Reassessing Accenture (ACN) Valuation After Its Recent Share Price Rebound

Accenture (ACN) has quietly outpaced the broader market over the past month, with the stock climbing about 13%, even as its year to date return remains down more than 21%.

See our latest analysis for Accenture.

At a share price of $273.74, Accenture’s recent 30 day share price return of 13.43% and 90 day gain of 14.27% suggest momentum is rebuilding, even though total shareholder return over the past year remains negative and longer term performance is modestly positive.

If Accenture’s rebound has you thinking about what else could be lining up for a turn, it is worth exploring fast growing stocks with high insider ownership as another source of ideas.

With earnings still growing and the share price trading at a modest discount to fair value estimates, investors now face a key question: is Accenture a compelling entry point, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 35.3% Overvalued

According to FCruz, the narrative fair value of $202.38 sits well below Accenture’s last close at $273.74, framing a notably rich valuation backdrop.

Scale & Efficiency: Revenue (TTM) ~US$68.5B, Operating margin ~16.8%, Net margin ~11.6%, ROE ~26.9%. Read-through: After a sector de-rating, ACN trades around its long-run average multiple with superior profitability and returns on capital for a services name.

Want to see how steady margins, disciplined cash generation, and a punchy future profit multiple all stack up into this premium price tag? The underlying growth, reinvestment assumptions, and long term earnings power might surprise you. Curious which moving part really drives that valuation gap? Read on to unpack the full narrative playbook.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softness in bookings and elongated consulting decision cycles could easily derail the margin story and challenge confidence in today’s premium valuation.

Find out about the key risks to this Accenture narrative.

Another View: Market Ratios Tell a Different Story

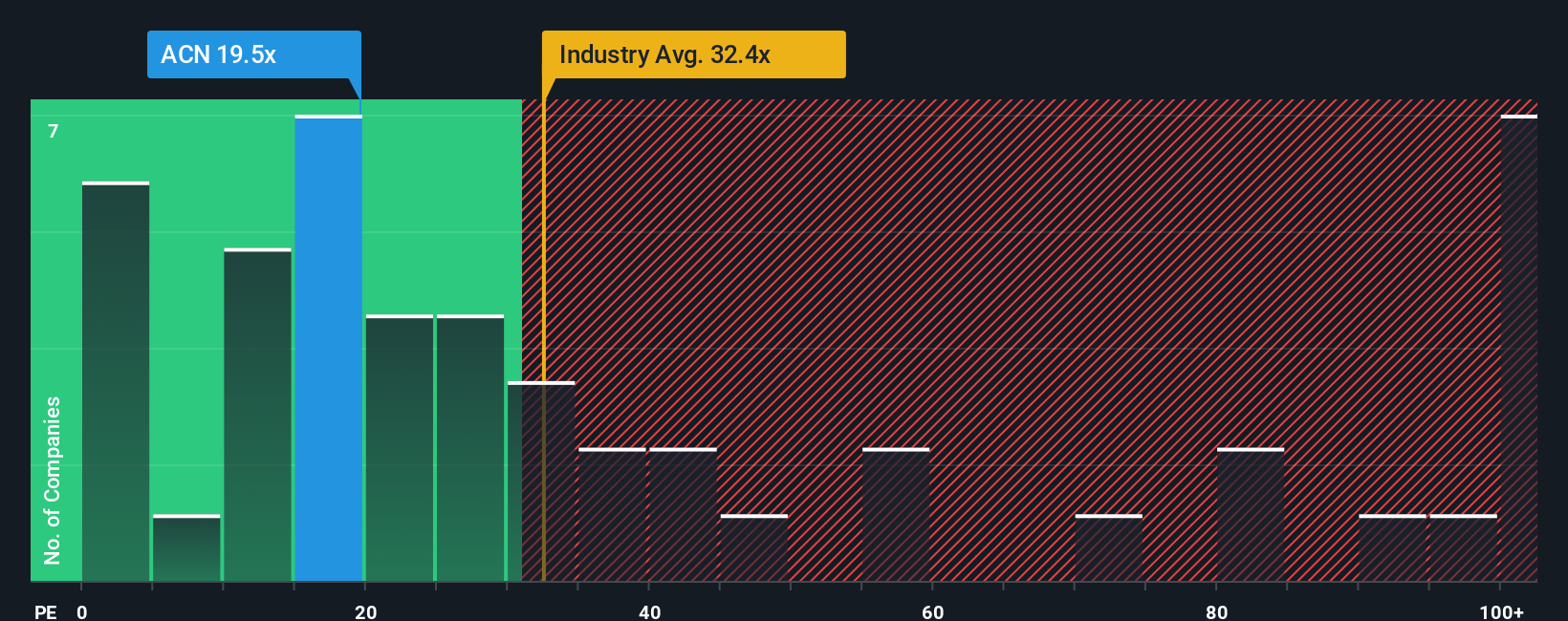

Accenture’s price to earnings ratio of 21.9 times looks far less stretched next to peers at 25.8 times and the US IT sector at 29.9 times, and still below a fair ratio of 36.5 times. This could hint at potential upside if sentiment normalizes, or it may reflect the market’s view of slower growth ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Accenture Narrative

If this perspective does not quite fit your view, or you prefer digging into the numbers yourself, you can build a fresh take in under three minutes, Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Ready for more high conviction ideas?

Do not stop with one stock when the market is full of potential. Use the Simply Wall Street Screener now to reduce the chance of missing your next winner.

- Capture overlooked value by running these 907 undervalued stocks based on cash flows that highlight companies trading below what their future cash flows may justify.

- Capitalize on structural shifts in medicine by scanning these 29 healthcare AI stocks targeting companies at the intersection of data, diagnostics, and patient outcomes.

- Supercharge your yield strategy by targeting these 13 dividend stocks with yields > 3% that can potentially strengthen portfolio income without reckless risk taking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报