Is ASML Still Attractive After Its Huge 2025 Run And DCF Signals Limited Upside?

- If you are wondering whether ASML Holding is still worth buying after its huge run, or if you would be paying top dollar for yesterday's story, you are not alone. That is exactly what this breakdown will tackle.

- The stock has slipped 3.2% over the last week, but is still up 6.9% over the past month and 53.6% year to date, with a 47.6% gain over the last year, 95.6% over three years and 134.8% over five years.

- Those moves come as ASML keeps reinforcing its role at the heart of advanced chipmaking. This ranges from demand for leading edge lithography tools used in AI data centers to ongoing geopolitical scrutiny around exports to certain markets. Together, these themes have sharpened both the excitement and the perceived risk around the stock's future cash flows and strategic importance.

- Despite all that, ASML Holding currently scores just 1/6 on our valuation checks, which suggests the market may already be baking in a lot of optimism. Next, we will walk through the main valuation approaches investors use for ASML and then, at the end, look at a more complete way to think about what the shares may be worth.

ASML Holding scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today.

For ASML Holding, the latest twelve months free cash flow is about €8.6 billion. Analysts and model estimates see this rising materially over time, with projected free cash flow reaching roughly €24.3 billion in 2035. Early years are based on analyst forecasts, while the later years are extrapolated using Simply Wall St assumptions about growth slowing over time as the business matures.

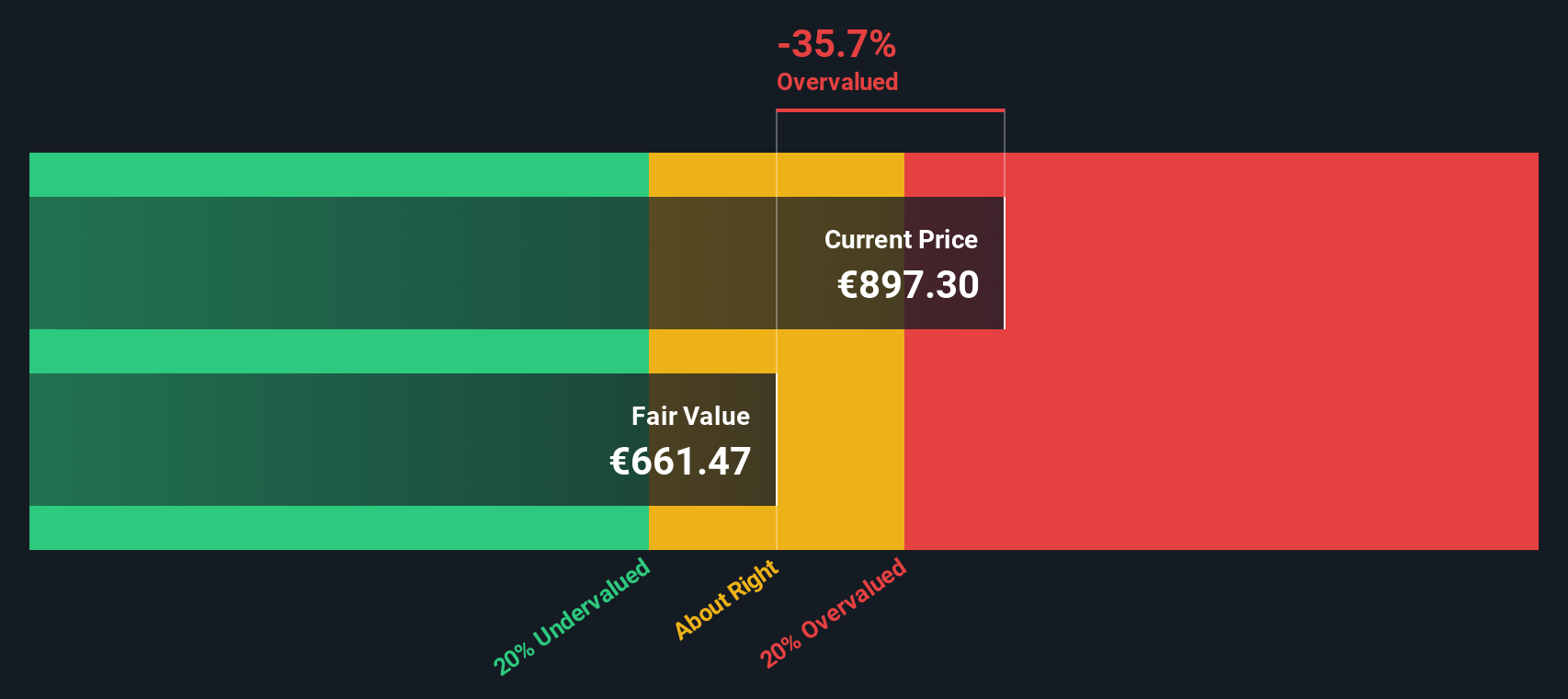

When all those future cash flows are discounted back to today using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out at about $777 per share. Compared with the current market price, the DCF implies the stock is around 38.5% overvalued, suggesting that a lot of future growth is already reflected in the share price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 38.5%. Discover 909 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings

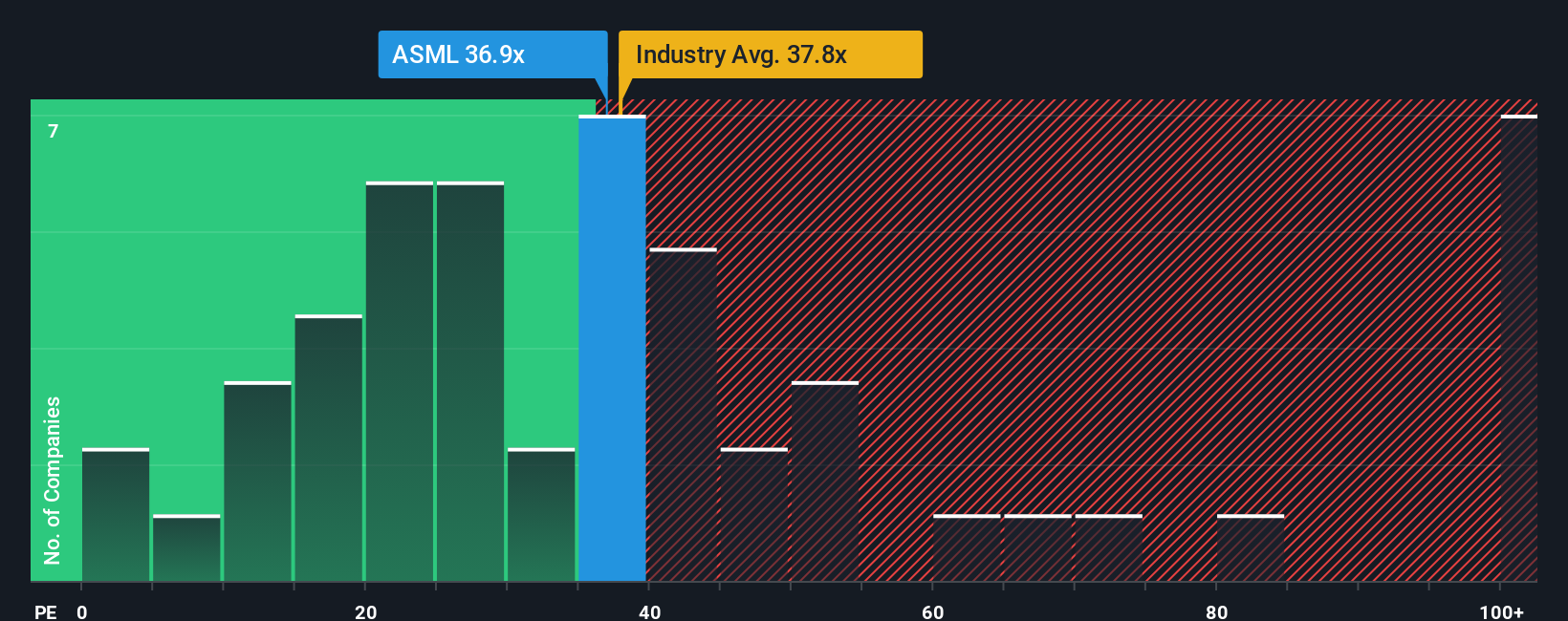

For established, profitable businesses like ASML Holding, the Price to Earnings (PE) ratio is a useful way to gauge what investors are paying for each dollar of current earnings. A higher PE can be justified when a company is expected to grow faster or is seen as less risky, while slower growth or higher uncertainty usually warrants a lower, more conservative multiple.

ASML currently trades on a PE of about 37.2x, which is broadly in line with the wider Semiconductor industry average of around 36.8x and below the peer group average of roughly 42.6x. On the surface, that suggests the market is not giving ASML a large premium over the sector despite its strategic importance in advanced chipmaking.

Simply Wall St takes this a step further with its proprietary Fair Ratio, which estimates what PE multiple a company should trade on after considering its earnings growth outlook, profitability, risk profile, industry and market cap. For ASML, this Fair Ratio is 31.0x, notably below the current 37.2x market multiple. That gap implies investors are paying more than the model suggests is reasonable given the fundamentals, indicating some overvaluation on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of ASML Holding’s story to a concrete financial forecast and a fair value estimate. A Narrative lets you spell out why you think revenue, earnings and margins will move a certain way, then automatically turns that story into projected financials and a fair value that you can compare with today’s share price to consider whether ASML might be a buy, hold or sell candidate. Narratives live inside the Community page on Simply Wall St, where millions of investors share and refine these story driven models, and each one is updated dynamically when fresh information like earnings results or major news comes in. For ASML, for example, one Narrative might see long term AI demand and its EUV monopoly as supporting a fair value above $1,000 per share, while a more cautious Narrative might focus on expectations for slowing 2026 growth and arrive at a far lower fair value.

Do you think there's more to the story for ASML Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报