Assessing Sekisui House Reit (TSE:3309) Valuation After Strategic Portfolio Shift and Upgraded Growth Outlook

Sekisui House Reit (TSE:3309) just signed off on a portfolio reshuffle, selling 12 properties and buying seven higher yielding assets, while simultaneously lifting its forecasts for revenue, profit, and distributions.

See our latest analysis for Sekisui House Reit.

Those moves seem to be resonating with investors, with a 1 day share price return of 3.0 percent and year to date share price gains of almost 9 percent, while the 1 year total shareholder return of around 22 percent points to steadily building momentum.

If this portfolio refresh has you thinking more broadly about where capital is flowing, it could be a good time to explore fast growing stocks with high insider ownership for other potential ideas.

Yet with units now trading roughly in line with analyst targets despite recent distribution upgrades, investors must ask whether Sekisui House Reit still offers mispriced upside or if the market already reflects the next leg of growth.

Price-to-Earnings of 18.7x: Is it justified?

On a price-to-earnings ratio of 18.7 times, Sekisui House Reit trades at a modest discount to both peers and the broader Japanese REITs industry, even after its recent run up.

The price-to-earnings multiple compares the current unit price to annual earnings per unit. It is a widely used yardstick for income focused, mature vehicles like REITs where profits and distributions tend to be relatively stable.

In this case, the 18.7 times earnings valuation sits below the peer average of 21.8 times and the industry average of 19.8 times. This suggests the market is not paying a premium for Sekisui House Reit despite its earnings profile and margins. It also screens as good value when stacked against an estimated fair price-to-earnings ratio of 22.7 times.

Explore the SWS fair ratio for Sekisui House Reit

Result: Price-to-Earnings of 18.7x (UNDERVALUED)

However, slowing revenue and net income growth, along with units already trading slightly above analyst targets, could constrain further multiple expansion from here.

Find out about the key risks to this Sekisui House Reit narrative.

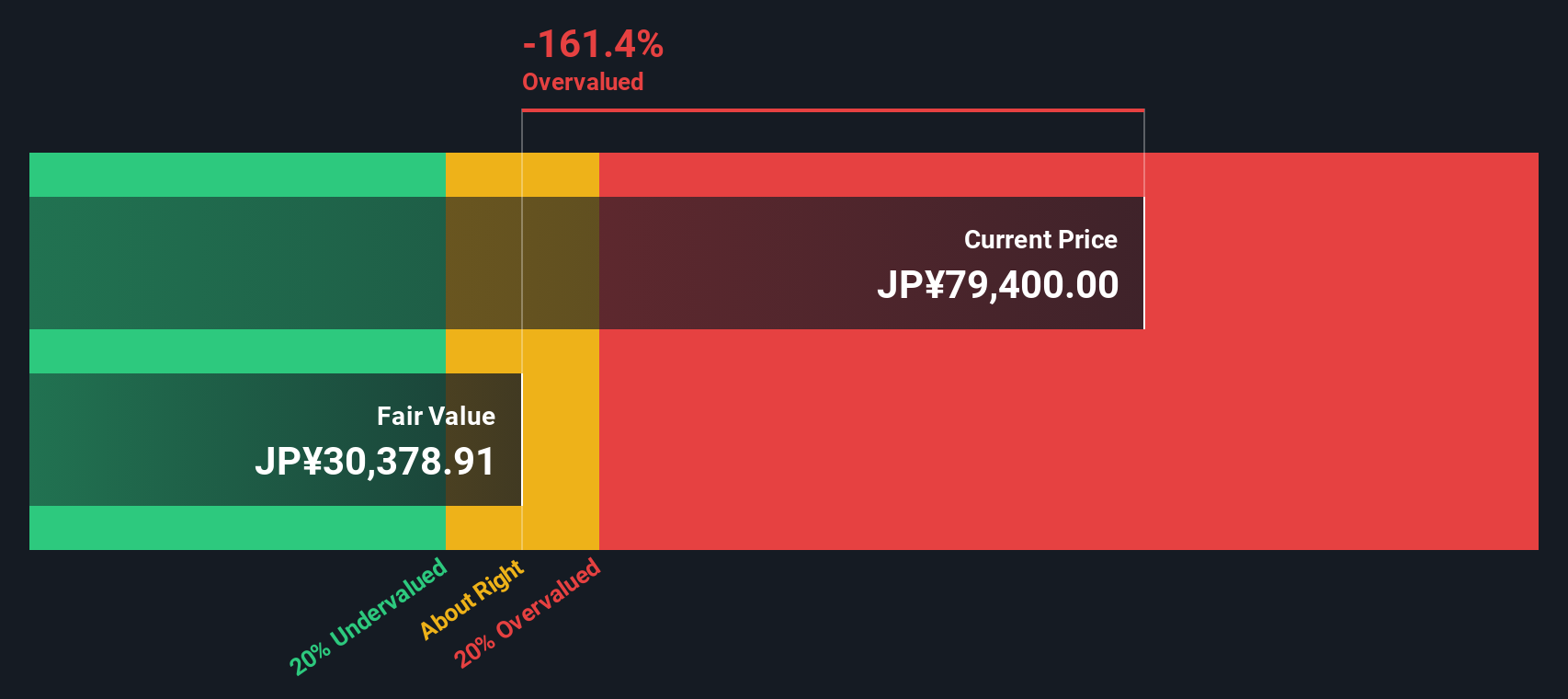

Another View: DCF Puts a Different Spin on Value

While the price-to-earnings lens hints at value, our DCF model paints a more cautious picture, with an estimated fair value of around ¥30560 per unit compared with today’s ¥85500 price, implying Sekisui House Reit may actually be overvalued. Is the market overestimating the durability of cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sekisui House Reit for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sekisui House Reit Narrative

If you would rather examine the numbers yourself and challenge these assumptions, you can quickly build a personalised view of Sekisui House Reit in just a few minutes, Do it your way.

A great starting point for your Sekisui House Reit research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop with a single opportunity. Use the Simply Wall Street Screener to uncover focused, data backed ideas that most investors will overlook.

- Capture potential multi baggers early by reviewing these 3636 penny stocks with strong financials that pair tiny market caps with surprisingly resilient financials and improving business momentum.

- Position yourself ahead of the next technology wave by scanning these 26 AI penny stocks shaping breakthroughs in automation, intelligent infrastructure, and real world AI adoption.

- Seek resilient cash returns by targeting these 13 dividend stocks with yields > 3% that combine solid balance sheets with dividend yields that meaningfully exceed low risk alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报