Uxin (NasdaqGS:UXIN) Q3 Revenue Surge Tests Bullish High-Growth Narrative vs. Ongoing Losses

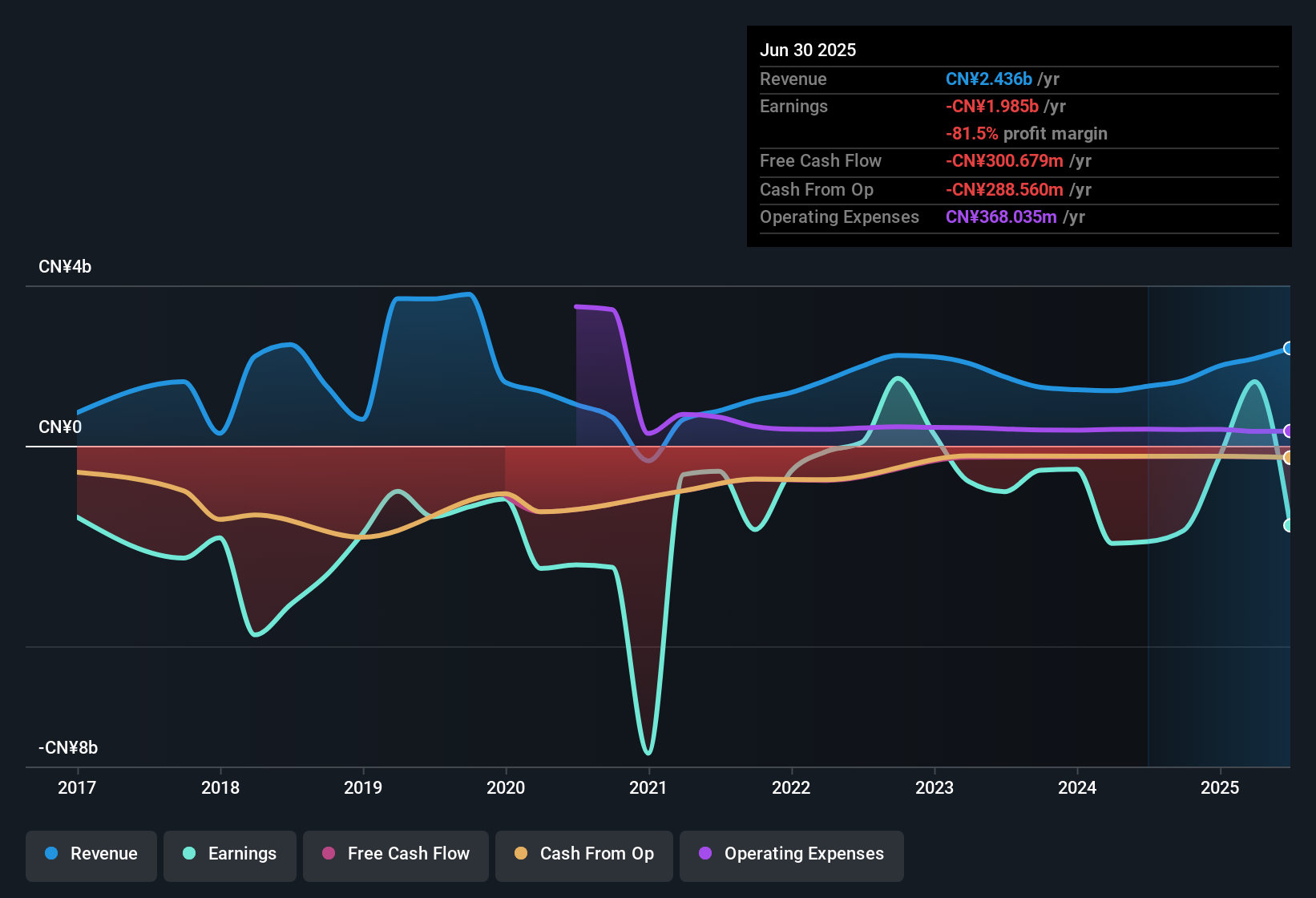

Uxin (NasdaqGS:UXIN) has just posted its Q3 2025 numbers, with revenue at about 879 million CNY and basic EPS at roughly -0.30 CNY, alongside trailing twelve month revenue of approximately 2.8 billion CNY and basic EPS of around -0.84 CNY. The company has seen quarterly revenue move from roughly 497 million CNY in Q3 2024 to 879 million CNY in Q3 2025, while EPS has shifted from about -0.32 CNY to -0.30 CNY over the same stretch. This gives investors a clearer view of how quickly the top line is scaling relative to ongoing losses. With that backdrop, the focus now turns to whether rapid growth can eventually offset still negative margins and move the business toward a more sustainable earnings profile.

See our full analysis for Uxin.With the headline numbers on the table, the next step is to see how this latest report aligns with the broader narratives around Uxin’s growth prospects, path to profitability and overall risk profile.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Nearly Doubles Year on Year

- Q3 2025 revenue of about 879 million CNY compares with roughly 497 million CNY in Q3 2024, while trailing twelve month revenue has reached approximately 2.8 billion CNY.

- What stands out for a bullish case is how this actual growth links to the forecast of roughly 101.8 percent annual revenue expansion, yet

- Net income excluding extra items for the last twelve months is still a loss of about 205.8 million CNY, showing that stronger sales have not yet translated into positive bottom line results.

- Over the past five years losses have reportedly narrowed by about 25.9 percent per year, which supports optimism on direction but also highlights that profitability remains a work in progress.

After seeing revenue almost double while losses persist, many investors will want to understand how far this growth story can really run before cash and patience run thin. 📊 Read the full Uxin Consensus Narrative.

Losses Still Material Despite Improvement

- On a quarterly view, net income excluding extra items was a loss of about 63.2 million CNY in Q3 2025 compared with losses of roughly 73.8 million CNY in Q2 2025 and 92.0 million CNY in Q4 2024.

- From a more cautious, bearish angle, critics highlight that even with this improvement the trailing twelve month loss of around 205.8 million CNY keeps the business firmly in the red,

- Basic EPS over the trailing twelve months sits at about negative 0.84 CNY, and each of the last four reported quarters except one special item period shows negative EPS.

- The exceptional Q2 2024 figures, with basic EPS of about 18.67 CNY and net income near 3.5 billion CNY, sit in sharp contrast to the surrounding losses and suggest one off items that do not yet reflect a steady, profitable run rate.

High Growth Valuation With Thin Cash Cushion

- Uxin trades on a price to sales ratio of about 1.6 times, which is notably above the US specialty retail industry average of roughly 0.5 times and the peer average of about 0.6 times, while the company is assessed as having less than one year of cash runway.

- Bears argue this combination of a premium multiple and a short cash runway raises real balance sheet and valuation risks,

- The premium price to sales ratio rests heavily on forecasts of about 101.8 percent annual revenue growth, even though the trailing twelve month net loss remains over 200 million CNY.

- With under a year of cash runway flagged as a key risk, any slowdown in that high growth or delay in reaching profitability could make fresh funding both necessary and potentially dilutive for existing shareholders.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Uxin's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Uxin’s rapid revenue growth is overshadowed by ongoing losses, a premium valuation and a thin cash runway that together raise meaningful financial risk.

If that mix feels too precarious, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly find businesses with sturdier balance sheets, stronger liquidity and earnings profiles built to better withstand uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报