Teva (TEVA) Secures Revolver Extension: A Subtle Shift In Balance Sheet Risk Or Strategy?

- In December 2025, Teva Pharmaceutical Industries obtained lender consent to extend the maturity of its senior unsecured sustainability-linked revolving credit facility from April 29, 2027, to April 29, 2028, while resetting key leverage and interest-cover covenants tied to potential Investment Grade Status.

- This covenant flexibility, together with recent progress in higher-margin branded and biosimilar products, gives Teva more room to align its balance sheet with its ongoing business transformation.

- Next, we’ll examine how this extended revolving credit facility and adjusted leverage covenants intersect with Teva’s investment narrative and risk profile.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Teva Pharmaceutical Industries Investment Narrative Recap

To own Teva today, you have to believe its shift toward higher-margin branded and biosimilar drugs can offset a sluggish generics base while it steadily manages a still-heavy debt load. The extended revolving credit facility modestly supports that case by easing near term refinancing pressure, but it does not change the key short term catalyst around execution on new product launches, nor the biggest risk linked to balance sheet leverage and funding flexibility.

In that context, Teva’s recent New Drug Application for its olanzapine extended release injectable for schizophrenia, together with European approvals for two denosumab biosimilars, looks directly tied to the growth narrative that needs to complement cautious generics and debt constraints. These pipeline and biosimilar milestones sit alongside the updated leverage covenants, highlighting how access to liquidity and progress in higher value products are now closely intertwined for shareholders.

Yet, set against this progress, the scale of Teva’s remaining debt and covenant conditions is something investors should be aware of...

Read the full narrative on Teva Pharmaceutical Industries (it's free!)

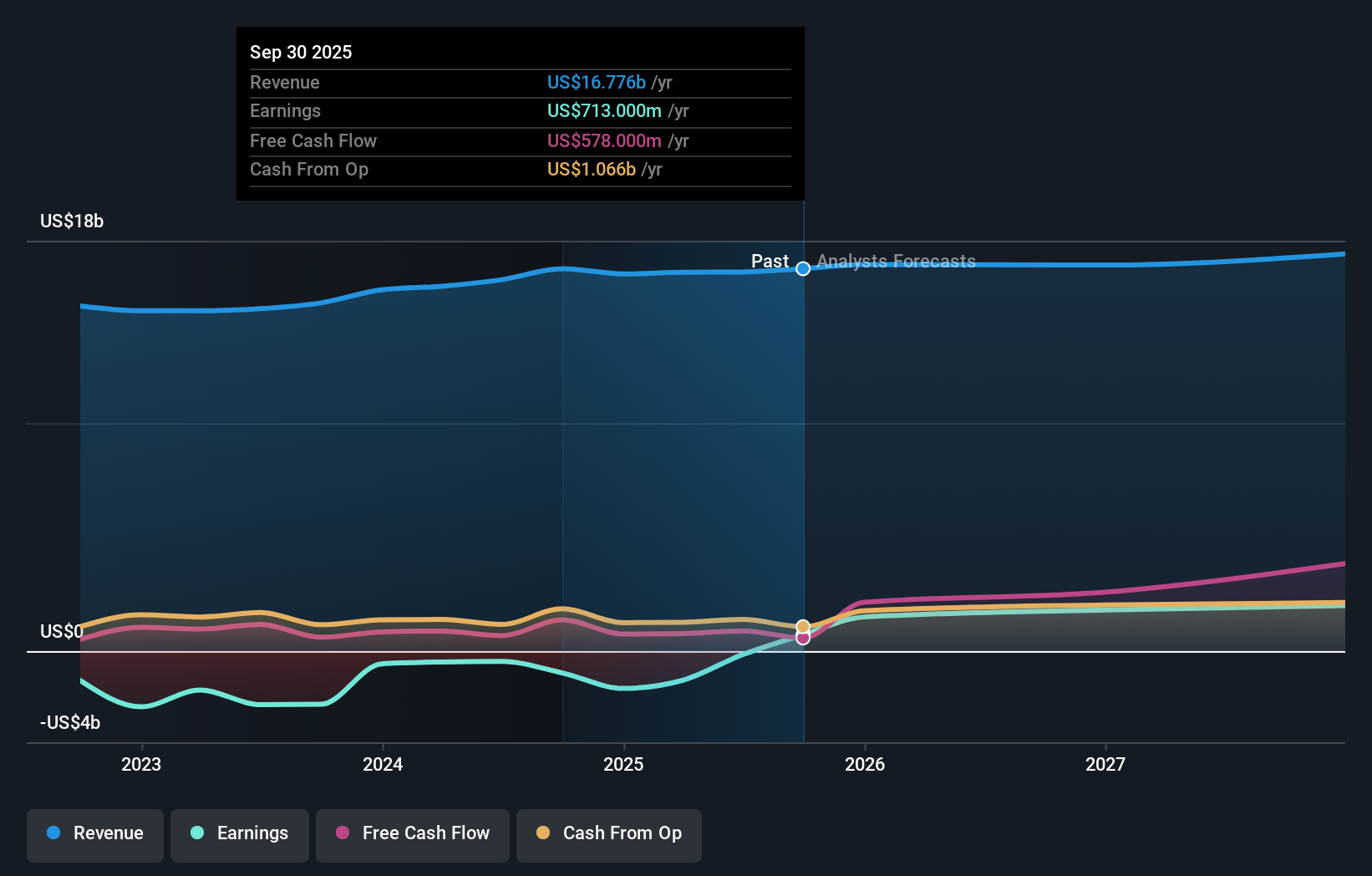

Teva Pharmaceutical Industries' narrative projects $17.8 billion revenue and $1.5 billion earnings by 2028.

Uncover how Teva Pharmaceutical Industries' forecasts yield a $28.61 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community currently place Teva’s fair value between US$26.31 and US$72.78, showing a wide spread of expectations. Against that backdrop, the company’s sizeable debt burden and covenant framework may matter more than many price targets suggest, so it can pay to compare several viewpoints before deciding how Teva fits in your portfolio.

Explore 14 other fair value estimates on Teva Pharmaceutical Industries - why the stock might be worth over 2x more than the current price!

Build Your Own Teva Pharmaceutical Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teva Pharmaceutical Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Teva Pharmaceutical Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teva Pharmaceutical Industries' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报