Penske Automotive Group (PAG): Assessing Valuation After Recent Share Price Rebound

Penske Automotive Group (PAG) has quietly added to recent gains, with the stock up about 6% over the past month even as its performance over the past 3 months remains slightly negative.

See our latest analysis for Penske Automotive Group.

Zooming out, Penske’s roughly 12% year to date share price return and strong multi year total shareholder returns suggest momentum has cooled recently, but the longer term trend still reflects solid value creation as investors reassess growth and cyclicality risks.

If Penske’s move has you watching the whole sector, it could be a good moment to explore other listed auto manufacturers that might offer similar or complementary exposure.

With Penske trading just below analyst targets and modestly above some intrinsic estimates, the key question now is whether investors are overlooking further upside or if the current price already bakes in the next leg of growth?

Most Popular Narrative: 7.1% Undervalued

With Penske Automotive Group last closing at 167.98 dollars against a narrative fair value of about 180.89 dollars, the current setup implies modest upside if the long term assumptions play out.

Disciplined capital allocation including regular share repurchases, a steadily growing dividend (19th consecutive increase), and incremental tuck in acquisitions signals management confidence in long term free cash flow growth, which should positively impact future EPS and shareholder returns.

Want to see what kind of future earnings path justifies this upside case? The narrative leans on steady growth, firm margins, and a richer profit multiple than today. Curious which specific financial levers drive that higher valuation and how long they are expected to last? Read on to unpack the full story behind the fair value math.

Result: Fair Value of $180.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still need to weigh luxury exposure in a potential downturn, as well as the disruptive impact of EV shifts and direct to consumer sales models.

Find out about the key risks to this Penske Automotive Group narrative.

Another Angle on Value

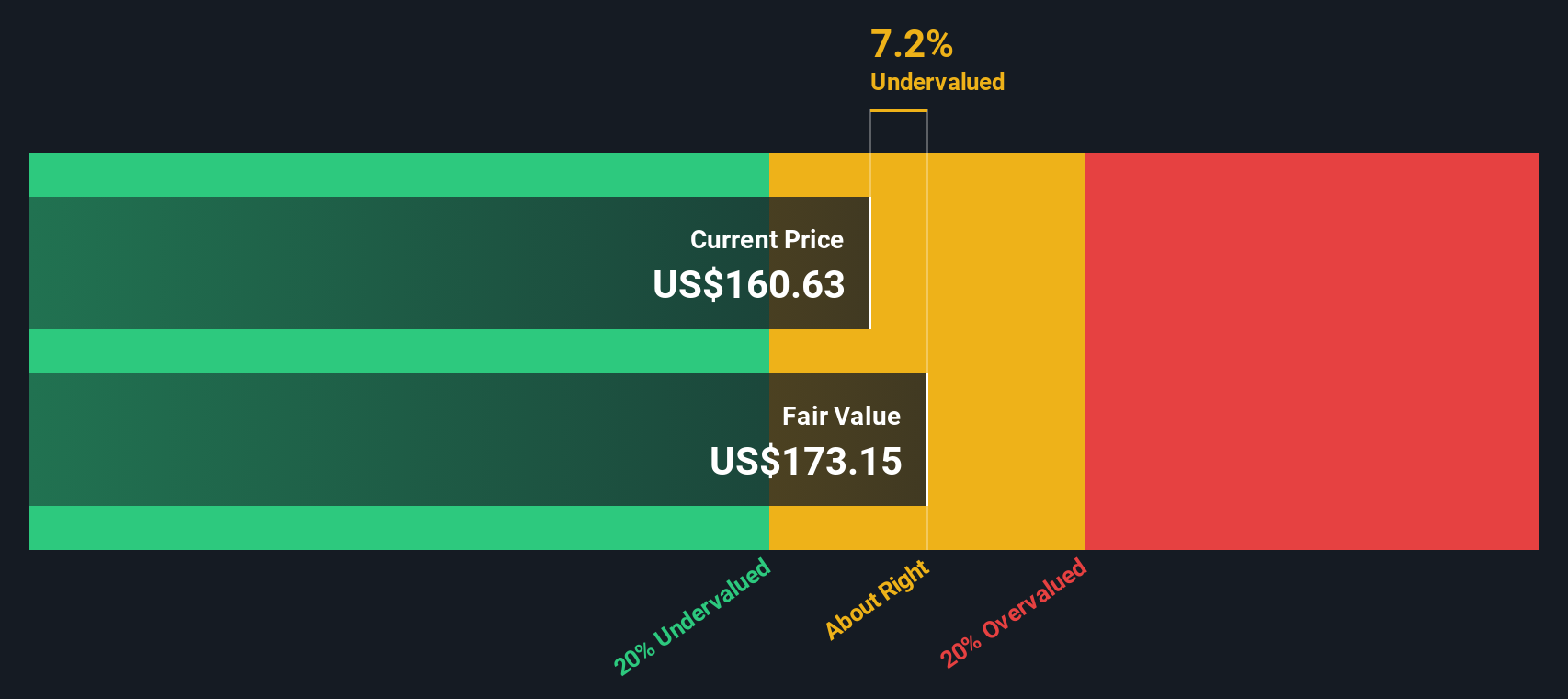

Our SWS DCF model paints a cooler picture, with Penske trading just above its estimated fair value of 167.09 dollars. That implies limited upside from cash flow alone and puts more weight on execution and capital returns. Is the market already pricing in most of the easy gains?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Penske Automotive Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Penske Automotive Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A great starting point for your Penske Automotive Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover focused opportunities other investors may be overlooking right now.

- Capture potential mispricings early by filtering for companies trading below their cash flow value through these 909 undervalued stocks based on cash flows that match your risk and return profile.

- Target cutting edge innovation by zeroing in on these 26 AI penny stocks that could benefit most as artificial intelligence adoption accelerates across industries.

- Strengthen your income strategy by pinpointing reliable payers using these 13 dividend stocks with yields > 3% to support both yield and long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报