Has Comfort Systems USA’s Massive 1,748% Surge Fully Reflected Its Data Center Growth Story?

- Wondering if Comfort Systems USA is still worth buying after that massive run up in price, or if most of the upside is already baked in? This breakdown will help you evaluate whether the stock still offers value or is leaning into hype.

- The share price has pulled back around 1.5% over the last week, but it is still up 6.5% over the past month, 126.0% year to date, and an eye catching 1,748.4% over 5 years. This trajectory naturally raises questions about how much future growth is already priced in.

- Recent headlines have focused on Comfort Systems USA winning large scale mechanical and electrical contracting work tied to data centers and infrastructure projects, reinforcing the narrative that it is a key beneficiary of long term investment in mission critical facilities. At the same time, commentary around tight labor markets and project execution risk has added nuance to the story and reminds investors that rapid growth can come with higher expectations and scrutiny.

- On our checks, Comfort Systems USA scores a 4/6 valuation rating. This suggests it still looks undervalued on several fronts even after its rally. Next we will walk through those valuation methods, before finishing with a more holistic way to judge whether the current price truly reflects the long term story.

Approach 1: Comfort Systems USA Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today to reflect the time value and risk of that money.

For Comfort Systems USA, the latest twelve month Free Cash Flow is about $798.7 Million. Analysts and extrapolated estimates used in this 2 Stage Free Cash Flow to Equity model see cash flows rising steadily, reaching roughly $4.0 Billion by 2035. These projections reflect a period of faster growth in the near term, followed by moderating but still healthy expansion as the business matures.

When all those future cash flows are discounted back, the model arrives at an intrinsic value of about $1,476.44 per share. That implies the shares are trading at a 34.4% discount to this estimate, suggesting the market is not fully pricing in the projected cash generation or its durability.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Comfort Systems USA is undervalued by 34.4%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Comfort Systems USA Price vs Earnings

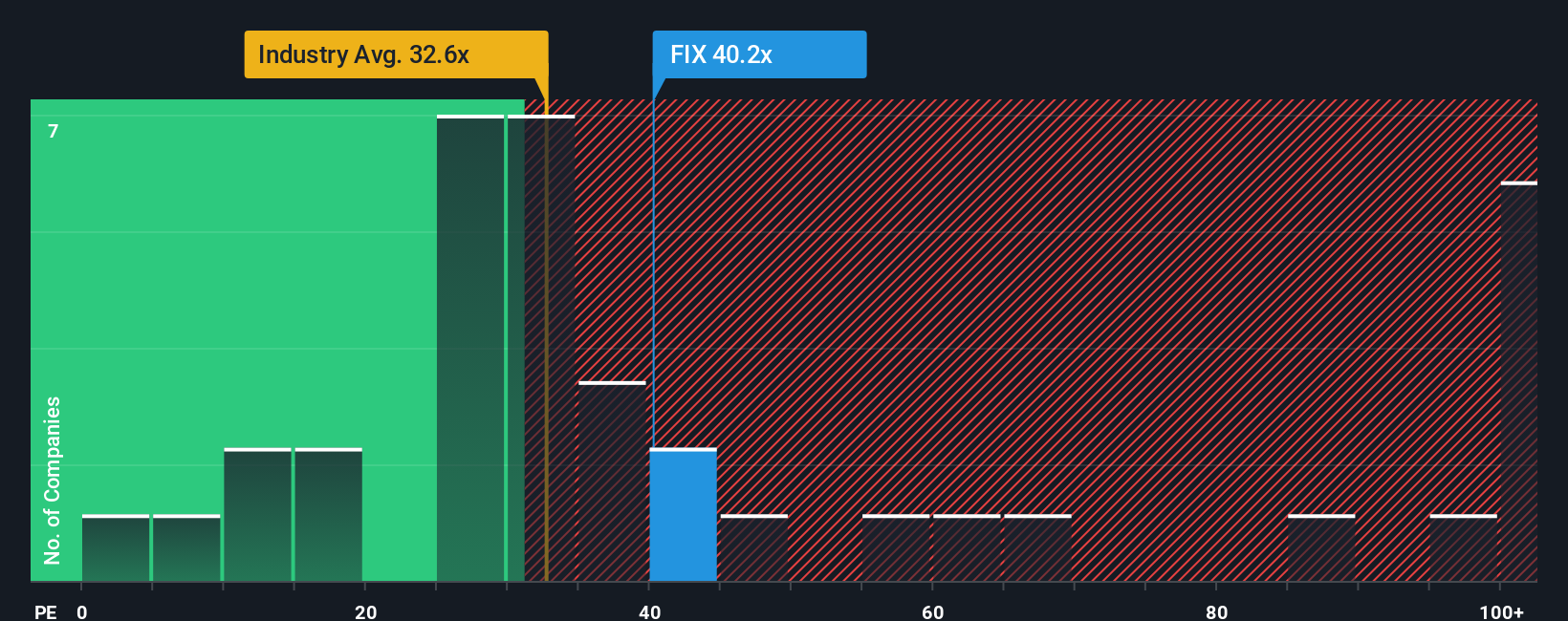

For profitable companies like Comfort Systems USA, the price to earnings ratio is a useful yardstick because it connects what investors pay today to the earnings the business is already generating. A higher or lower PE should reflect how quickly earnings are expected to grow and how risky or cyclical those earnings are, so a fair range is always tied to both growth prospects and uncertainty.

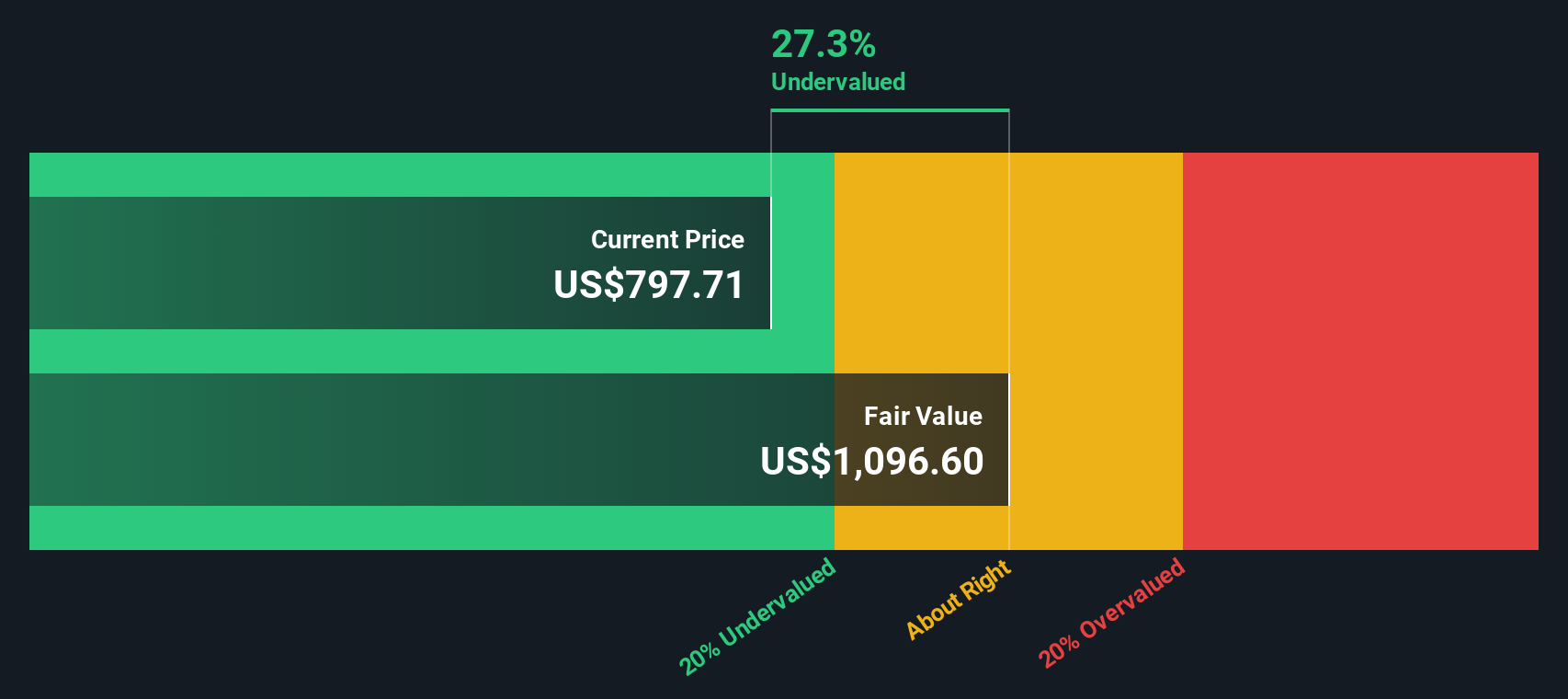

Comfort Systems USA currently trades on about 40.69x earnings, which is above the broader Construction industry average of roughly 32.44x but below the peer group average of around 61.15x. Simply Wall St also calculates a Fair Ratio of 43.65x, a proprietary estimate of what the multiple should be given Comfort Systems USA's growth profile, margins, industry, size and risk factors. This tends to be more informative than a simple peer or industry comparison, because it adjusts for the specific earnings outlook and quality of the company rather than assuming all contractors deserve the same valuation.

With the actual PE of 40.69x sitting below the 43.65x Fair Ratio, the shares appear modestly undervalued on this metric, even after their strong run.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Comfort Systems USA Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Comfort Systems USA's story with concrete forecasts for its future revenue, earnings, margins and ultimately a fair value estimate.

A Narrative on Simply Wall St is your own story for a company. You spell out what you think will drive its growth, how profitable it can be, and what risks matter most. You then link that story directly to a financial forecast and a fair value number. Narratives live inside the Community page on Simply Wall St, which is used by millions of investors. They are easy to use because the platform turns your assumptions into projected financials and a fair value that you can compare to today’s share price to decide whether you see Comfort Systems USA as a buy, hold or sell. They are also dynamic, updating automatically when new data, news or earnings are released, so your narrative stays current. For example, some investors may build a bullish Comfort Systems USA narrative around strong industrial reshoring demand and robust margins that supports a fair value above $1,100 per share, while more cautious investors might emphasize project concentration and labor risk and arrive at a fair value closer to the current price or even below it.

Do you think there's more to the story for Comfort Systems USA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报