ASX Penny Stocks To Watch In December 2025

Australian shares have seen a positive shift this week, echoing Wall Street's upward trend following the latest U.S. CPI data release. As investors navigate these evolving market dynamics, penny stocks remain an intriguing option for those seeking potential growth in smaller or newer companies. While the term 'penny stocks' may seem outdated, their potential for value and growth is still significant when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$114.64M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$69.82M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$47.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.83 | A$434.94M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.11 | A$229.71M | ✅ 4 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.26B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.945 | A$136.02M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.27 | A$124.98M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$642.58M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 434 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Great Southern Mining (ASX:GSN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Great Southern Mining Limited focuses on the exploration and evaluation of mineral properties in Australia, with a market cap of A$33.89 million.

Operations: Great Southern Mining Limited has not reported any revenue segments.

Market Cap: A$33.89M

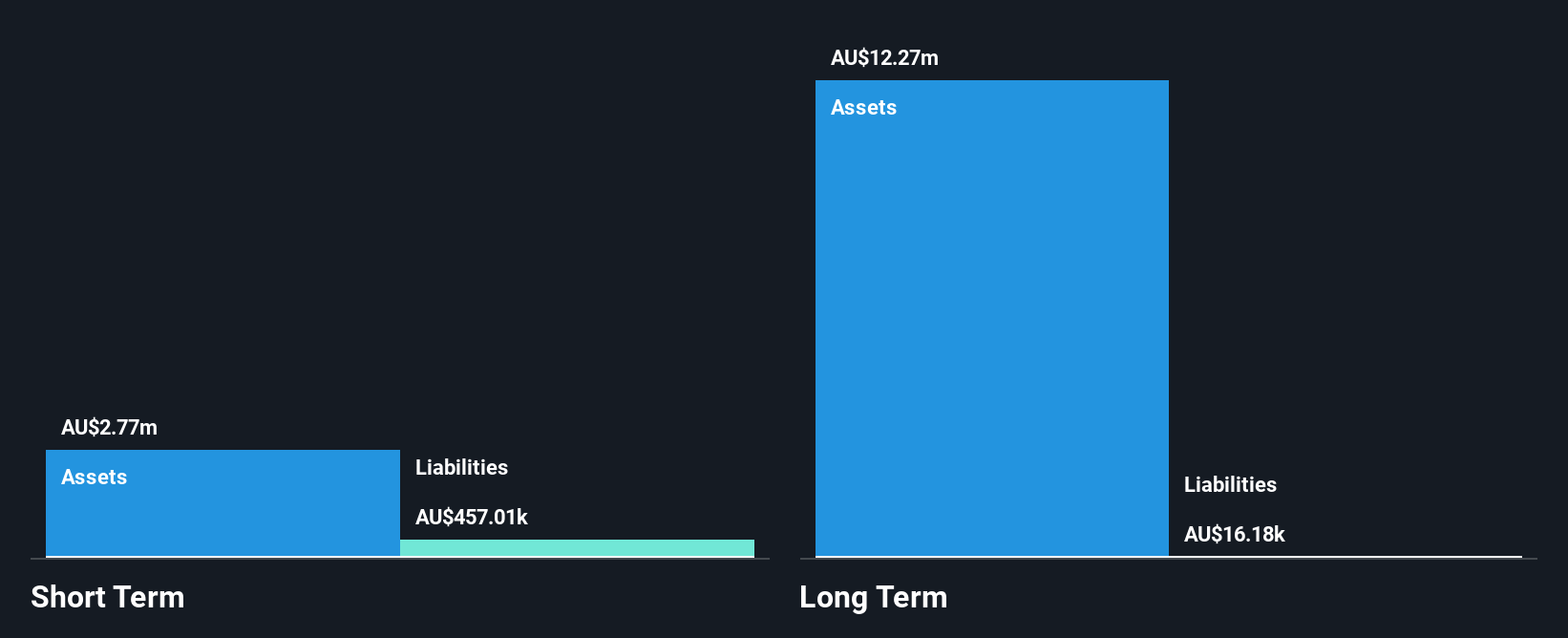

Great Southern Mining Limited, with a market cap of A$33.89 million, is a pre-revenue company focused on mineral exploration in Australia. It recently secured two co-funding grants from the Western Australian State Government's Exploration Incentive Scheme, highlighting its projects' technical merit. Despite being unprofitable and having less than a year of cash runway, Great Southern Mining has been reducing losses by 12.2% annually over the past five years and remains debt-free. The company's short-term assets exceed both its short- and long-term liabilities, indicating sound financial management amidst ongoing exploration efforts.

- Take a closer look at Great Southern Mining's potential here in our financial health report.

- Understand Great Southern Mining's track record by examining our performance history report.

Hawthorn Resources (ASX:HAW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hawthorn Resources Limited is involved in the exploration and development of mineral resources in Australia, with a market cap of A$31.49 million.

Operations: The company's revenue is primarily generated from its mineral exploration and mining activities, amounting to A$1.11 million.

Market Cap: A$31.49M

Hawthorn Resources Limited, with a market cap of A$31.49 million, is a pre-revenue entity engaged in mineral exploration in Australia. The company remains debt-free and has no long-term liabilities, which can be appealing for risk-averse investors. Its board of directors is experienced with an average tenure of 7.3 years, providing stable governance. Despite being unprofitable and experiencing increased losses over the past five years at 29.7% annually, Hawthorn's short-term assets (A$12.6M) comfortably cover its short-term liabilities (A$1.6M). Investors should note its earnings release scheduled for December 19, 2025.

- Click to explore a detailed breakdown of our findings in Hawthorn Resources' financial health report.

- Assess Hawthorn Resources' previous results with our detailed historical performance reports.

Janison Education Group (ASX:JAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Janison Education Group Limited offers online assessment software, products, and services across Australia, New Zealand, Asia, and internationally with a market cap of A$68.87 million.

Operations: The company generates revenue from two main segments: Product, contributing A$16.00 million, and Platform, accounting for A$30.82 million.

Market Cap: A$68.87M

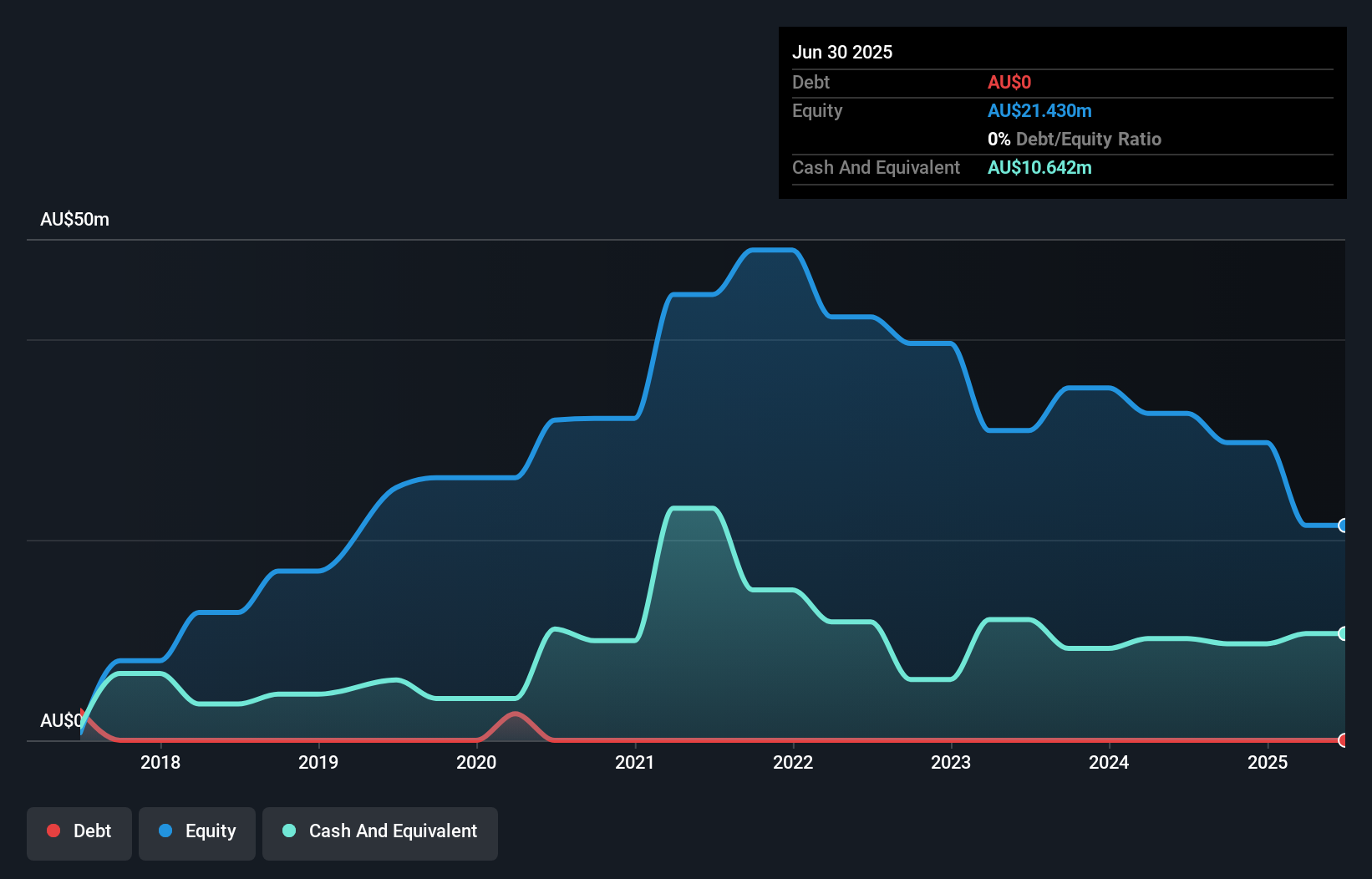

Janison Education Group, with a market cap of A$68.87 million, is an unprofitable entity in the online assessment software sector. Despite its lack of profitability, the company has no debt and maintains a positive cash flow with a sufficient runway exceeding three years. Its revenue streams are robust, split between Product (A$16.00 million) and Platform (A$30.82 million) segments. The board of directors is experienced with an average tenure of 3.8 years, though management's tenure averages only 1.3 years, indicating recent changes in leadership. Short-term assets cover both short-term and long-term liabilities comfortably.

- Click here and access our complete financial health analysis report to understand the dynamics of Janison Education Group.

- Gain insights into Janison Education Group's historical outcomes by reviewing our past performance report.

Make It Happen

- Investigate our full lineup of 434 ASX Penny Stocks right here.

- Contemplating Other Strategies? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报