Clearwater Analytics (CWAN): Reassessing Valuation After Recent Share Price Rebound

Clearwater Analytics Holdings (CWAN) has quietly outperformed the broader market over the past month, with the stock up about 9% and roughly 12% over the past 3 months despite a weaker year to date.

See our latest analysis for Clearwater Analytics Holdings.

That recent strength sits against a tougher backdrop, with the year to date share price return still negative while the 3 year total shareholder return remains positive. This suggests momentum in Clearwater Analytics Holdings is only now starting to rebuild around its $21.7 share price.

If Clearwater’s rebound has your attention, this could be a good moment to scan other high growth tech names using Simply Wall St’s high growth tech and AI stocks.

With the share price still below analyst targets but recent gains narrowing the gap, the key question now is whether Clearwater Analytics remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 24% Undervalued

With Clearwater Analytics last closing at $21.70 against a narrative fair value near $28.55, the prevailing view sees considerable upside still on the table.

Continuous product innovation, especially the integration of generative AI, the launch of proprietary data and risk platforms (e.g., Helios), and the buildout of a unified, front to back, multi asset SaaS solution, positions the company to increase cross sell/upsell to its existing sticky client base, which should drive up net revenue retention and average revenue per customer.

Want to see what kind of revenue surge and margin reset that innovation roadmap is banking on, plus the bold earnings multiple it assumes? The full narrative lays it bare.

Result: Fair Value of $28.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on smooth integration and sustained growth, with acquisition missteps or slower second half momentum potentially undermining the bullish take-private narrative.

Find out about the key risks to this Clearwater Analytics Holdings narrative.

Another Angle on Value

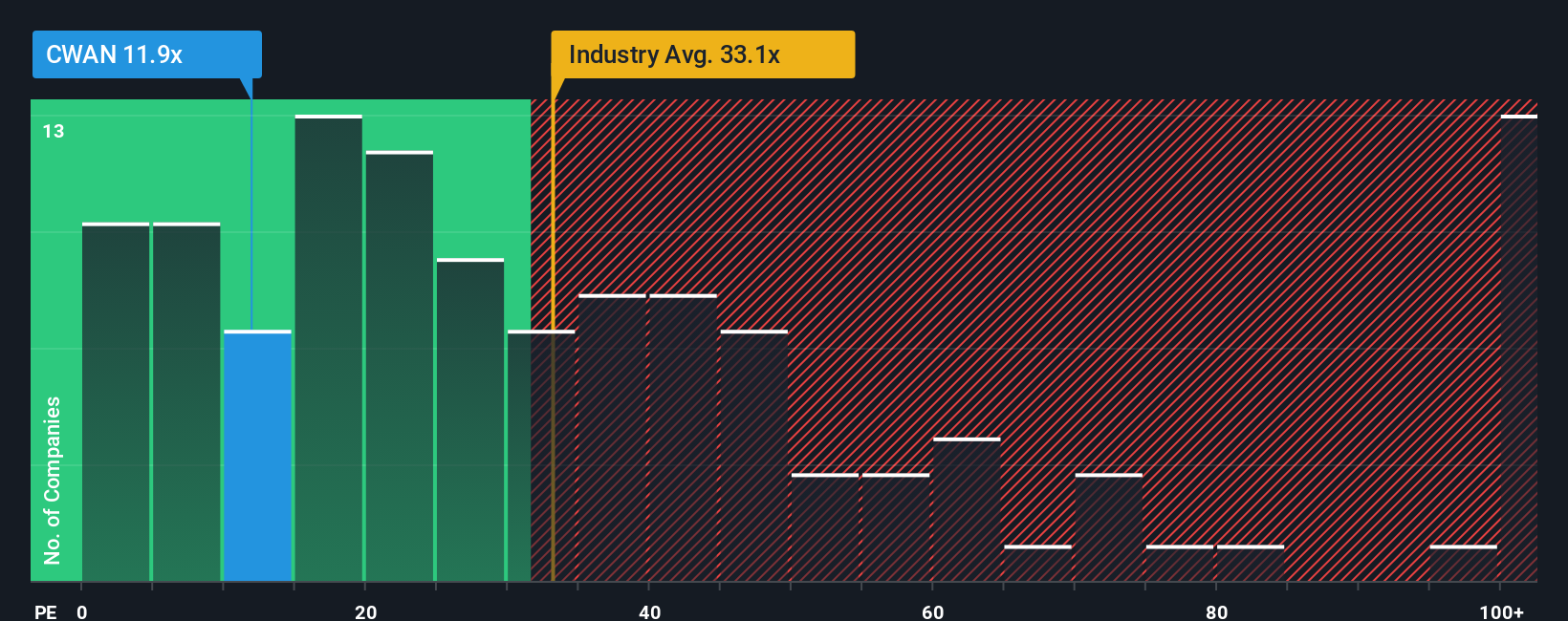

While the narrative fair value pins Clearwater Analytics at about 24% undervalued, its 15.9x price to earnings ratio paints a more cautious picture. That is well below the US Software industry at 32.7x, peers at 21.5x, and even its 24.3x fair ratio, hinting at upside but also asking why the market is so restrained.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Clearwater Analytics Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Clearwater Analytics Holdings Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Clearwater Analytics Holdings research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity; use the Simply Wall St Screener to uncover more potential winners before the crowd catches on and moves the market.

- Capitalize on mispriced potential by scanning these 914 undervalued stocks based on cash flows that still look overlooked despite strong cash flow support.

- Ride powerful secular trends by targeting these 26 AI penny stocks positioned at the heart of the AI transformation.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报