3 Global Growth Companies With High Insider Ownership Expecting 37% Revenue Growth

As global markets navigate a landscape of interest rate adjustments and economic uncertainties, investors are keeping a keen eye on growth companies that demonstrate resilience and potential for expansion. In this setting, stocks with high insider ownership can offer unique insights into company confidence, making them particularly intriguing as they project significant revenue growth amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

Here we highlight a subset of our preferred stocks from the screener.

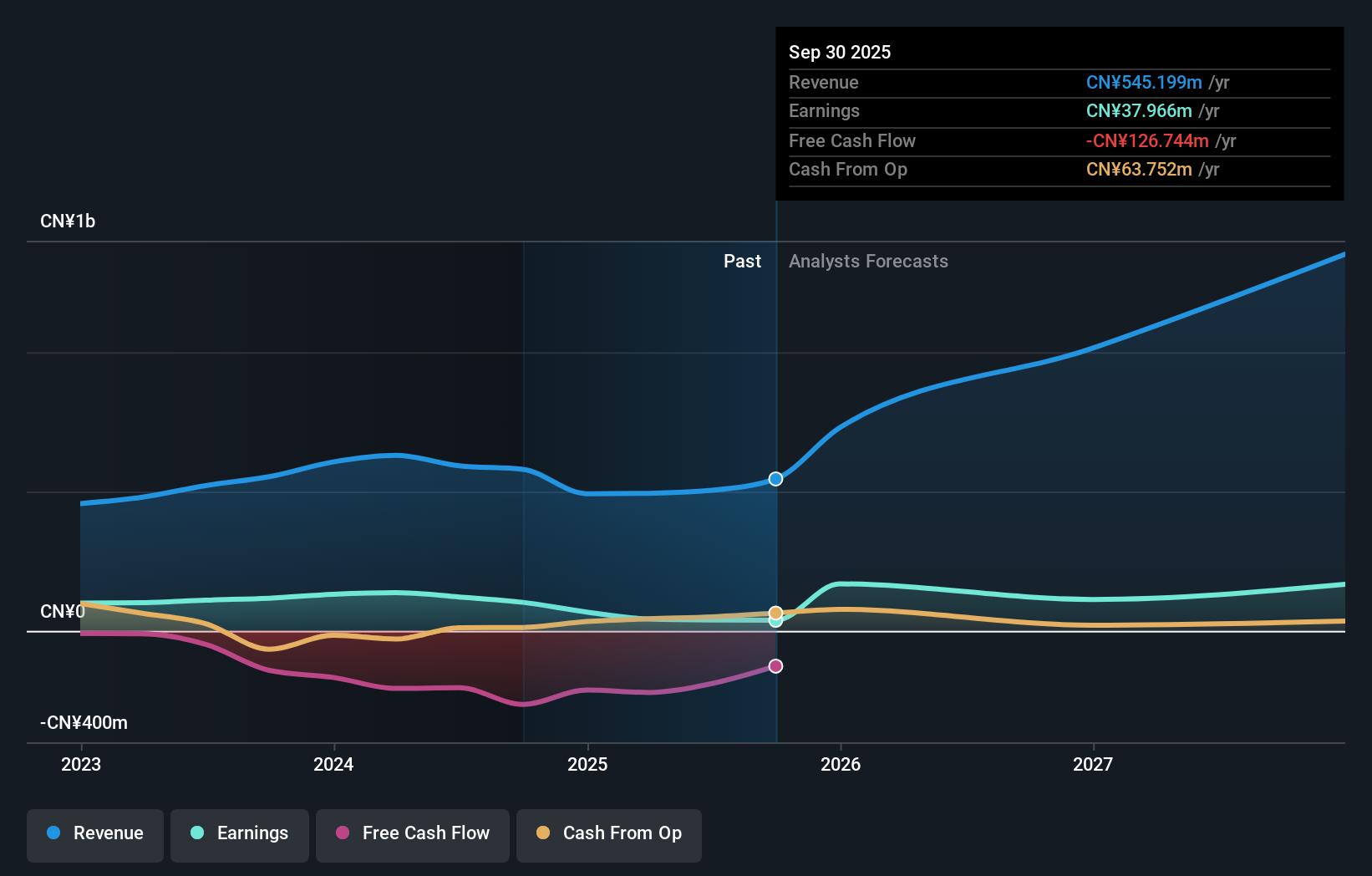

Farsoon Technologies (SHSE:688433)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Farsoon Technologies Co., Ltd. manufactures and supplies industrial-level polymer and metal laser powder bed fusion systems across China, North America, and Europe, with a market cap of CN¥22.28 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, which generated CN¥545.20 million.

Insider Ownership: 11.5%

Revenue Growth Forecast: 37.6% p.a.

Farsoon Technologies shows potential as a growth company with high insider ownership, despite recent challenges. The company's revenue is forecast to grow significantly at 37.6% annually, outpacing the CN market's 14.5%. However, profit margins have declined from 17.6% to 7%, and net income has decreased from CNY 43.8 million to CNY 14.56 million year-over-year, indicating volatility in financial performance amidst expected strong earnings and revenue growth projections.

- Click here to discover the nuances of Farsoon Technologies with our detailed analytical future growth report.

- Our expertly prepared valuation report Farsoon Technologies implies its share price may be too high.

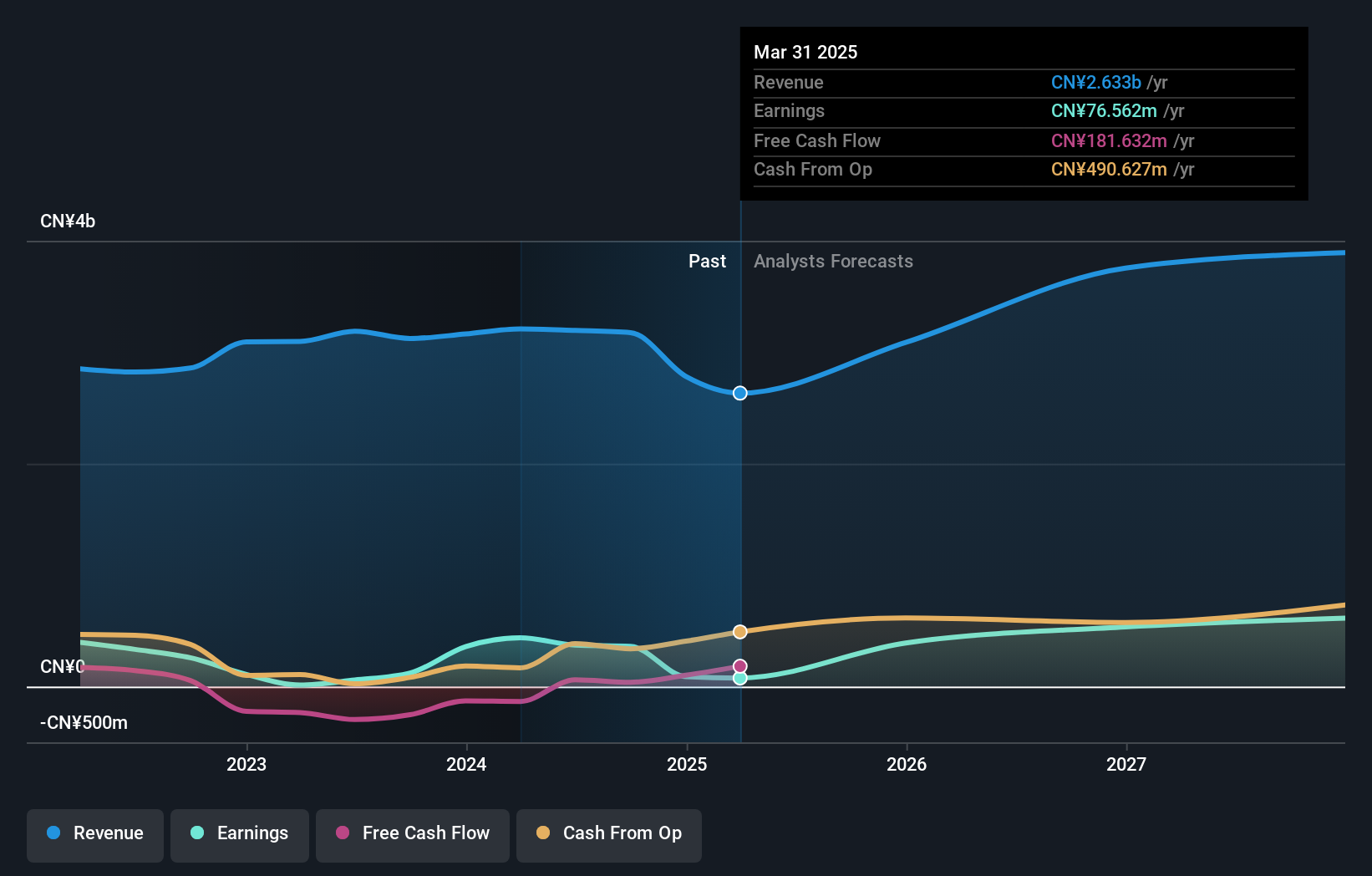

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Winning Health Technology Group Co., Ltd. offers digital health services to medical and health institutions in China, with a market cap of CN¥18.81 billion.

Operations: Winning Health Technology Group Co., Ltd. generates revenue through its provision of digital health services to medical and health institutions across China.

Insider Ownership: 22.2%

Revenue Growth Forecast: 20.3% p.a.

Winning Health Technology Group is positioned for growth with a forecasted revenue increase of 20.3% annually, surpassing the CN market's 14.4% growth expectation. Despite trading at 64.1% below its estimated fair value and analysts predicting a 32.2% rise in stock price, recent earnings show challenges with sales dropping to CNY 1.30 billion and a net loss of CNY 241.39 million compared to last year's profit, highlighting current financial volatility amidst future profitability projections within three years.

- Navigate through the intricacies of Winning Health Technology Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Winning Health Technology Group's shares may be trading at a discount.

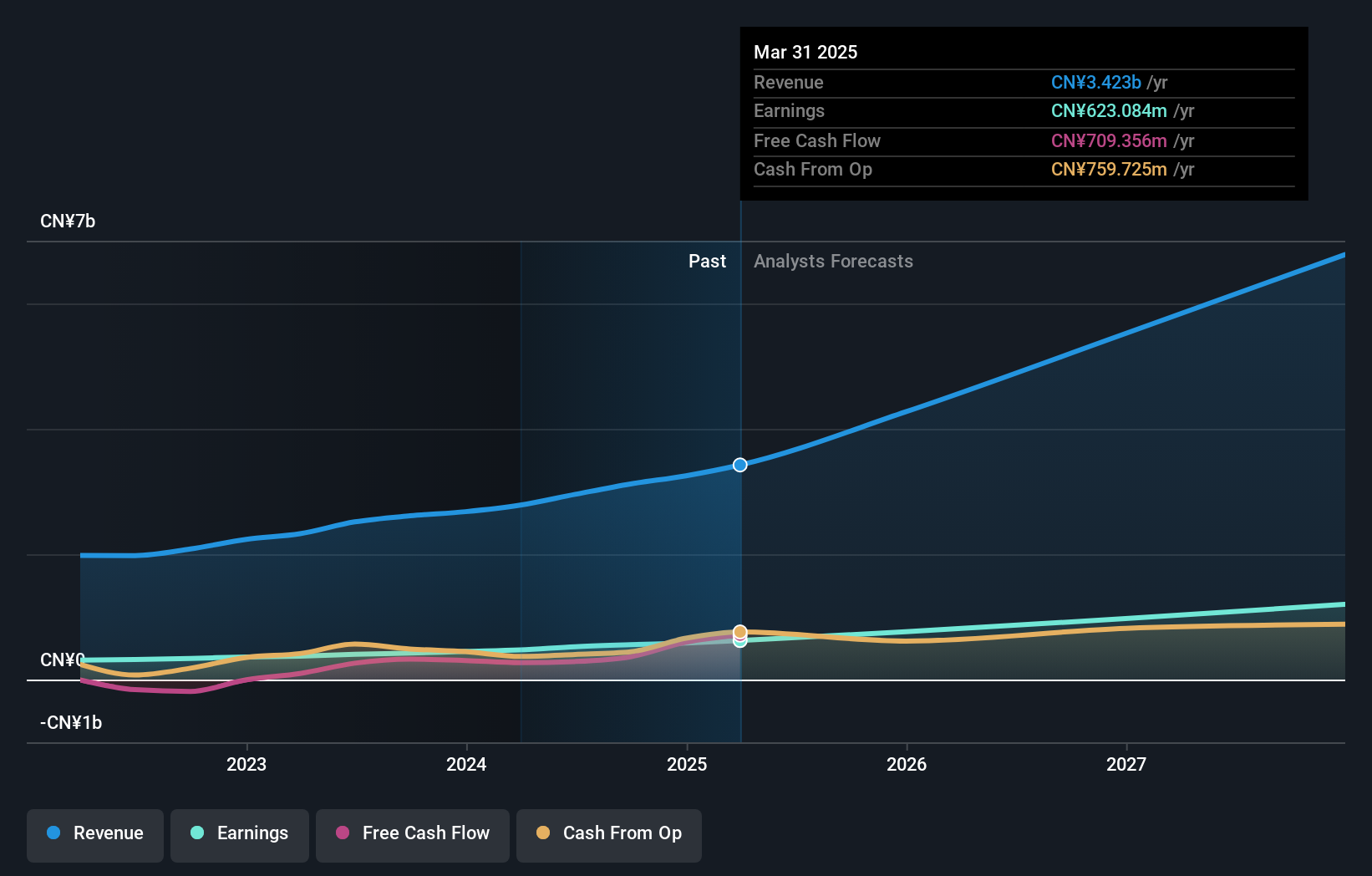

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Huace Navigation Technology Ltd. operates in the field of navigation and positioning technology, with a market cap of CN¥25.01 billion.

Operations: Shanghai Huace Navigation Technology Ltd. generates its revenue primarily through its operations in navigation and positioning technology.

Insider Ownership: 24.2%

Revenue Growth Forecast: 24.5% p.a.

Shanghai Huace Navigation Technology is poised for substantial growth, with earnings projected to rise 24.21% annually and revenue expected to outpace the market at 24.5% per year. The company's recent strategic partnership with CNH Industrial enhances its precision agriculture offerings, potentially expanding its market reach across the EMEA region. Despite a high Price-To-Earnings ratio of 36.4x, it remains below the CN market average of 42.4x, indicating relative value potential amidst robust growth forecasts.

- Click here and access our complete growth analysis report to understand the dynamics of Shanghai Huace Navigation Technology.

- The analysis detailed in our Shanghai Huace Navigation Technology valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Explore the 865 names from our Fast Growing Global Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报