Reassessing Herbalife (HLF) Valuation After Its Recent Share Price Surge

Herbalife (HLF) has quietly turned into a comeback story, with the stock climbing sharply over the past month and past 3 months, even as long term returns still lag badly.

See our latest analysis for Herbalife.

At around $14.30 per share, Herbalife’s powerful recent share price momentum, including a triple digit year to date share price return, contrasts sharply with its weak five year total shareholder return. This suggests sentiment has only recently turned.

If this rebound has you rethinking what could run next, it may be worth exploring fast growing stocks with high insider ownership as a way to uncover other potential turnaround or high conviction stories.

With earnings still under pressure but the share price racing ahead, the key question now is whether Herbalife remains undervalued on fundamentals, or if the market has already priced in a full turnaround and future growth?

Most Popular Narrative Narrative: 48% Overvalued

Against the last close of $14.30, the most followed narrative anchors fair value much lower, framing Herbalife as already pricing in a rich recovery.

The analysts have a consensus price target of $9.333 for Herbalife based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $11.0, and the most bearish reporting a price target of just $7.0.

Curious how a business with stabilising sales, shrinking margins, and lower future earnings can still command a higher implied multiple than today? The full narrative explains the underlying growth assumptions, the reset in profitability, and the discount rate that together help frame this valuation view.

Result: Fair Value of $9.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid traction in personalized wellness, better than expected volume growth, or faster margin recovery under new leadership could invalidate concerns embedded in this valuation.

Find out about the key risks to this Herbalife narrative.

Another Lens, Same Stock

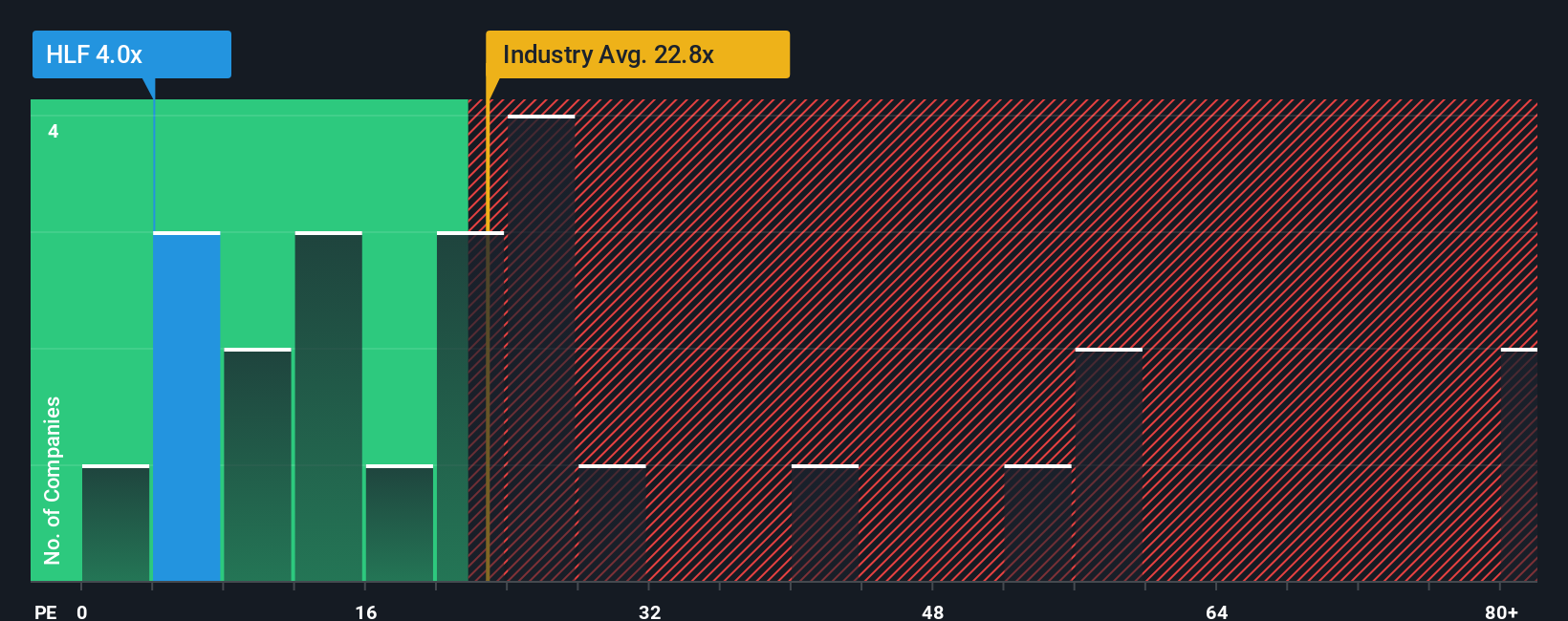

Step away from analyst targets and the story shifts. On a simple price to earnings basis, Herbalife trades at about 4.6 times earnings, far below peers near 19 times and a fair ratio of 12 times, suggesting the market may be underpricing its earnings power.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Herbalife Narrative

If this perspective does not quite fit your view, or you would rather dive into the numbers yourself, you can craft a custom storyline in minutes: Do it your way.

A great starting point for your Herbalife research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Herbalife when you can quickly uncover fresh opportunities with our powerful Simply Wall Street Screener, tailored to different strategies and market themes.

- Explore potential income by targeting companies in these 12 dividend stocks with yields > 3% that aim to reward shareholders with reliable cash returns.

- Position yourself early in transformative innovation by reviewing these 26 AI penny stocks shaping the next wave of intelligent technology.

- Strengthen your margin of safety by focusing on these 911 undervalued stocks based on cash flows that may be trading below their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报