Assessing BOK Financial’s (BOKF) Valuation After Its Recent Share Price Outperformance

Recent Performance Puts BOK Financial In Focus

BOK Financial (BOKF) has quietly outperformed many regional peers, with the stock up about 14% over the past month and roughly 7% over the past 3 months, drawing fresh investor attention.

See our latest analysis for BOK Financial.

That surge sits on top of an 11.7% year to date share price return and a 12.7% one year total shareholder return, suggesting momentum is quietly building as markets reassess BOK Financial’s earnings power and risk profile.

If BOK Financial’s steady climb has you thinking about what else could be re rated next, it is worth scanning fast growing stocks with high insider ownership for potential standouts.

With shares hovering just below analyst targets and trading at a modest intrinsic discount, the key question now is whether BOK Financial still offers upside for new buyers or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 0.4% Undervalued

With BOK Financial last closing at $119.25 versus a narrative fair value of about $119.70, the valuation case hinges on its regional growth and capital deployment story.

The company's diversified fee income including trading, wealth management, and treasury services provides resilience against interest rate fluctuations and contributes to a more stable and growing earnings base.

Want to see what justifies a richer future profit multiple for a regional bank, and how steady growth and margins are projected to do the heavy lifting? Dive into the full narrative to unpack the precise revenue, earnings, and discount rate assumptions sitting behind that near market fair value mark.

Result: Fair Value of $119.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to commercial real estate and energy loans, combined with intense regional competition for deposits, could quickly undermine that balanced outlook.

Find out about the key risks to this BOK Financial narrative.

Another Angle On Valuation

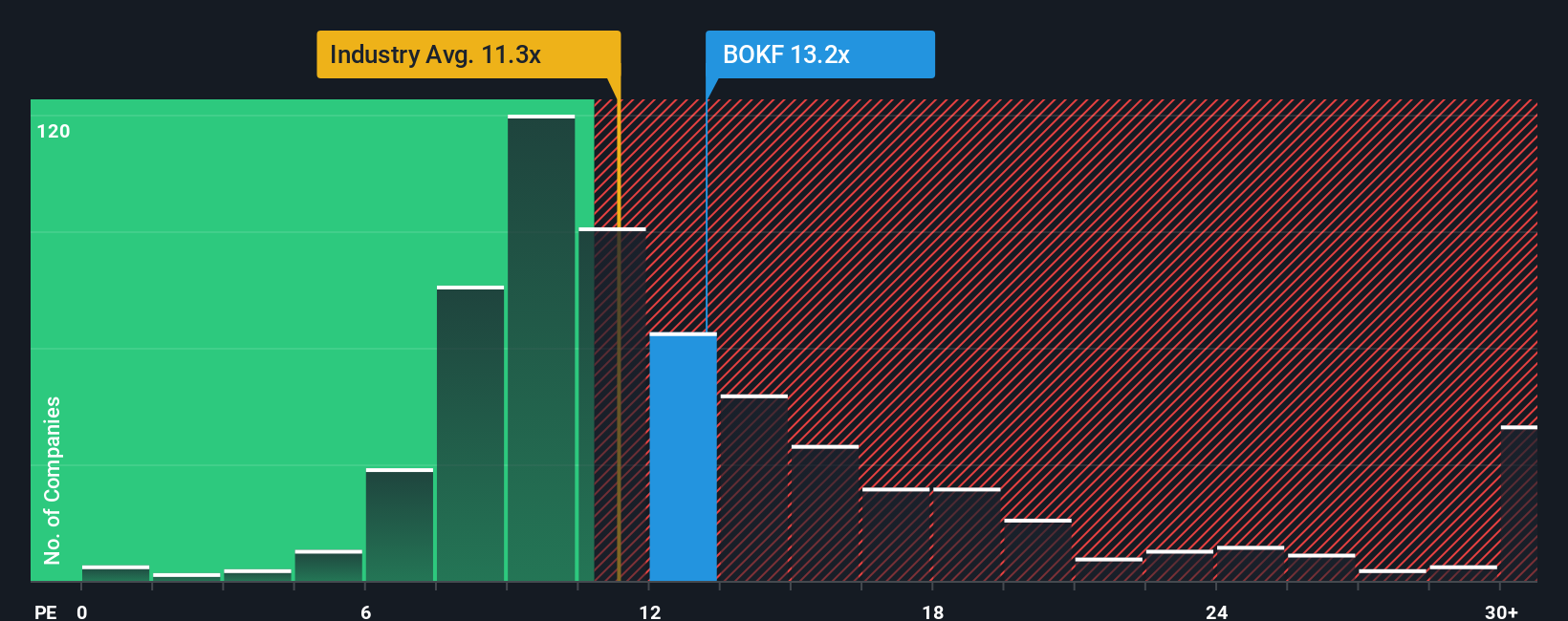

Looked at through its earnings multiple, BOK Financial trades at about 14.2 times earnings, noticeably richer than both the US banks sector at 12 times and a fair ratio of 11.8 times. That premium signals confidence, but also raises the risk that any slip in execution hits the share price hard if sentiment turns quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BOK Financial Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BOK Financial.

Ready For More High Conviction Ideas?

Before momentum shifts again, lock in your next moves with focused stock ideas backed by data rich screeners, not guesswork or market noise.

- Capture powerful long term compounding from steady cash generators with these 13 dividend stocks with yields > 3% and let reliable income streams anchor your portfolio through cycles.

- Capitalize early on breakthroughs in automation, data, and machine learning by scanning these 24 AI penny stocks before the crowd chases the headlines.

- Hunt for quality businesses trading at a discount using these 918 undervalued stocks based on cash flows so you are not left watching others benefit from mispriced opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报