Werner Enterprises, Inc.'s (NASDAQ:WERN) P/E Is Still On The Mark Following 29% Share Price Bounce

Werner Enterprises, Inc. (NASDAQ:WERN) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

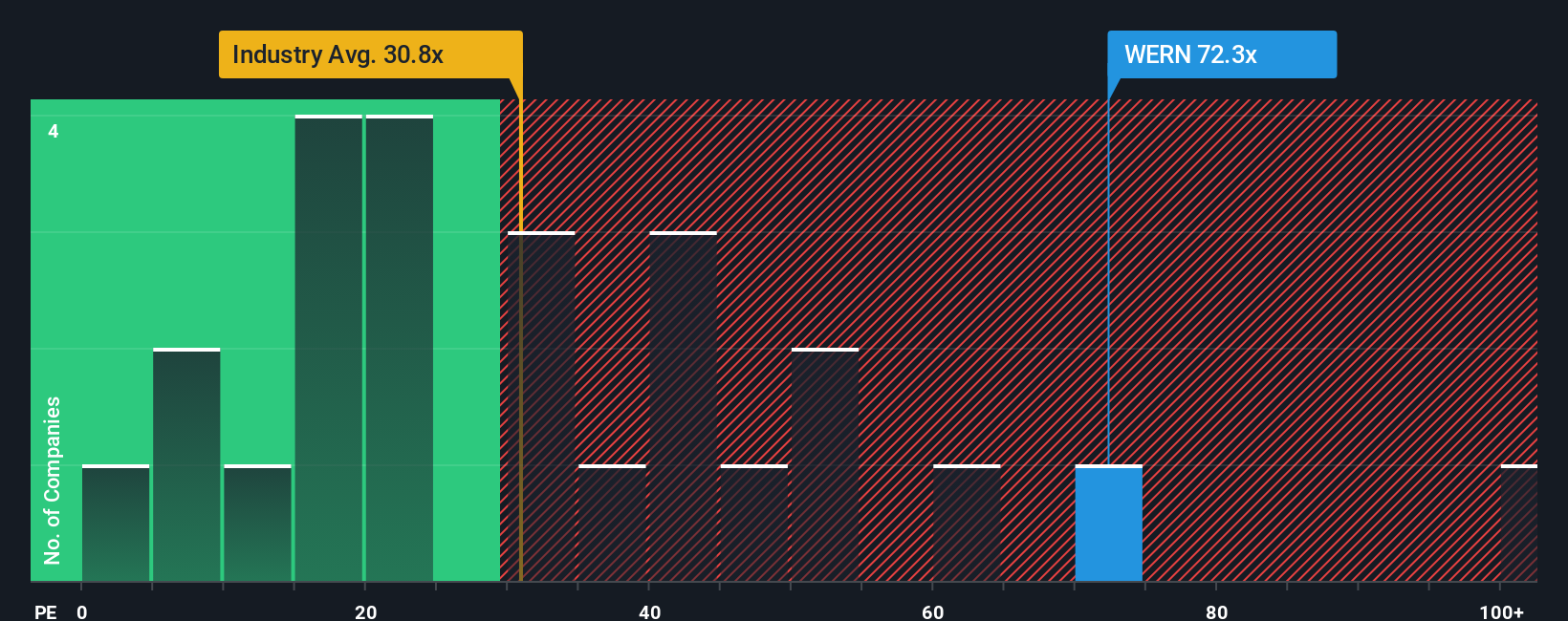

Following the firm bounce in price, Werner Enterprises may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 72.3x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Werner Enterprises' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Werner Enterprises

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Werner Enterprises' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 43%. As a result, earnings from three years ago have also fallen 89% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 66% over the next year. With the market only predicted to deliver 16%, the company is positioned for a stronger earnings result.

With this information, we can see why Werner Enterprises is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Werner Enterprises' P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Werner Enterprises' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Werner Enterprises (of which 2 are a bit unpleasant!) you should know about.

Of course, you might also be able to find a better stock than Werner Enterprises. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报