Vertiv (VRT) Valuation Check After PurgeRite Deal, AI Data Center Wins, and Dividend Increase

Vertiv Holdings Co (VRT) just added another proof point to its AI data center story, closing the PurgeRite acquisition, deepening a high profile Hut 8 and Jacobs collaboration, and backing it with a higher dividend.

See our latest analysis for Vertiv Holdings Co.

Despite a sharp 7 day share price return of negative 13.6 percent and a softer 30 day share price return of negative 6.4 percent, Vertiv still has a robust year to date share price return of about 30 percent and a 3 year total shareholder return above 1,100 percent. This suggests that long term momentum remains intact even as near term enthusiasm cools.

If Vertiv's AI infrastructure push has caught your eye, it could be worth exploring other high potential names using our high growth tech and AI stocks to see what else is building momentum.

With AI data center orders surging, a near 30 percent intrinsic discount and analyst targets sitting well above today’s price, investors face a key question: is Vertiv still mispriced, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 21.6% Undervalued

With Vertiv last closing at $154.37 against a narrative fair value near $196.83, the story leans firmly toward upside potential grounded in long term AI demand.

Ongoing investments in R&D and engineering, highlighted by collaborations with industry leaders (e.g., CoreWeave, Dell, Oklo), position Vertiv to deliver next-generation solutions ahead of technology refresh cycles, creating recurring upgrade opportunities and sustaining top-line and earnings growth.

To see the math behind that confidence, from aggressive revenue ramps to a richer profit profile and a bold future earnings multiple, unpack the full narrative.

Result: Fair Value of $196.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain hiccups or hyperscale customers bringing more power and cooling in house could cap Vertiv's margins and slow its AI driven momentum.

Find out about the key risks to this Vertiv Holdings Co narrative.

Another Angle on Valuation

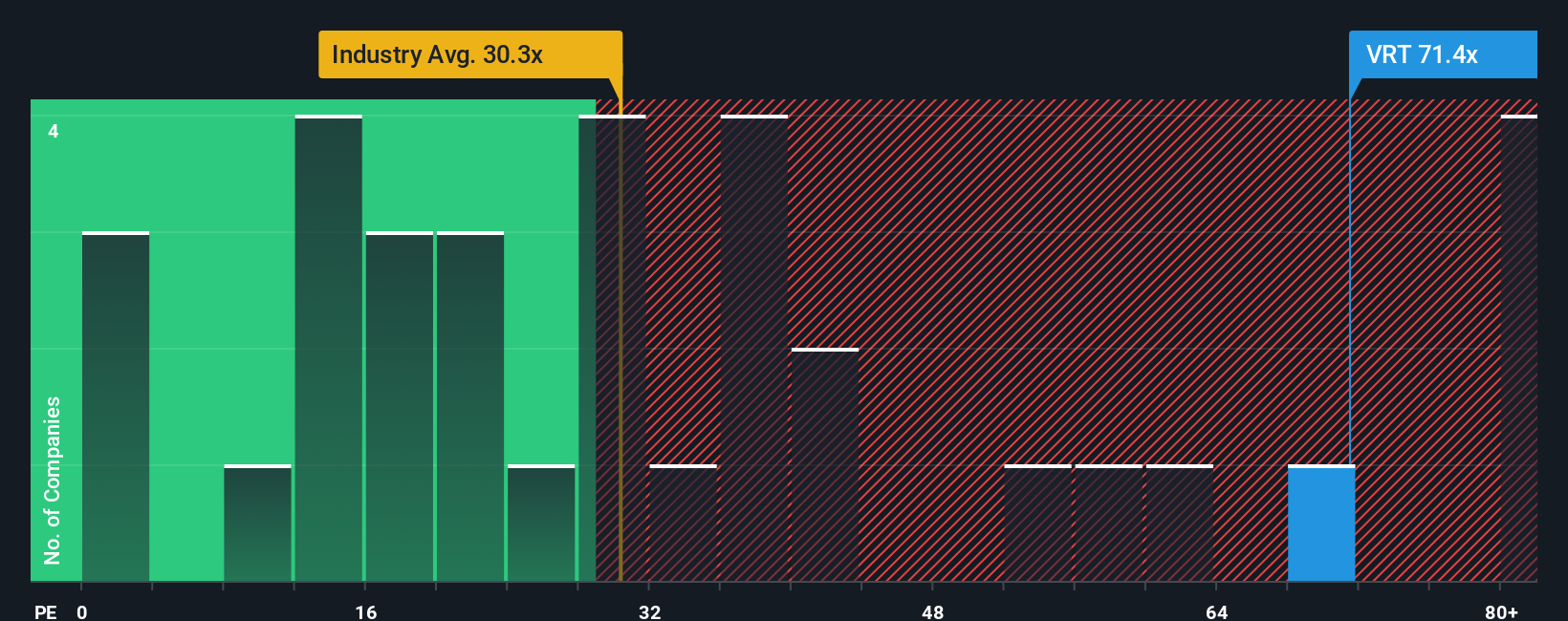

While the narrative and DCF work suggest Vertiv may be undervalued, the market is already paying a steep price at about 57 times earnings. This compares with 31 times for the US Electrical industry and 36.5 times for peers, and a fair ratio of 57.1 times indicates there may be little multiple cushion if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertiv Holdings Co Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a custom Vertiv view in just minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Vertiv Holdings Co.

Ready for your next investing move?

Do not stop at one great story when you can build a smarter watchlist today with focused ideas that match your strategy and risk appetite.

- Capture early-stage potential by scanning these 3629 penny stocks with strong financials that already show solid financials instead of pure speculation.

- Lock in steadier income streams by targeting these 13 dividend stocks with yields > 3% that can bolster total returns through market cycles.

- Position ahead of deep tech disruption with these 28 quantum computing stocks poised to benefit as real world adoption accelerates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报