Does Afya’s Recent Weak Share Price Signal a Long Term Opportunity in 2025?

- If you are wondering whether Afya is quietly turning into a value opportunity after a tough few years, or whether the market still has it priced about right, this breakdown is for you.

- The stock has inched up about 1.1% over the last week but is still down roughly 1.0% over 30 days and 6.5% year to date, suggesting that sentiment is cautious despite some short term strength.

- Recent attention on Brazil's private education sector, including ongoing regulatory discussions and shifting demand for medical education seats, has kept Afya on investors' radar. At the same time, industry consolidation and interest in scalable digital education platforms have influenced how the market is reassessing Afya's long term growth story.

- Based on our checks, Afya scores a 5/6 valuation score. This suggests it screens as undervalued on most fronts. Next we will walk through those methods and then consider an additional way to think about its true worth later in the article.

Approach 1: Afya Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those amounts back to a present value.

Afya generated trailing twelve month free cash flow of roughly R$1.18 billion, and analysts expect this to continue growing, with internal projections reaching about R$1.58 billion in free cash flow by 2035. Near term, external analysts see free cash flow rising to around R$1.15 billion in 2026 and R$1.24 billion in 2027, with later years extrapolated by Simply Wall St based on modest growth assumptions.

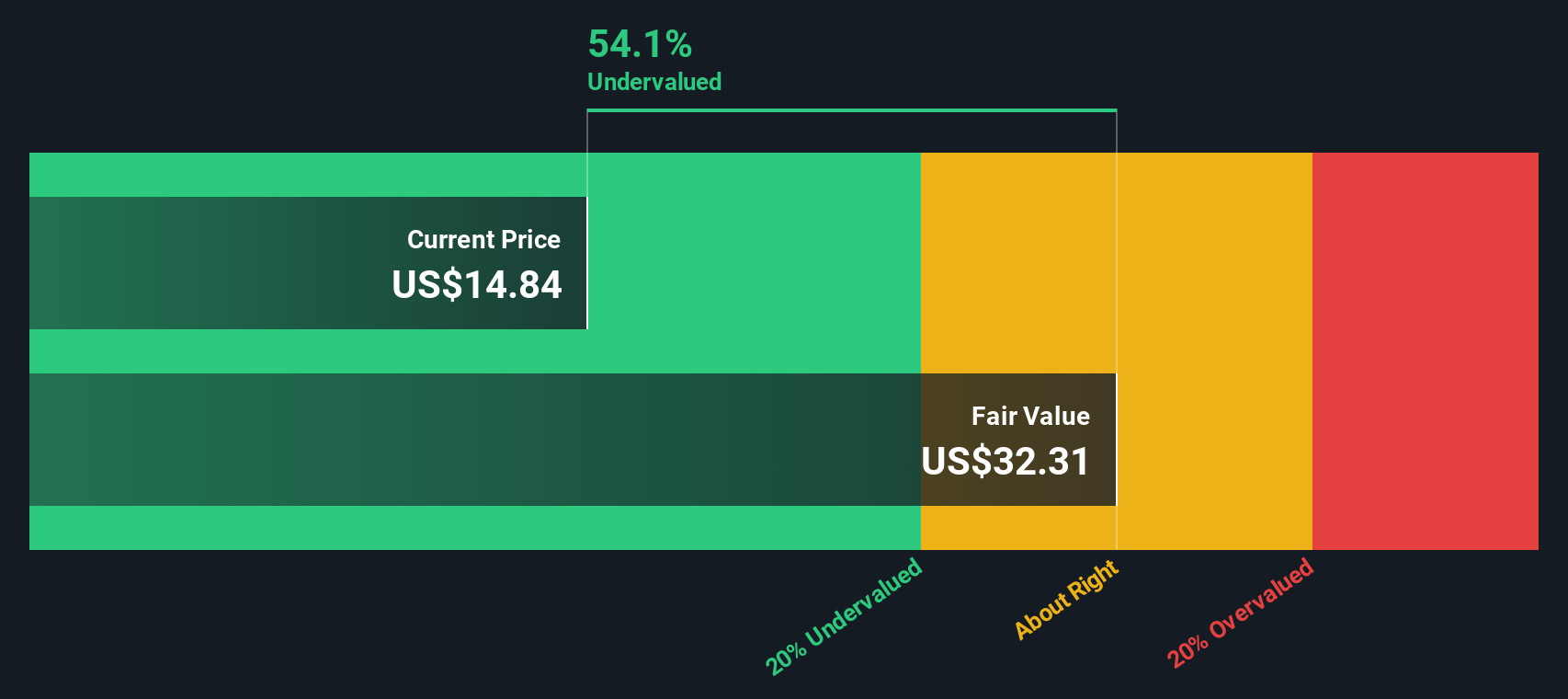

Using a 2 Stage Free Cash Flow to Equity model on these cash flows results in an estimated intrinsic value of about $30.82 per share. Compared with the current market price, this implies Afya trades at roughly a 52.6% discount to its DCF fair value, indicating that the market is pricing in a much weaker outlook than the cash flow projections suggest.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Afya is undervalued by 52.6%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Afya Price vs Earnings

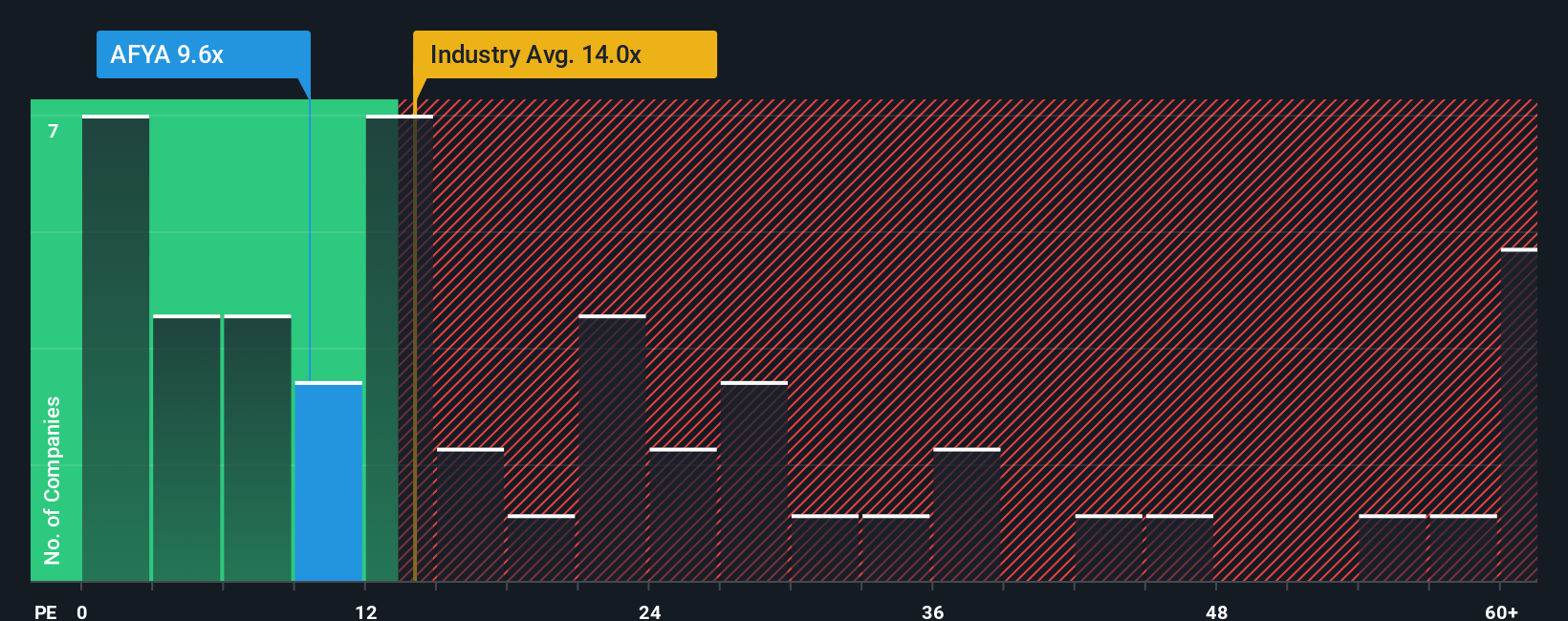

For a consistently profitable company like Afya, the price to earnings, or PE, ratio is a useful way to check whether investors are paying a reasonable price for each dollar of current earnings. In general, faster growing and lower risk businesses deserve a higher PE, while companies facing slower growth or greater uncertainty should trade on a lower multiple.

Afya currently trades on a PE of about 10.0x, which is well below both the broader Consumer Services industry average of around 16.6x and the peer group average near 25.4x. To go a step further, Simply Wall St also calculates a proprietary “Fair Ratio” of 17.2x, which estimates the PE Afya might trade on given its earnings growth outlook, margins, risk profile, industry and market cap.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for Afya specific fundamentals rather than assuming all education companies deserve the same valuation. Comparing the Fair Ratio of 17.2x with the actual 10.0x suggests the market is pricing Afya at a meaningful discount relative to this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Afya Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page. Here you connect your story about Afya, such as assumptions about Brazil’s demand for doctors, digital expansion or regulation, to a clear financial forecast of future revenue, earnings and margins. This then flows through to a Fair Value you can compare with today’s share price to decide whether to buy, hold or sell. The Narrative automatically updates as new earnings or news arrive. One investor might build a bullish Afya Narrative that sees rapid enrollment growth, improving margins and a Fair Value closer to the higher end of recent targets around $25. Another might choose a more cautious Narrative that bakes in slower growth, regulatory headwinds and a Fair Value nearer the low analyst end around $14. This allows both to act consistently with their own view rather than relying only on static multiples.

Do you think there's more to the story for Afya? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报