Daiichi Sankyo (TSE:4568): Revisiting Valuation After ENHERTU’s Landmark First-Line FDA Approval

Daiichi Sankyo Company (TSE:4568) just picked up a major US win, with the FDA approving ENHERTU plus pertuzumab as first line therapy for unresectable or metastatic HER2 positive breast cancer, reshaping expectations around its oncology growth story.

See our latest analysis for Daiichi Sankyo Company.

The ENHERTU milestone lands after a mixed run in the market, with the latest share price at ¥3,462 and a year to date share price return of about negative 19 percent, even as the five year total shareholder return remains positive. This suggests long term holders are still ahead despite recent volatility and shifting sentiment around oncology execution, ongoing ENHERTU trials and the new Lunit AI collaboration.

If this FDA decision has you rethinking your healthcare exposure, it could be a good moment to explore other potential leaders using healthcare stocks.

With shares still trading well below analyst targets despite double digit earnings growth and a fresh ENHERTU label, is Daiichi Sankyo quietly undervalued, or are markets already factoring in the next leg of oncology driven expansion?

Most Popular Narrative: 37.6% Undervalued

Compared to the last close at ¥3,462, the most widely followed narrative sees Daiichi Sankyo’s fair value far higher, hinging on oncology driven growth.

Pipeline depth in antibody drug conjugates supported by ongoing R&D investment and multiple upcoming pivotal data readouts and regulatory submissions (e.g., for breast, gastric, lung, and gynecological cancers) positions the company to capture higher margin opportunities as precision medicine gains traction, which could further boost future net margins and earnings.

Curious how steady double digit growth, rising margins, and a richer future earnings multiple combine into that valuation gap? The full narrative unpacks every assumption.

Result: Fair Value of ¥5,546.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on ENHERTU and Datroway, plus rising R&D costs and regulatory uncertainty, could quickly narrow that perceived valuation gap.

Find out about the key risks to this Daiichi Sankyo Company narrative.

Another Lens on Value

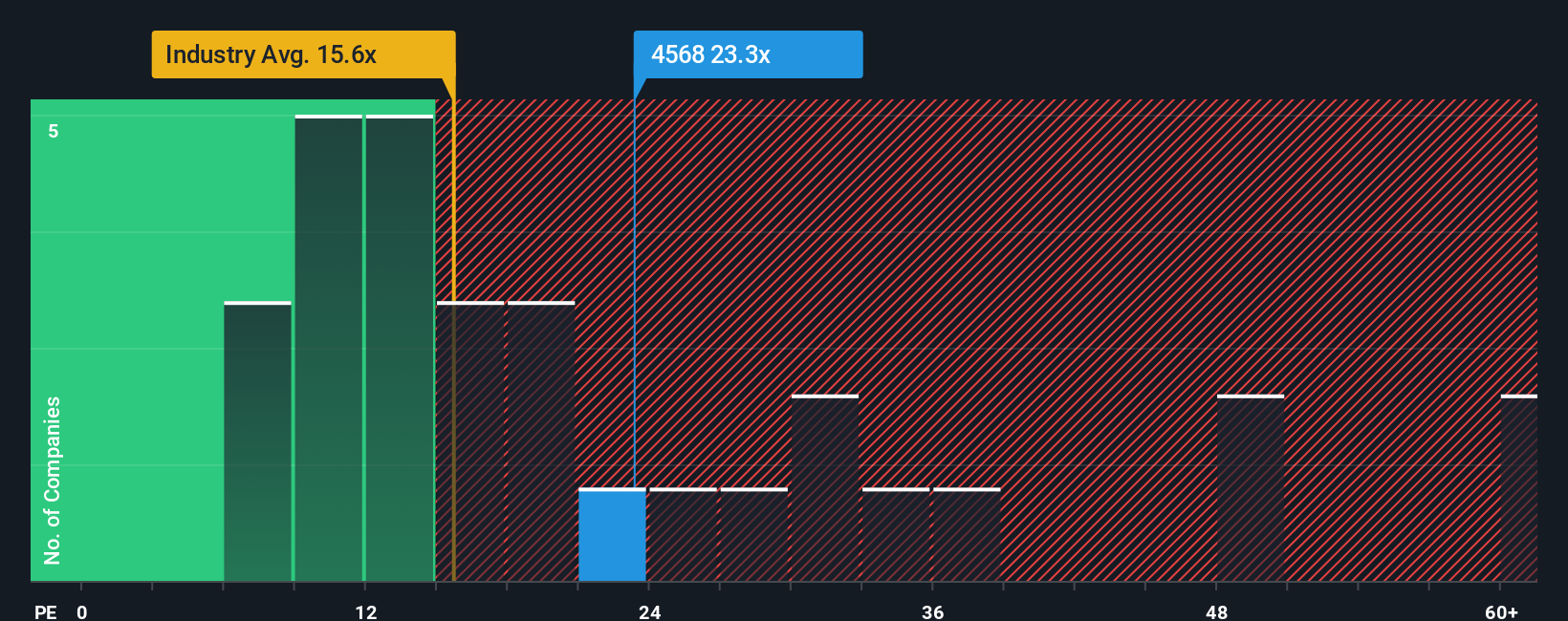

Even with a popular narrative calling Daiichi Sankyo undervalued, its current price to earnings ratio of 22.9 times sits above both peers at 22.1 times and the JP pharma industry at 16.2 times, while remaining below a fair ratio of 29.6 times that the market could drift toward.

That mix of modest expensiveness versus peers but headroom versus the fair ratio points to a more balanced risk reward than the headline discount suggests, leaving investors to ask whether growth will be strong enough to close that gap before sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daiichi Sankyo Company Narrative

If you see the story differently or want to test your own assumptions directly against the data, you can build a custom view in minutes: Do it your way.

A great starting point for your Daiichi Sankyo Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more actionable ideas?

Before markets move on without you, lock in your next opportunity by using the Simply Wall St Screener to uncover focused, data driven stock ideas in minutes.

- Target reliable income potential with these 12 dividend stocks with yields > 3% that spotlight companies sharing more of their cash flow with investors.

- Ride the most promising innovation trends by filtering for these 26 AI penny stocks positioned at the front of the AI adoption curve.

- Position yourself early in turnaround stories by scanning these 80 cryptocurrency and blockchain stocks that may benefit most from the next surge in blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报