Canadian Solar (NasdaqGS:CSIQ): Valuation Check After New 408 MWh Australian Battery Storage Deal

Canadian Solar (NasdaqGS:CSIQ) just landed another big battery deal in Australia, with its e-STORAGE unit set to deliver a 408 MWh system for Vena Energy’s Tailem Bend 3 project in South Australia.

See our latest analysis for Canadian Solar.

The latest Australian storage win lands as Canadian Solar’s momentum has swung sharply higher, with a roughly 90 day share price return of about 103% and a 1 year total shareholder return of around 121%, despite deeper five year total shareholder losses suggesting the longer term recovery story is still playing out.

If Canadian Solar’s storage push has caught your attention, this could be a good moment to see what else is building in clean energy and discover high growth tech and AI stocks.

Yet with the share price already more than doubling in a year and trading close to analyst targets, while our model still flags a hefty intrinsic discount, is this a mispriced clean energy turnaround, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 1.8% Overvalued

With Canadian Solar last closing at $23.74 against a narrative fair value of about $23.33, expectations for future growth are doing the heavy lifting.

The company's forward integration into battery storage, with plans to expand BESS manufacturing capacity from 10 GWh to 24 GWh by 2026 and battery cell capacity from 3 GWh to 9 GWh, positions Canadian Solar to capture higher margin business and increase average order value, positively impacting future net margins and earnings.

Curious how a mid single digit profitability target, double digit top line expansion and a richer earnings multiple combine to justify that fair value? The full narrative unpacks the exact growth path, margin reset and valuation bridge that underpin this call.

Result: Fair Value of $23.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy uncertainty and intensifying trade barriers could still derail margin recovery, disrupt U.S. growth plans, and challenge the current valuation narrative.

Find out about the key risks to this Canadian Solar narrative.

Another View: Multiples Paint a Richer Picture

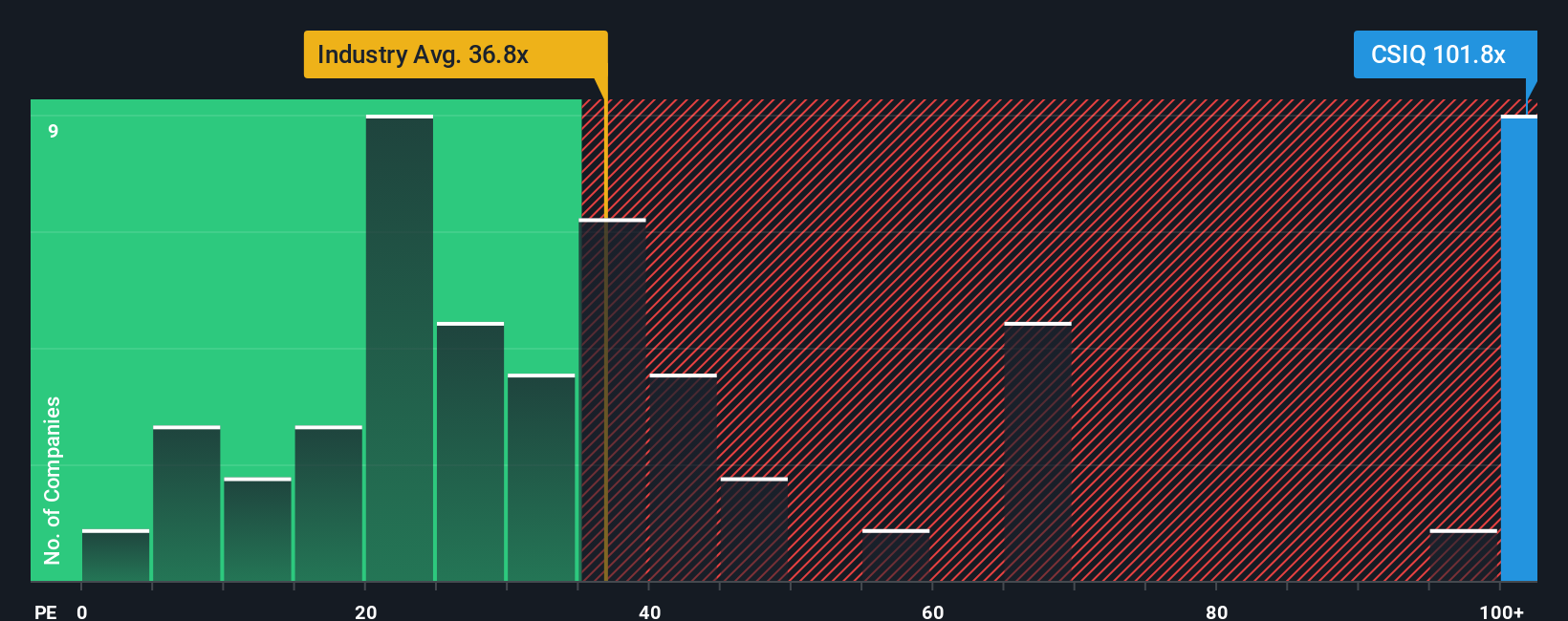

Our fair value narrative sees Canadian Solar as only about 1.8% overvalued, but the earnings multiple tells a tougher story. At roughly 98.6 times earnings versus 35.8 times for the US Semiconductor industry and a 59.4 times peer average, the stock screens expensive, even if its fair ratio of 144.3 times suggests the market could stretch further if growth delivers. Is this a value trap in the making, or early pricing for a bigger turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canadian Solar Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market moves without you, use the Simply Wall St Screener to spot clear opportunities and pressure test your next moves beyond Canadian Solar.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value through these 916 undervalued stocks based on cash flows.

- Position yourself in the next wave of innovation by hunting for market leaders in automation and machine learning via these 24 AI penny stocks.

- Strengthen your income stream by focusing on steady cash generators offering meaningful yields through these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报