Teva (TEVA): Assessing Valuation After a 65% Three‑Month Share Price Surge

Teva Pharmaceutical Industries (TEVA) has quietly turned into one of the market’s stronger comeback stories, with shares up roughly 65% over the past 3 months and more than 40% over the past year.

See our latest analysis for Teva Pharmaceutical Industries.

That surge has been underpinned by solid execution, with Teva’s 30 day share price return of 22.04% and a three year total shareholder return of 230.95%. This suggests momentum is building as investors re rate its turnaround potential.

If Teva’s comeback has caught your eye, this could be a good moment to explore other opportunities in pharma by browsing pharma stocks with solid dividends.

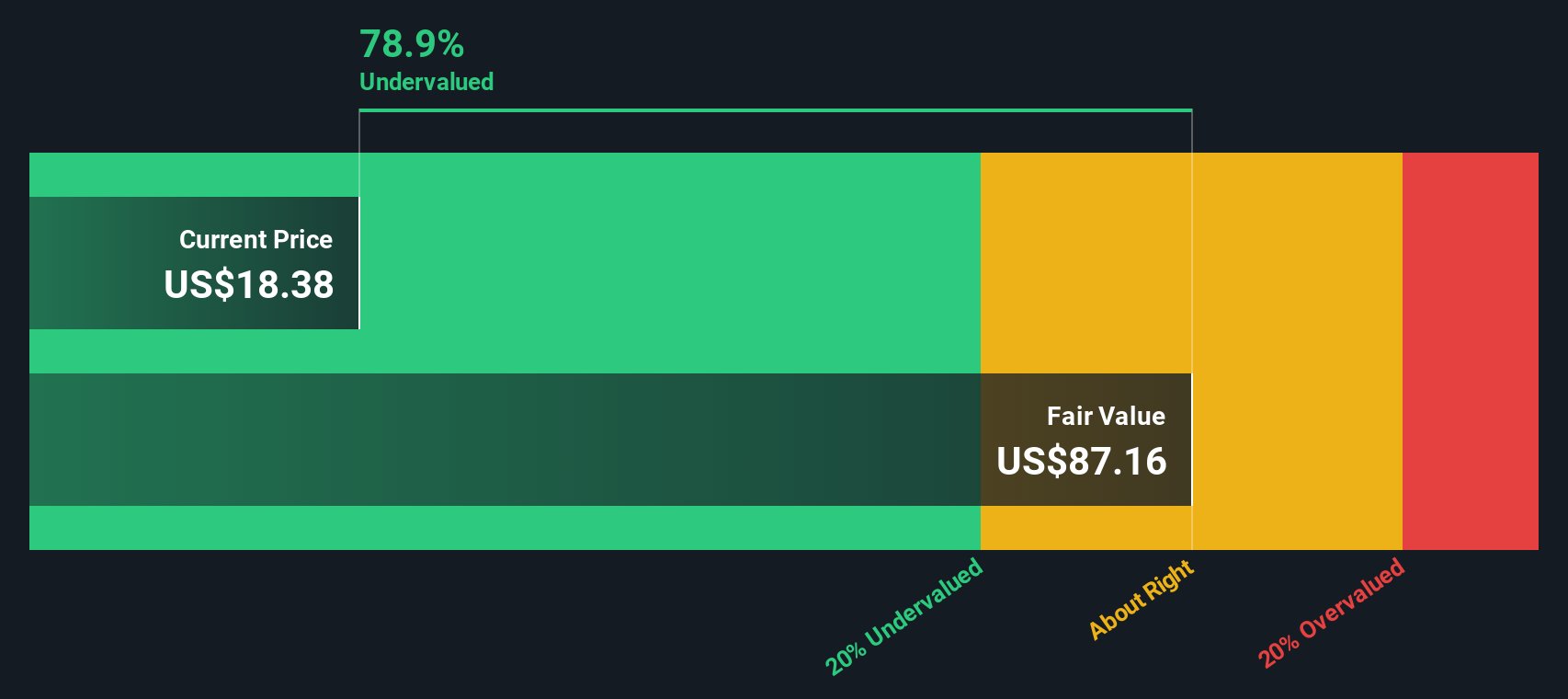

After such a dramatic rerating, investors now face a key question: Is Teva still trading at a discount to its improving fundamentals, or has the market already priced in the bulk of its future growth?

Most Popular Narrative Narrative: 6% Overvalued

With Teva closing at $30.32 against a narrative fair value near $28.60, the current share price already leans ahead of the implied upside.

The accelerating launch cadence of biosimilars (with 8 launches targeted through 2027 and a goal to double biosimilar revenue), backed by favorable regulatory trends increasing biosimilar adoption in major markets, should unlock incremental, higher margin revenue streams and offset headwinds from traditional generics, powering long term EBITDA growth.

Want to see how steady top line growth, rising margins, and a reset earnings multiple combine to justify that valuation gap? The full narrative unpacks the exact growth runway, profit mix shift, and long term earnings power that underpin this fair value view.

Result: Fair Value of $28.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering reliance on a few branded drugs and Teva’s still hefty debt load could quickly challenge the margin gains that underpin this valuation.

Find out about the key risks to this Teva Pharmaceutical Industries narrative.

Another Take on Value

While the narrative fair value suggests Teva is about 6% overvalued, our DCF model points the other way, indicating shares trade roughly 58% below its fair value of $72.78. One view says expectations are stretched; the other suggests significant upside. Which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teva Pharmaceutical Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teva Pharmaceutical Industries Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Teva Pharmaceutical Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next smart move by scanning fresh opportunities that match your style, so potential winners do not slip past unnoticed.

- Unlock potential long term compounders by targeting these 916 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride structural tailwinds in digital innovation with these 80 cryptocurrency and blockchain stocks positioned at the intersection of blockchain, payments, and next generation infrastructure.

- Supercharge your income strategy by targeting these 13 dividend stocks with yields > 3% offering attractive yields without ignoring balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报