Coupang (NYSE:CPNG): Reassessing Valuation After the Major Data Breach and Steep Share Price Drop

Coupang (CPNG) is back in the spotlight after disclosing a massive data breach affecting roughly 34 million customers, a crisis that quickly erased recent gains and pushed the stock sharply lower.

See our latest analysis for Coupang.

The selloff around the breach comes on top of an already weak stretch, with the share price down sharply over the past quarter even though the three year total shareholder return remains strongly positive. This suggests long term momentum has not completely broken.

If this kind of shock has you rethinking concentration risk, it might be a good moment to scan fast growing stocks with high insider ownership as a curated way to spot other compelling ideas.

Yet even after the breach driven selloff, Coupang still trades at a hefty discount to analyst targets while posting double digit growth. This leaves investors to weigh whether this is a mispriced growth story or if the market is already looking ahead.

Most Popular Narrative Narrative: 37.3% Undervalued

With Coupang last closing at $22.72 against a narrative fair value near $36, the gap rests on bold assumptions about future scale and profitability.

Ongoing investments in automation, AI, and logistics technology are already driving major improvements in operational efficiency and gross margins, and management sees significant further upside as these technologies are scaled. Over time, this is likely to result in continued margin expansion and growth in earnings.

Curious what kind of revenue trajectory and margin lift are needed to justify that valuation gap, and what future earnings power it implies? You will want to see the full narrative.

Result: Fair Value of $36.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain, particularly if scaling Taiwan and other Developing Offerings drags on profitability longer than expected or if competitive pressures inflate logistics and tech costs.

Find out about the key risks to this Coupang narrative.

Another Angle on Valuation

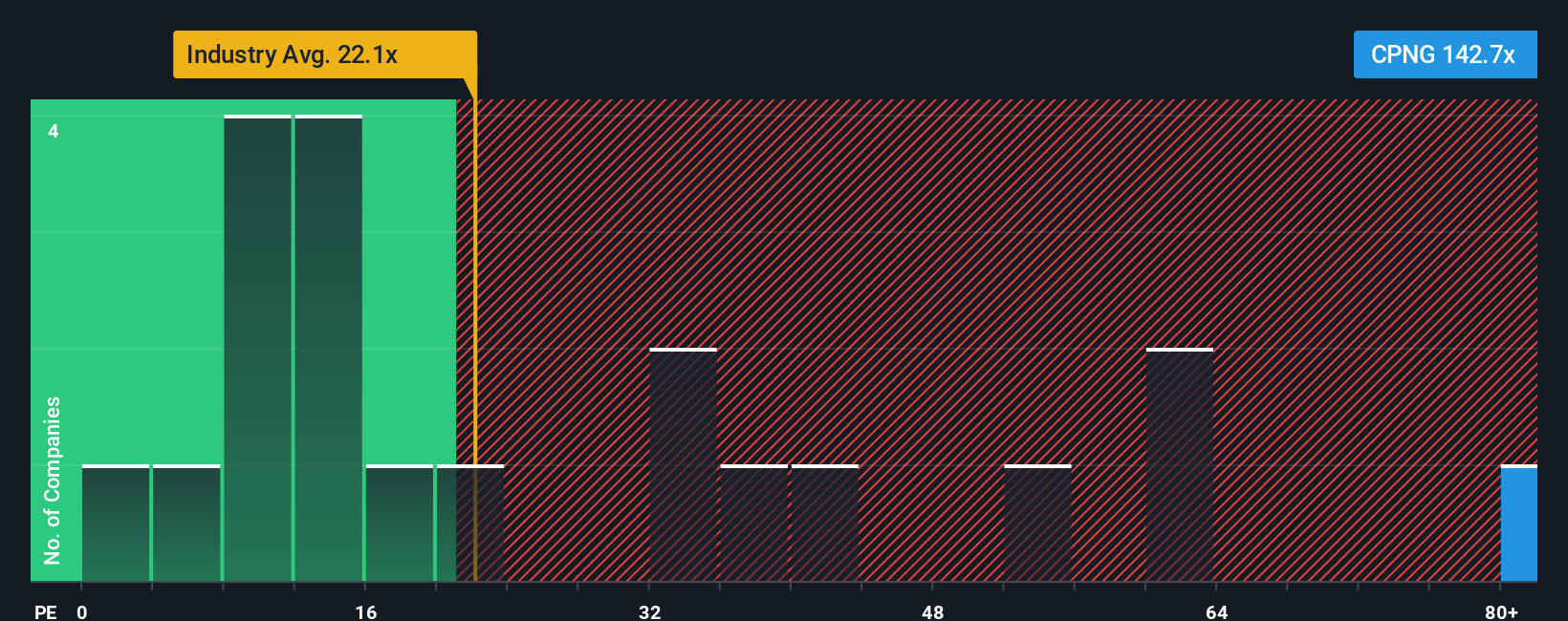

Look past narrative fair value and the picture changes. Coupang trades on a steep 106.4x price to earnings ratio versus 19.7x for the global multiline retail group and a 42.1x fair ratio. That kind of premium narrows the margin for error if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coupang Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Coupang research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the opportunity slips away, use the Simply Wall Street Screener to uncover fresh, data backed stocks that fit your strategy instead of chasing headlines.

- Capitalize on overlooked value by scanning these 915 undervalued stocks based on cash flows where strong cash flow profiles meet attractive entry prices.

- Ride structural growth trends by targeting innovation focused names through these 24 AI penny stocks positioned at the forefront of intelligent automation.

- Strengthen your income stream by selecting reliable payers from these 13 dividend stocks with yields > 3% with yields above 3 percent and room for sustainable distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报