Nu Holdings (NYSE:NU): Rethinking Valuation After a Strong Multi‑Year Share Price Surge

Nu Holdings (NYSE:NU) has quietly become one of the standout fintech stories in Latin America, and its recent share performance has investors weighing how much growth is already priced into the stock.

See our latest analysis for Nu Holdings.

At around $16.20 per share, Nu’s recent pullback contrasts with a powerful trend. Its year to date share price return above 50 percent and three year total shareholder return above 300 percent suggest momentum is still very much intact.

If Nu’s run has you rethinking where growth could come from next, it may be worth scanning fast growing stocks with high insider ownership for other fast moving opportunities.

Yet with revenue still growing nearly 50 percent annually and the stock now trading below analyst targets, investors face a key question: is Nu still mispriced for its long runway, or is the market already baking in tomorrow’s growth?

Most Popular Narrative: 12.1% Undervalued

With Nu closing at $16.20 against a narrative fair value near $18.43, the valuation case leans positive while still hinging on aggressive growth assumptions.

The analysts have a consensus price target of $16.989 for Nu Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $14.0.

Want to see what kind of revenue surge, margin reset, and future earnings multiple are needed to support that upside case? The full narrative lays out the playbook.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and heavier regulation across Latin America could slow customer growth, squeeze margins, and challenge the optimistic earnings path embedded in forecasts.

Find out about the key risks to this Nu Holdings narrative.

Another View: Market Multiple Sends A Caution Flag

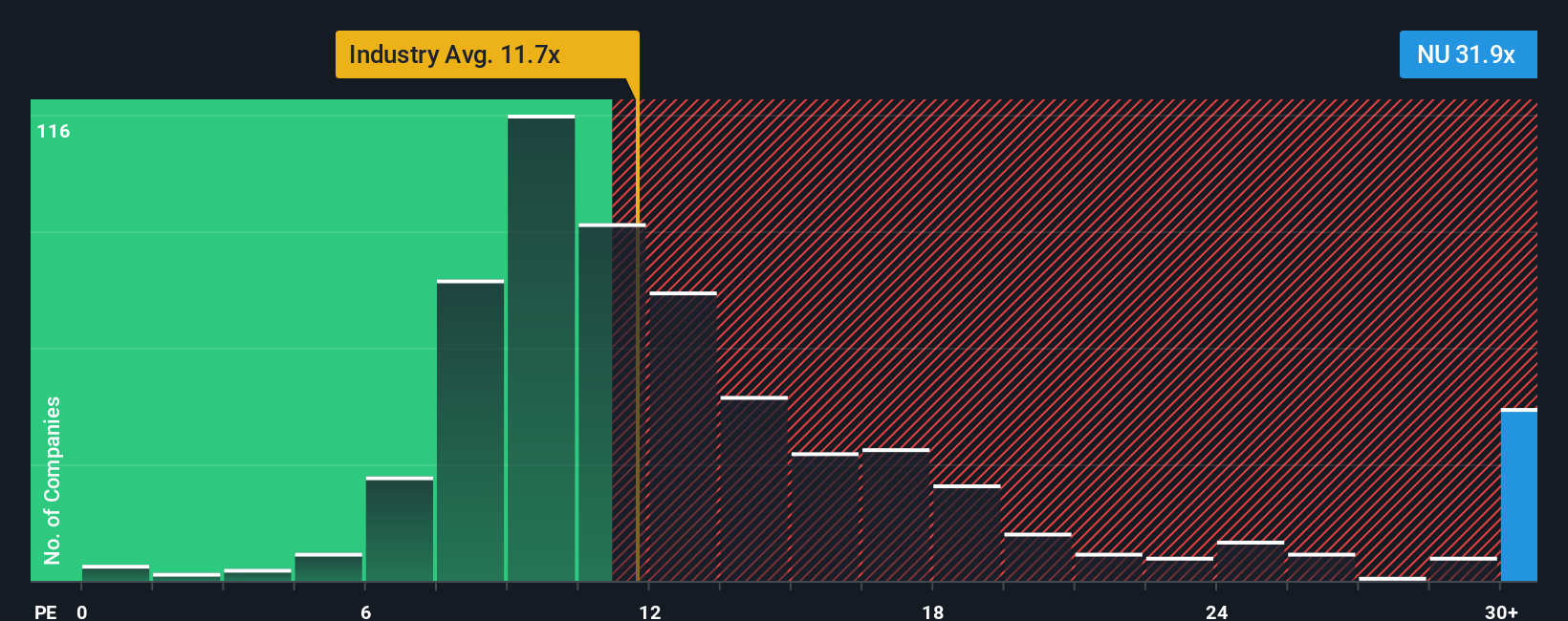

While the narrative fair value suggests upside, the market’s own yardstick paints a tougher picture. Nu trades around 31 times earnings, far richer than both peers at 13 times and a fair ratio of 22.7 times, which implies meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you see Nu’s story differently or want to test your own assumptions, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Nu is just one opportunity, and you do not want to miss other potential winners. Use the Simply Wall St Screener to uncover what the market is overlooking.

- Capture early-stage potential by targeting these 3636 penny stocks with strong financials that already show real financial strength instead of relying on hype alone.

- Position yourself at the heart of technological transformation with these 26 AI penny stocks shaping how data, automation, and intelligent systems power the next growth cycle.

- Lock in attractive entry points by focusing on these 909 undervalued stocks based on cash flows where current prices lag their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报