Tempus AI (TEM): Valuation Check After New Breast Cancer Research Abstracts Gain Symposium Spotlight

Tempus AI (TEM) just drew fresh attention after ten of its oncology research abstracts were accepted for the 2025 San Antonio Breast Cancer Symposium, spotlighting how its real world data platform is being applied in metastatic breast cancer.

See our latest analysis for Tempus AI.

Despite the excitement around these SABCS abstracts, Tempus AI's recent performance has been choppy, with a 7 day share price return of minus 15.77 percent and a 90 day share price return of minus 29.5 percent. At the same time, its year to date share price return sits at 81.64 percent, and its 1 year total shareholder return of 88.34 percent signals momentum is still firmly positive for long term holders at the latest share price of 62.21 dollars.

If this kind of data driven healthcare innovation is on your radar, it is worth exploring other potential candidates using our curated list of healthcare stocks as a starting point.

Yet with revenues growing over 20 percent annually, ongoing losses, and shares still trading nearly 45 percent below the average analyst target, investors now face a key question: is this a genuine entry point, or is the market already discounting future growth?

Most Popular Narrative Narrative: 31.9% Undervalued

With Tempus AI last closing at 62.21 dollars versus a narrative fair value near 91.42 dollars, the most followed view frames a sizable upside gap and leans heavily on aggressive margin expansion and growth assumptions.

The ongoing expansion of clinical-genomic integrations, such as Tempus' broad MRD and liquid biopsy portfolios, means that, upon future reimbursement, there is further upside to both volume and revenue, with potential positive impact on net margins due to greater operating leverage on fixed R&D costs.

Want to see how this story turns soaring revenues into future profits, and why it supports such a rich earnings multiple? The full narrative lays out a step by step path that blends rapid top line growth, rising margins, and a punchy valuation multiple into one bold fair value call.

Result: Fair Value of $91.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and slower than expected reimbursement decisions could easily derail the margin expansion and valuation multiple that this bullish narrative relies on.

Find out about the key risks to this Tempus AI narrative.

Another Angle on Valuation

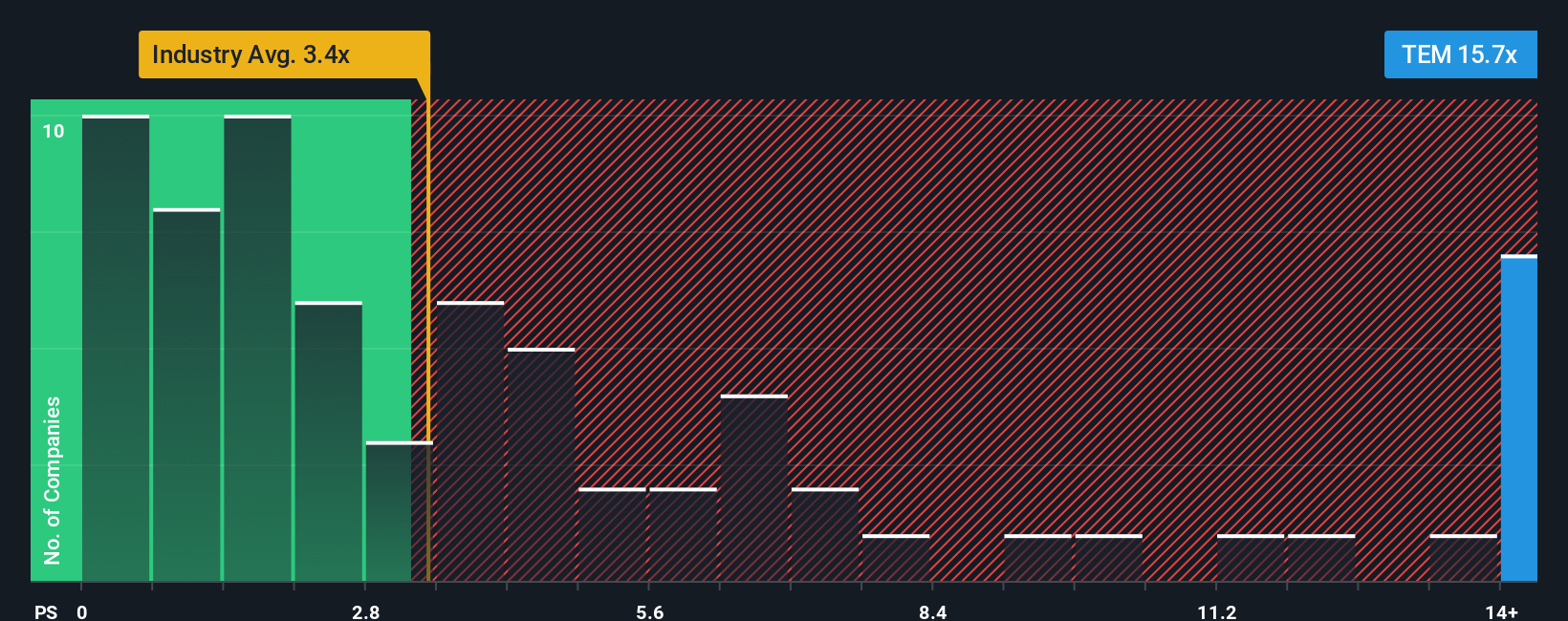

While the narrative fair value suggests upside, our look at Tempus AI through its price to sales ratio paints a tougher picture. Shares trade around 10 times sales, versus a fair ratio near 8.4 times, and well above both peers and the broader US Life Sciences industry.

This gap implies investors are already paying a steep premium for future growth, leaving less room for error if margins or revenue underwhelm. Is that premium a sign of conviction, or a valuation risk waiting for a catalyst?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tempus AI Narrative

If you see the story differently or want to dive into the numbers yourself, you can craft a custom view in just minutes: Do it your way.

A great starting point for your Tempus AI research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Turn this momentum into a smarter portfolio decision by using the Simply Wall St Screener to pinpoint fresh, data driven opportunities before everyone else catches on.

- Capitalize on mispriced opportunities by targeting companies that our models flag as attractively valued through these 917 undervalued stocks based on cash flows.

- Ride the next wave of innovation by focusing on high potential names in intelligent automation and data driven platforms using these 24 AI penny stocks.

- Lock in reliable cash flow potential by filtering for companies offering robust income streams via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报