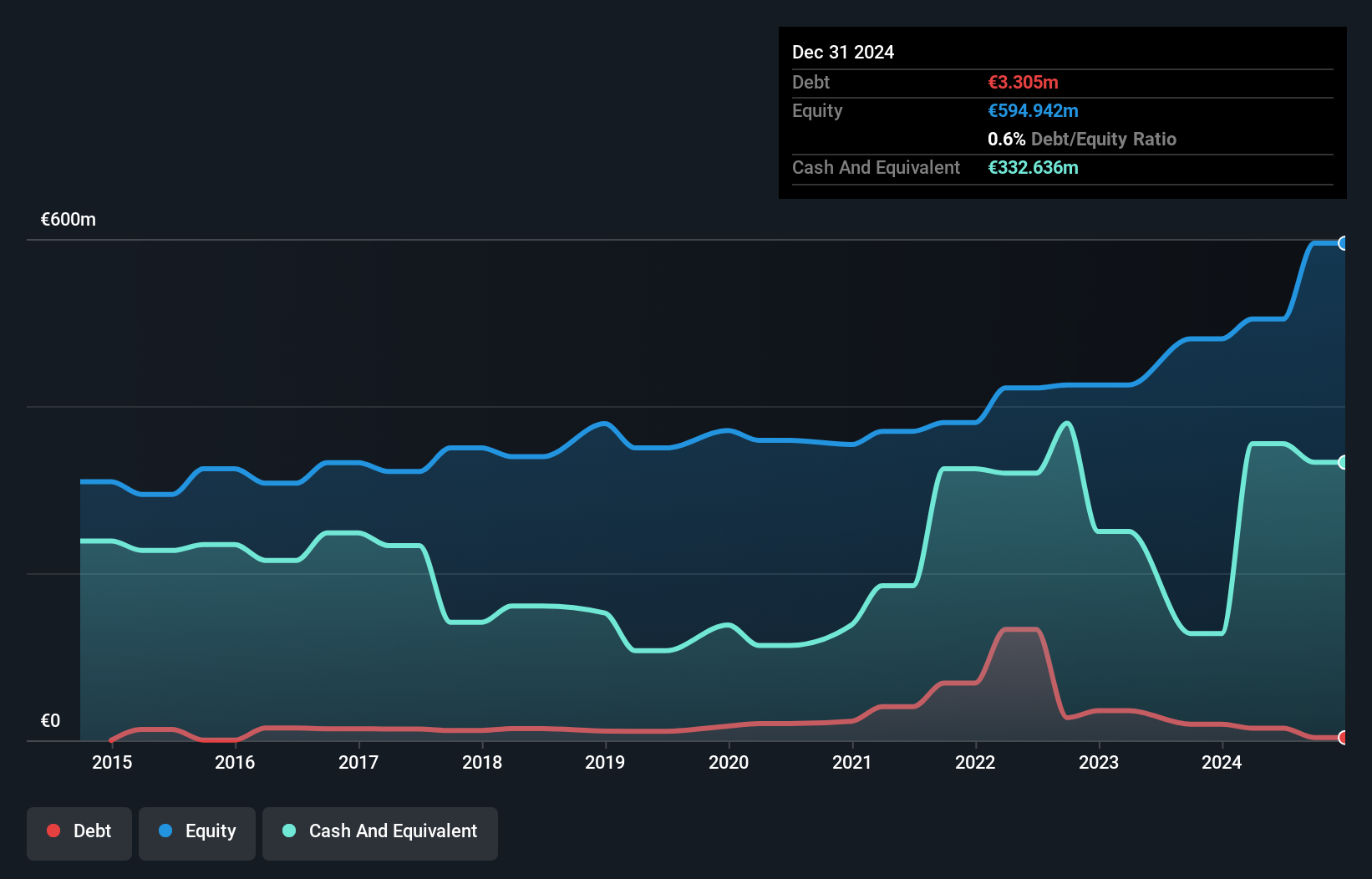

Électricite de Strasbourg, a smaller player in the European energy sector, has shown promising financial health with its debt to equity ratio dropping from 5.6 to 0.5 over five years and having more cash than total debt. Trading at 56% below fair value estimates, it appears undervalued despite earnings growth of 10%, outpacing the industry's -1.5%. Recent earnings announcements revealed net income increased to €84 million from €79 million, while basic earnings per share rose slightly to €11.76 from €11.06, suggesting robust profitability amidst a challenging revenue environment of €720 million compared to last year's €823 million.

Ponsse Oyj (HLSE:PON1V)

Simply Wall St Value Rating: ★★★★★★

Overview: Ponsse Oyj is a manufacturer of cut-to-length forest machines with operations spanning the Nordic and Baltic countries, Central and Southern Europe, South America, North America, Asia, Australia, and Africa, with a market cap of €719.48 million.

Operations: Ponsse Oyj generates revenue primarily from its Forest Machines and Maintenance Services segment, which accounted for €753.91 million. The company's financial performance is influenced by its operational efficiency, with particular attention to cost management impacting its profitability metrics such as the gross profit margin.

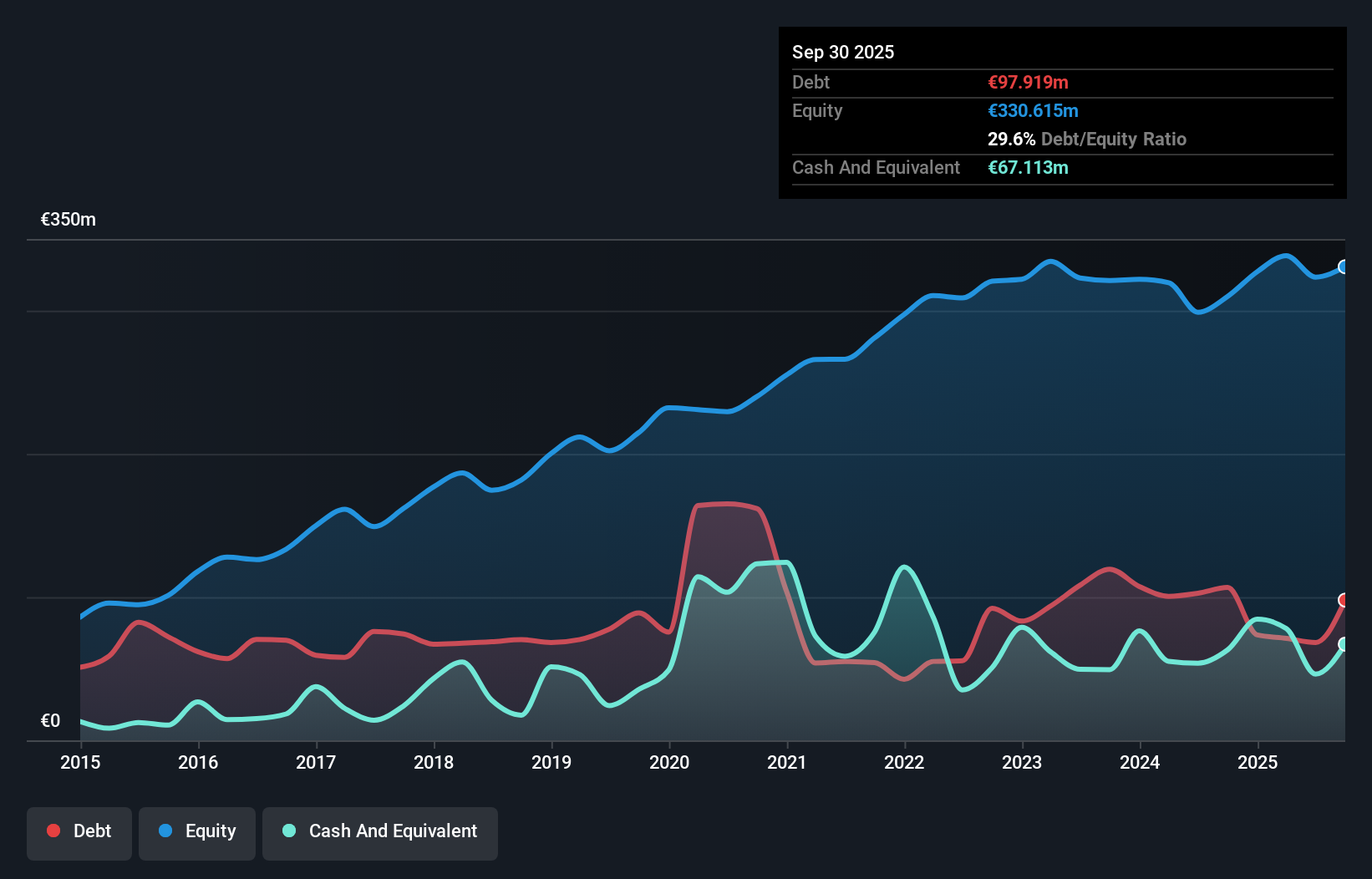

Ponsse Oyj, a notable player in the machinery sector, has demonstrated impressive earnings growth of 352.6% over the past year, significantly outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 9.3%, reflecting prudent financial management as it reduced from 67.4% to 29.6% in five years. Recent earnings announcements highlighted a substantial increase in net income to €23.73 million from just €0.32 million the previous year, with basic earnings per share rising sharply to €0.85 from €0.01, showcasing robust performance and potential for future value realization amidst ongoing technological advancements like the PONSSE Manager system enhancements.

- Click to explore a detailed breakdown of our findings in Ponsse Oyj's health report.

Assess Ponsse Oyj's past performance with our detailed historical performance reports.

Ernst Russ (XTRA:HXCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Ernst Russ AG is a publicly owned investment manager with a market cap of €235.15 million.

Operations: The company generates revenue primarily through investment management activities. It has a market capitalization of €235.15 million.

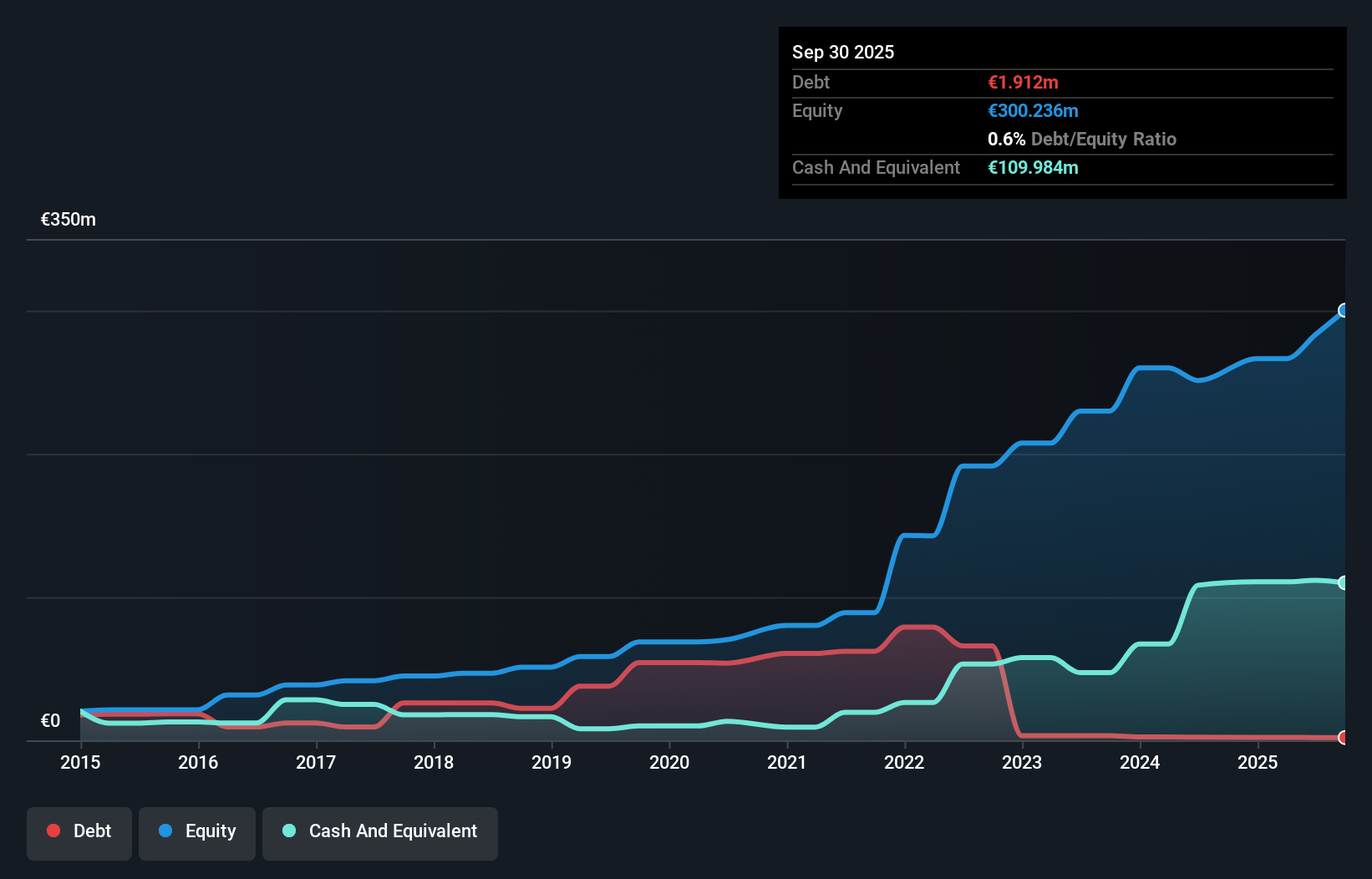

Ernst Russ, a small player in the maritime sector, has shown a notable increase in net income to €54.64M for the first nine months of 2025, up from €33.9M last year, despite sales dipping to €119.2M from €129.06M. Basic earnings per share improved to €1.62 compared to last year's €1.01, reflecting strong operational efficiency and strategic vessel sales that are likely boosting profitability margins significantly this year. The company expects full-year revenue between €152M and €162M with operating profit projections adjusted upwards due to favorable market conditions impacting their vessel operations positively this period.

- Take a closer look at Ernst Russ' potential here in our health report.

Review our historical performance report to gain insights into Ernst Russ''s past performance.

Turning Ideas Into Actions

- Reveal the 308 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报