Hormel Foods (HRL) Valuation Check After Justin’s Spinoff Partnership and New Enterprise CMO Strategy

Hormel Foods (HRL) just reshaped its growth playbook, spinning Justin's into a standalone partnership with Forward Consumer Partners and installing veteran marketer Jason Levine as its first enterprise-wide CMO, both aimed squarely at revitalizing brand driven growth.

See our latest analysis for Hormel Foods.

Despite these brand moves and fresh leadership, the stock’s 7.67% 1 month share price return only partially claws back a much weaker year to date share price performance and a multi year negative total shareholder return. Momentum is tentatively improving, but the longer term track record still weighs on sentiment.

If Hormel’s reshuffle has you thinking about where branded food names go next, it could be worth exploring fast growing stocks with high insider ownership for other under the radar growth stories with skin in the game.

With shares still down sharply over one and three years, yet trading at a hefty implied discount to some valuation models, is Hormel now an overlooked turnaround story, or has the market already penciled in its next leg of growth?

Most Popular Narrative Narrative: 12.0% Undervalued

With the most followed narrative putting Hormel Foods' fair value above the last close of $23.99, the valuation hinges on a gradual but durable earnings rebuild.

The company's active modernization, innovation, and investment in healthier, leaner, and natural products (e.g., Jennie-O, Applegate, renovation of core brands) aligns with consumers' rising emphasis on health and wellness, helping preserve pricing power and protect or expand net margins in the future.

Curious how steady revenue gains, margin rebuild and a richer future earnings multiple combine into that upside case? The full narrative unpacks the entire playbook.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn commodity inflation and slower than expected pricing pass through could keep margins under pressure for longer and challenge the earnings recovery story.

Find out about the key risks to this Hormel Foods narrative.

Another Way of Looking at Value

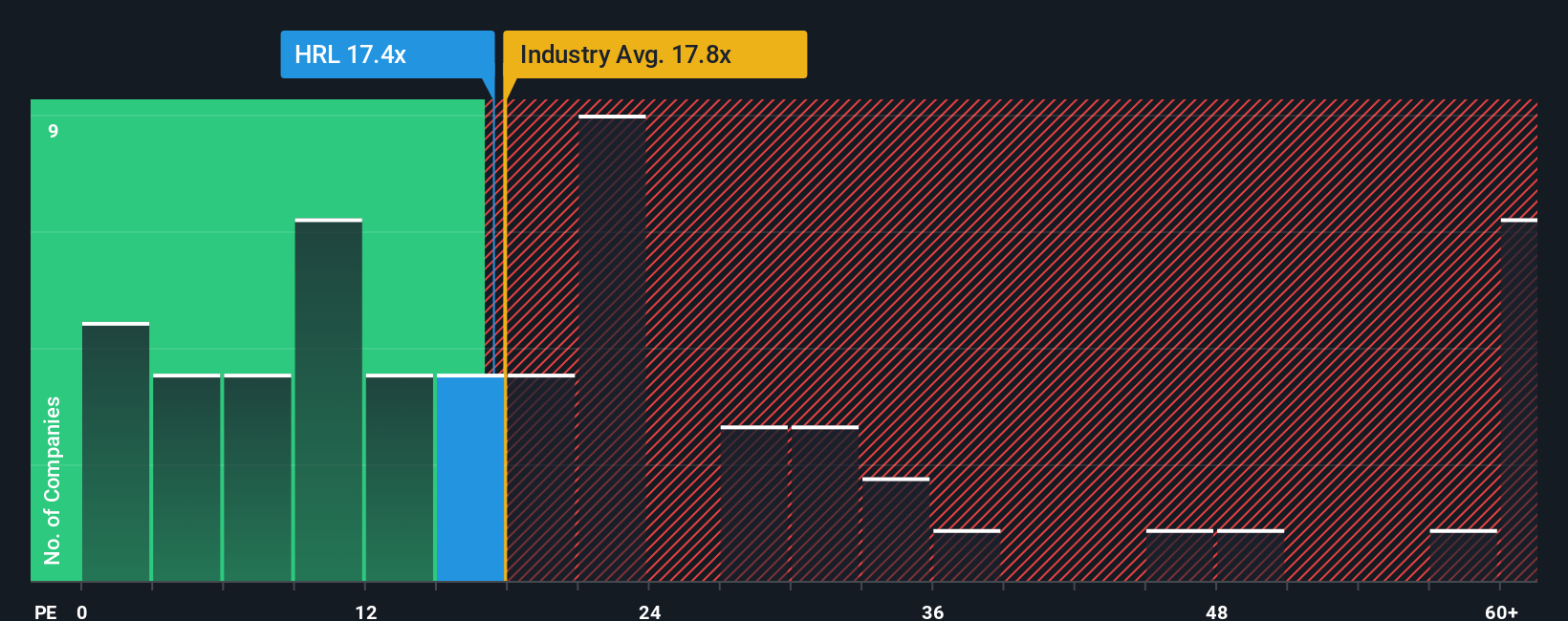

While narratives point to upside, the simple earnings multiple tells a tougher story. Hormel trades on a P/E of 27.6x, far richer than both the US food industry at 19.8x and its own 20.2x fair ratio. This suggests investors already pay up for a recovery that has yet to fully materialize. If sentiment sours before margins rebuild, that premium could unwind.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hormel Foods Narrative

If your view differs or you would rather dig into the numbers yourself, you can quickly build a personalized thesis in under three minutes: Do it your way.

A great starting point for your Hormel Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Hormel when you can quickly scan focused shortlists built from real data, spot fresh angles, and move ahead of slower investors.

- Capitalize on early stage momentum by targeting smaller names with strong balance sheets using these 3635 penny stocks with strong financials before the crowd catches on.

- Ride the structural shift toward automation and smarter software by filtering the market through these 24 AI penny stocks and focusing only on businesses with real traction.

- Explore potential value opportunities by zeroing in on companies trading below estimated cash flow worth via these 912 undervalued stocks based on cash flows while they are still overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报