Is Chipotle (CMG) Using its New High Protein Menu to Reframe the Long-Term Growth Story?

- Chipotle Mexican Grill recently launched its first-ever High Protein Menu across the U.S. and Canada, adding items like Double High Protein Bowls and low-priced High Protein Cups designed to capture growing demand for protein-focused, “clean label” fast-casual meals.

- This move highlights how Chipotle is using menu innovation and new lower-ticket options to respond to softer traffic trends and more price-conscious consumers.

- Now, we’ll explore how Chipotle’s new high-protein lineup could influence its long-term growth narrative built around unit expansion and efficiency.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Chipotle Mexican Grill Investment Narrative Recap

To own Chipotle, you generally need to believe its brand, pricing power and store expansion can overcome softer traffic and a cautious consumer. The new High Protein Menu directly targets value and nutrition focused guests, but its impact on the key near term catalyst, a recovery in same store traffic, is still uncertain, while the biggest risk remains ongoing consumer pullback and pressure on transaction trends if economic conditions stay weak.

Among recent announcements, the opening of Chipotle’s 4,000th restaurant and plans for 315 to 345 new locations in 2025 tie closely to this high protein push, because new formats like Chipotlanes and equipment upgrades are intended to boost throughput and convenience. Together with menu innovation at lower price points, these moves sit at the heart of the current growth narrative built around unit expansion and improved efficiency.

Yet investors should be aware that if consumer pullback persists and traffic stays weak, Chipotle’s growth story could...

Read the full narrative on Chipotle Mexican Grill (it's free!)

Chipotle Mexican Grill’s narrative projects $16.4 billion revenue and $2.3 billion earnings by 2028. This requires 12.3% yearly revenue growth and an earnings increase of about $0.8 billion from $1.5 billion today.

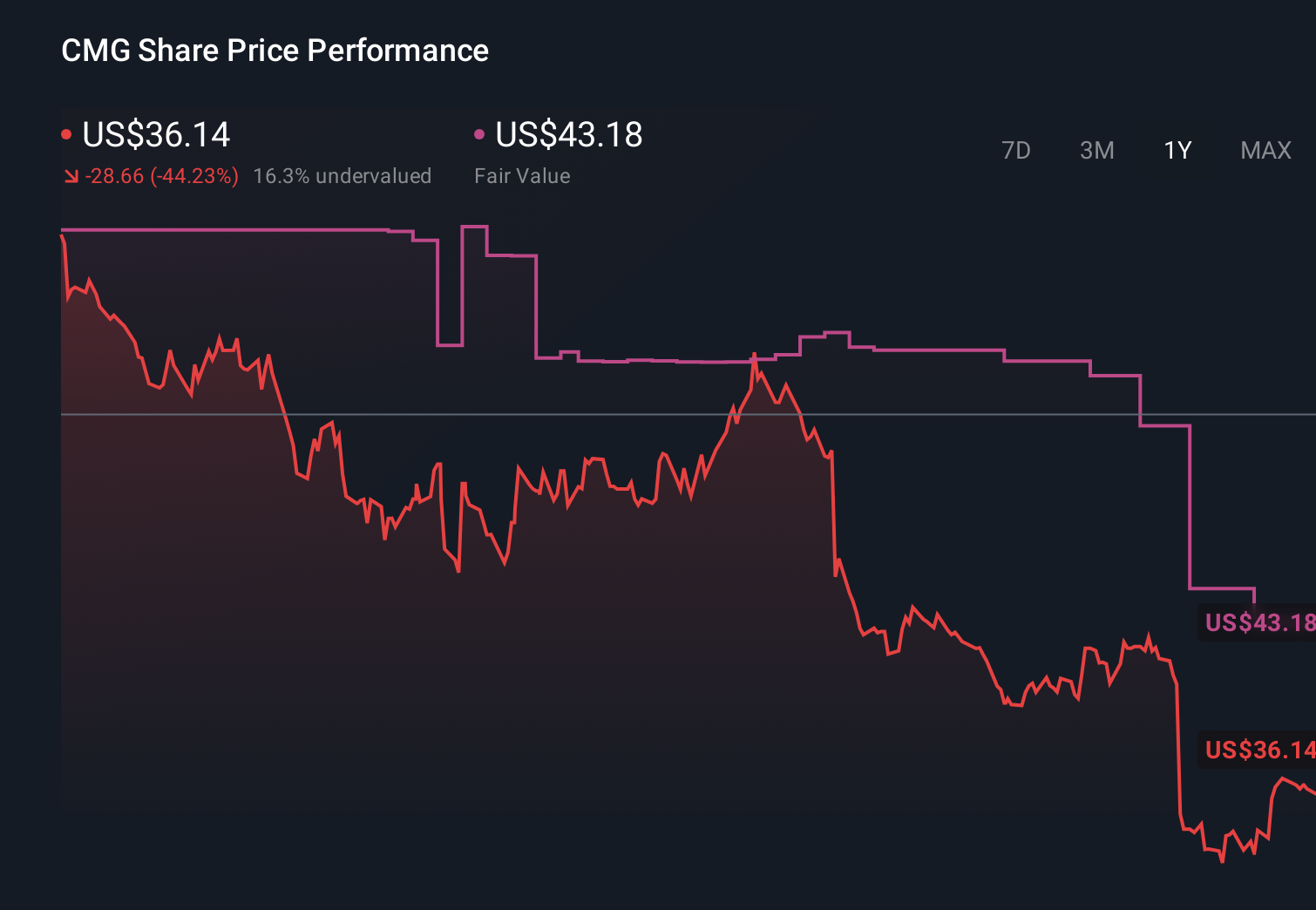

Uncover how Chipotle Mexican Grill's forecasts yield a $43.18 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Chipotle’s fair value between US$35.36 and US$67.56 across 22 independent views, underlining how far opinions can spread. You should weigh that dispersion against the risk that sustained consumer pullback and softer traffic could pressure both revenue growth and the return on Chipotle’s aggressive new store rollout.

Explore 22 other fair value estimates on Chipotle Mexican Grill - why the stock might be worth as much as 79% more than the current price!

Build Your Own Chipotle Mexican Grill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Chipotle Mexican Grill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chipotle Mexican Grill's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报