Is Philip Morris International (NYSE:PM) Still Undervalued After Its Strong 2024 Share Price Run?

Philip Morris International (PM) has quietly turned into one of 2024’s steadier compounders, with the stock up around 30% over the past year as investors warm to its smoke free transition story.

See our latest analysis for Philip Morris International.

That steady grind higher has come as the market leans into Philip Morris International’s smoke free and wellness push. The latest $157.95 share price sits on the back of a roughly 30 percent year to date share price return and a 5 year total shareholder return above 140 percent, which indicates that momentum has been building rather than fading.

If PM’s run has you thinking more broadly about where steady compounders might come from next, it is worth exploring fast growing stocks with high insider ownership for other ideas with aligned management and strong growth credentials.

With the shares hovering near record highs and analysts still seeing double digit upside, the key question now is whether Philip Morris International remains undervalued on its smoke free pivot or whether the market has already priced in its future growth.

Most Popular Narrative Narrative: 13.7% Undervalued

With the narrative fair value sitting comfortably above the recent 157.95 close, the current price frames an intriguing entry point for long term holders.

The accelerating global adoption of smoke free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is associated with strong double digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally support net revenues and operating margins over time.

Explore how steady topline growth, rising margins, and a richer earnings mix can support a premium style multiple. The narrative numbers might surprise you.

Result: Fair Value of $182.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and any slowdown in smoke free product adoption could quickly challenge the upbeat earnings and valuation narrative around PM.

Find out about the key risks to this Philip Morris International narrative.

Another Lens On Valuation

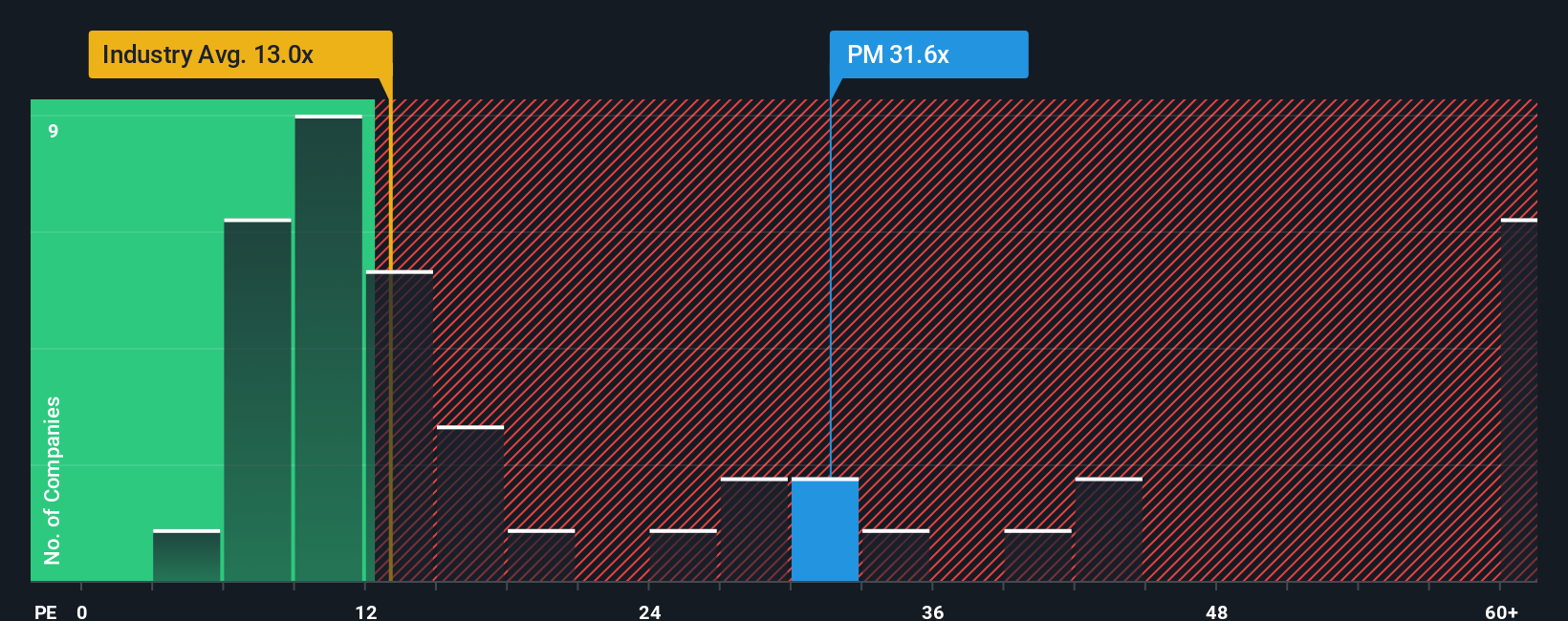

On earnings, the picture is less forgiving. PM trades on a 28.6x price to earnings ratio versus peers at 24.7x and the global tobacco average at 13.8x, while our fair ratio sits at 27.3x. That premium narrows the margin of safety, so how much execution risk are you really willing to take?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If this view does not quite fit your own or you prefer digging into the numbers yourself, you can build a complete narrative in minutes, Do it your way

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screener to work so you do not miss the next wave of market beating opportunities.

- Capture potential multibaggers early by targeting fast moving small caps using these 3636 penny stocks with strong financials with improving fundamentals and room to run.

- Position your portfolio for the AI transformation by focusing on companies powering intelligent technologies through these 26 AI penny stocks before the crowd fully catches on.

- Lock in a margin of safety by zeroing in on quality businesses trading below intrinsic value via these 909 undervalued stocks based on cash flows grounded in cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报