Is Galp Energia Still Attractive After Recent Share Price Pullback and Strong Multi Year Gains

- If you are wondering whether Galp Energia SGPS is still good value after a big run in past years, you are not alone. This breakdown is designed to give you a clear, no nonsense view of where the stock stands today.

- The share price has slipped recently, down around 3.0% over the last week and 24.0% over the last month, even though longer term holders are still sitting on gains of about 27.2% over 3 years and 104.1% over 5 years.

- That pullback comes as investors reassess European energy names in light of shifting oil and gas price expectations and ongoing capital allocation debates, as well as renewed focus on energy transition strategies across the sector. Together, these themes have nudged sentiment from optimistic to more cautious and set the backdrop for a closer look at what you are actually paying for Galp's future cash flows.

- On our checks, Galp scores a valuation rating of 4 out of 6, suggesting it looks undervalued on several key metrics. Next, we will walk through those traditional valuation approaches before finishing with a more holistic way to judge whether the current price truly reflects the full story.

Find out why Galp Energia SGPS's -12.5% return over the last year is lagging behind its peers.

Approach 1: Galp Energia SGPS Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in € terms. For Galp Energia SGPS, the 2 Stage Free Cash Flow to Equity model starts from last twelve month free cash flow of about €926 million and then applies analyst forecasts for the next few years, with Simply Wall St extrapolating further out.

Analysts currently see free cash flow peaking at around €1.35 billion in 2026 before gradually easing, with projections of roughly €676 million by 2029 and a slower decline thereafter. These cash flows are discounted back to today to reflect risk and the time value of money, producing an estimated intrinsic value of €15.56 per share.

Compared with the current market price, this points to roughly a 10.0% discount, suggesting the stock is modestly undervalued based on its projected cash generation rather than headline earnings alone.

Result: ABOUT RIGHT

Galp Energia SGPS is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

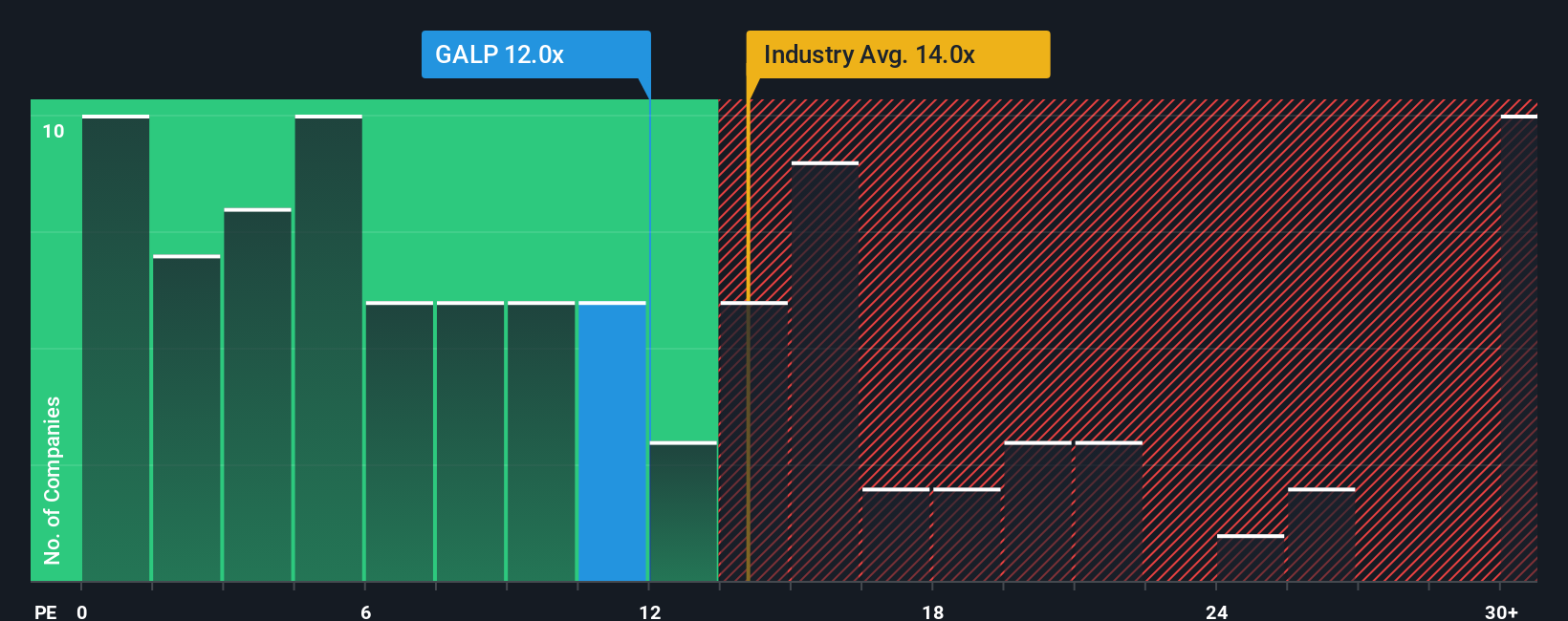

Approach 2: Galp Energia SGPS Price vs Earnings

For a profitable business like Galp, the price to earnings ratio, or PE, is a practical way to judge value because it links what you pay directly to the company’s bottom line. In general, faster growing and lower risk companies can justify a higher PE, while slower growth, cyclicality or higher risk usually call for a lower, more conservative multiple.

Galp currently trades on a PE of about 9.99x, which is noticeably below the Oil and Gas industry average of roughly 13.18x and also under the peer group average of around 13.04x. That discount hints at some market caution around the company’s future earnings profile, but by itself a lower multiple does not automatically mean the stock is cheap or expensive.

To get a more tailored view, Simply Wall St uses a proprietary Fair Ratio. This estimates what Galp’s PE should be once its earnings growth outlook, profit margins, risk profile, industry and market cap are all taken into account. This makes it more informative than a simple comparison with peers or the broad industry, which can overlook important differences in quality and risk. On this Fair Ratio basis, Galp’s current PE comes out broadly in line with what would be expected.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

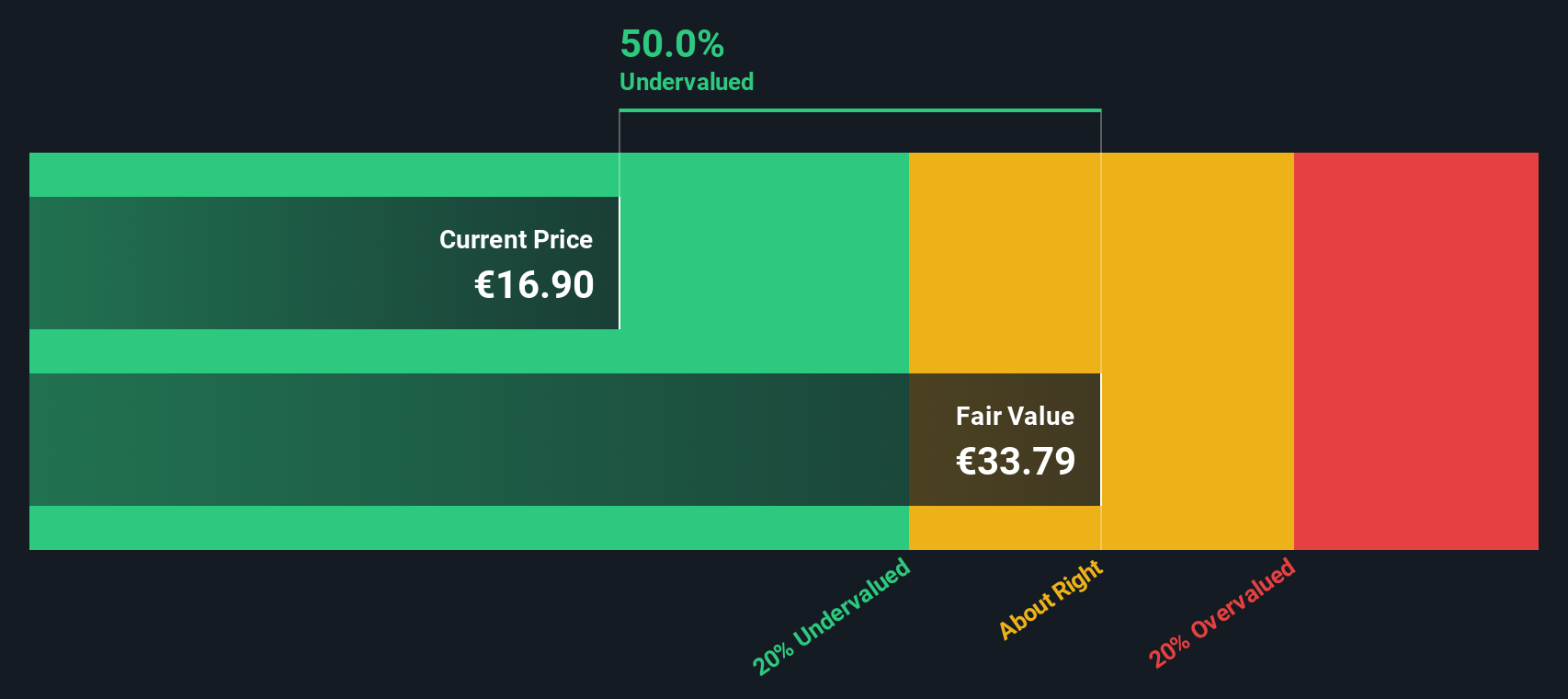

Upgrade Your Decision Making: Choose your Galp Energia SGPS Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more dynamic way to invest that goes beyond static ratios. A Narrative is simply your story about a company, expressed in numbers, where you outline what you think will happen to its revenue, earnings and margins and what that implies for its fair value. In other words, a Narrative connects three things in a straight line: Galp’s business story, the financial forecast that flows from that story and the fair value that drops out at the end. On Simply Wall St, millions of investors build and share Narratives on the Community page, using them as an easy tool to compare fair value with the current share price to decide whether to buy, hold or sell. Because Narratives are updated automatically when new information, such as results or major news, is released, they stay relevant rather than going stale. For example, one Galp Energia SGPS Narrative might assume robust refining margins and double digit revenue growth, while another bakes in weaker oil prices and modest growth, resulting in very different fair values and, therefore, very different decisions.

Do you think there's more to the story for Galp Energia SGPS? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报