3 Asian Dividend Stocks Yielding Up To 6.7%

As global markets navigate a complex landscape marked by interest rate adjustments and economic uncertainties, investors are increasingly turning their attention to Asia for opportunities. In this context, dividend stocks in the region stand out as attractive options for those seeking income stability amid fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.83% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.07% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.96% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.76% | ★★★★★★ |

Click here to see the full list of 1039 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

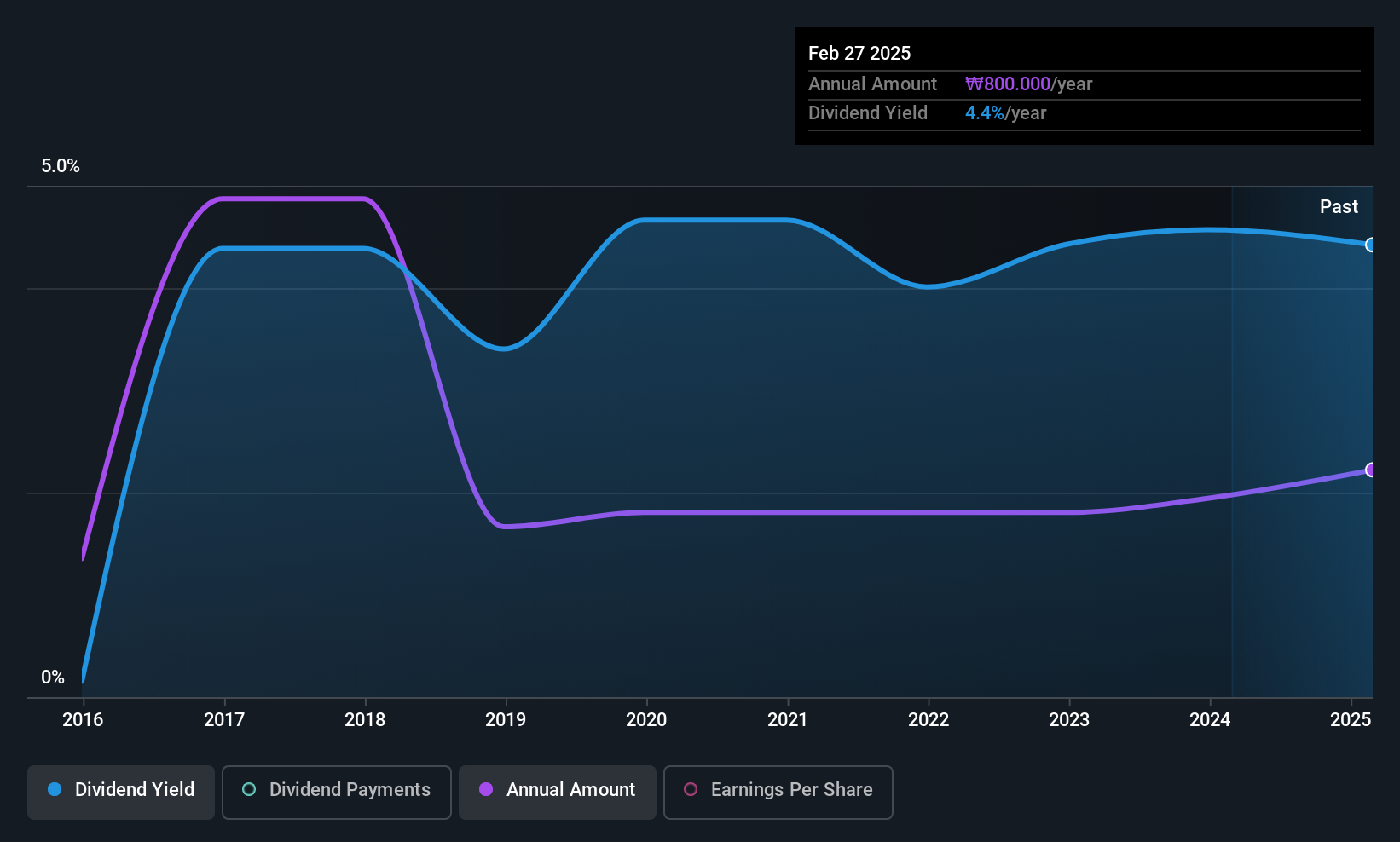

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ORION Holdings Corp. is a company that manufactures and sells confectioneries in South Korea, China, and internationally, with a market cap of ₩1.29 trillion.

Operations: ORION Holdings Corp. generates its revenue primarily from the confectionery segment, which accounts for ₩4.11 trillion, along with contributions from its video and landlord segments at ₩55.99 billion and ₩72.47 billion respectively.

Dividend Yield: 3.7%

ORION Holdings displays a mixed profile for dividend investors. While its dividend yield is in the top 25% of the Korean market, and dividends are well-covered by earnings and cash flows with low payout ratios, its track record over the past decade has been volatile. Recent earnings growth of 38.9% suggests potential stability, but historical unreliability in dividend payments remains a concern despite increased payouts over ten years.

- Click here to discover the nuances of ORION Holdings with our detailed analytical dividend report.

- Our valuation report here indicates ORION Holdings may be undervalued.

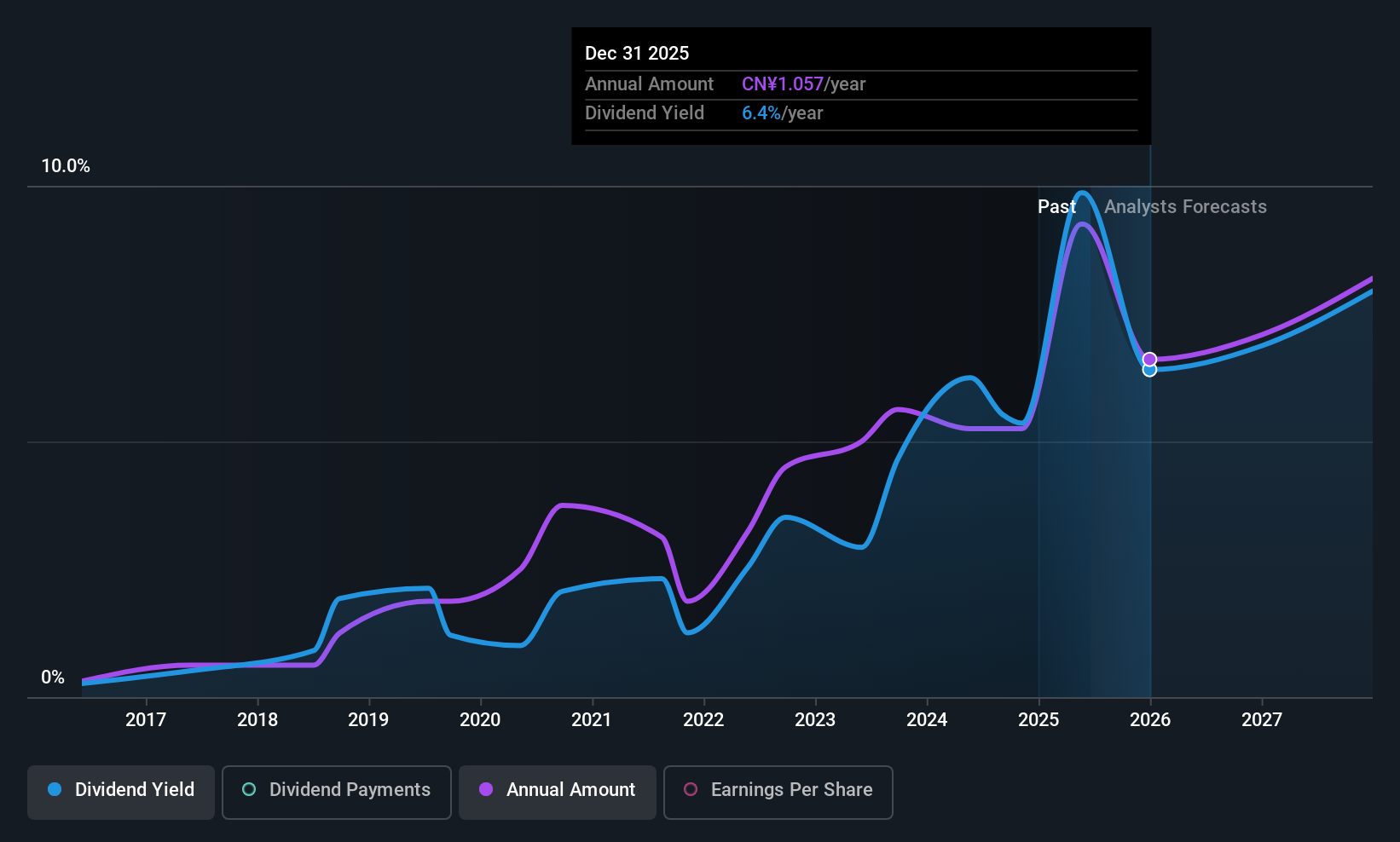

37 Interactive Entertainment Network Technology Group (SZSE:002555)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: 37 Interactive Entertainment Network Technology Group Co., Ltd. develops, distributes, and operates online games in China with a market cap of CN¥48.17 billion.

Operations: 37 Interactive Entertainment Network Technology Group Co., Ltd. generates revenue primarily through the development, distribution, and operation of online games in China.

Dividend Yield: 6.8%

37 Interactive Entertainment Network Technology Group offers a high dividend yield in the top 25% of the CN market, but its dividends have been volatile and not well-covered by cash flows. Despite a reasonable payout ratio of 70.4% covered by earnings and recent earnings growth, historical unreliability in dividend payments is notable. Recent announcements confirm continued payouts with CNY 2.10 per 10 shares for Q3 2025, highlighting ongoing commitment despite sustainability concerns.

- Delve into the full analysis dividend report here for a deeper understanding of 37 Interactive Entertainment Network Technology Group.

- According our valuation report, there's an indication that 37 Interactive Entertainment Network Technology Group's share price might be on the cheaper side.

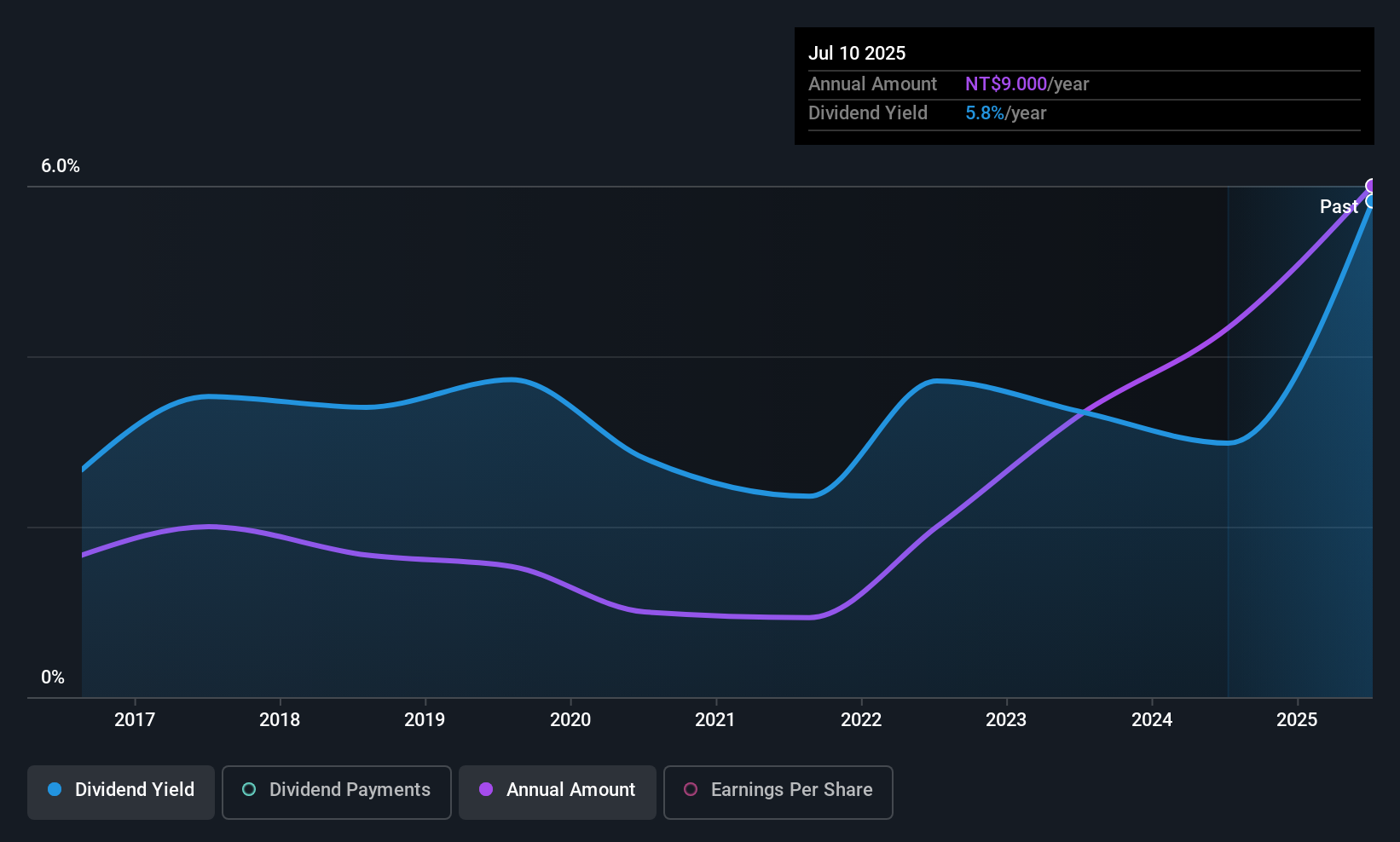

Depo Auto Parts Industrial (TWSE:6605)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Depo Auto Parts Industrial Co., Ltd. manufactures and sells automotive and related lighting products across Taiwan, Asia, and the Americas, with a market cap of NT$23.55 billion.

Operations: Depo Auto Parts Industrial Co., Ltd. generates revenue of NT$19.68 billion from its research, development, manufacturing, and sales of various automotive lamps.

Dividend Yield: 6.3%

Depo Auto Parts Industrial offers a dividend yield in the top 25% of the TW market, supported by a reasonable payout ratio of 65.6% and cash payout ratio of 31.7%. However, its dividend history has been volatile and unreliable over the past decade. Recent earnings showed declines with net income at TWD 556.66 million for Q3 2025, down from TWD 638.63 million a year ago, raising potential concerns about future dividend sustainability amidst fluctuating performance.

- Navigate through the intricacies of Depo Auto Parts Industrial with our comprehensive dividend report here.

- Our expertly prepared valuation report Depo Auto Parts Industrial implies its share price may be lower than expected.

Where To Now?

- Embark on your investment journey to our 1039 Top Asian Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报