Cintas (CTAS) Q2 2026: Margin Resilience Reinforces Premium Valuation Narrative

Cintas (CTAS) just posted Q2 2026 results that put revenue at about $2.8 billion and net income at roughly $495 million, with EPS of $1.23 helping frame another solid print for the uniform and business services group. The company has seen quarterly revenue move from $2.56 billion in Q2 2025 to $2.8 billion this quarter, while net income ticked from about $447 million to $495 million over the same period, underscoring a business that continues to scale on both the top and bottom line even as investors focus on how sustainably those margins hold up.

See our full analysis for Cintas.With the numbers on the table, the next step is to line them up against the most popular narratives around Cintas, highlighting where the story matches the data and where expectations may need a reset.

See what the community is saying about Cintas

Net Margin Holds Near 17.5 Percent

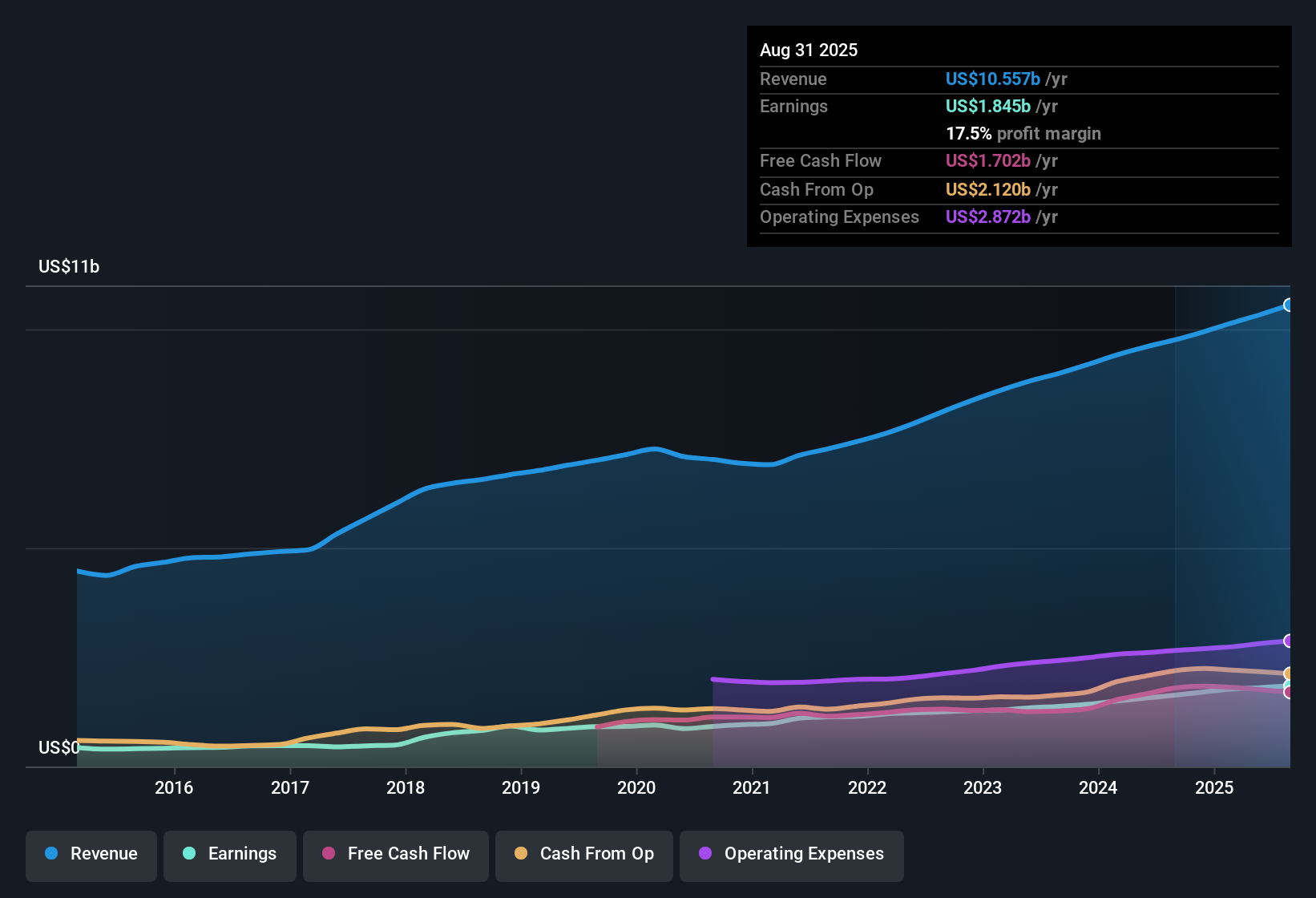

- Over the last 12 months, Cintas earned about $1.9 billion on roughly $10.8 billion of revenue, translating to a 17.5 percent net profit margin versus 17.2 percent a year earlier.

- Consensus narrative leans bullish on Cintas' ability to keep expanding margins through technology and cross selling, and that view is broadly aligned with the data, though the lift so far is modest.

- Trailing earnings grew 10.9 percent over the past year and have compounded at about 13 percent annually over five years, which fits the story of durable, high quality profitability.

- Analysts also expect margins to trend higher from 17.5 percent to 18.9 percent in three years, so the small margin uptick in the latest 12 month numbers is an early but still limited confirmation of that path.

Revenue Growth Slower Than Broader Market

- On a trailing basis, revenue is about $10.8 billion, and forecasts call for roughly 6.5 to 7.2 percent annual revenue growth, which sits below the wider US market forecast of around 10.6 percent per year.

- Analysts' consensus view is that product expansion and outsourcing trends can keep growth solid, but the forecast pace shows some tension with the idea of Cintas as a clear high growth story.

- Expected revenue of about $12.8 billion by 2028 implies steady but not rapid top line expansion, even as Cintas leans into new safety and hygiene offerings.

- Earnings are projected to reach about $2.4 billion by 2028, so profit is expected to compound faster than revenue, meaning much of the upside case depends on continued efficiency gains rather than a sudden acceleration in sales growth.

Premium Valuation With Debt Overhang

- At a share price of $187.37, Cintas trades on about 39.6 times trailing earnings versus a peer average of 32 times and an industry average of 24.4 times. The DCF fair value is estimated at roughly $164.21, and the analyst price target of $215.12 implies moderate upside from here.

- Bears focus on that valuation premium and the high debt load, and the current numbers give them plenty to point to alongside the solid fundamentals.

- The stock sits above the DCF fair value estimate and above peers on P E even though forecast revenue growth is only mid single digit. This strengthens the bearish argument that investors are paying up for quality.

- With earnings expected to grow about 8.8 percent per year and margins already in the mid teens, skeptics can reasonably question how much more upside is left if the multiple were to drift closer to industry levels, especially given the noted high level of debt.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cintas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently, or think the market is missing something? Turn that view into a concise, data backed narrative in minutes: Do it your way.

A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Cintas combines strong profitability with slowing revenue momentum, premium valuation, and a meaningful debt load that raises questions about downside protection if growth disappoints.

If that mix feels risky, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly zero in on financially sturdier businesses designed to handle shocks without putting your capital at unnecessary risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报