Robinhood (HOOD): Reassessing Valuation After a Triple-Digit Share Price Surge

Robinhood Markets (HOOD) has quietly turned into a long term winner, with the stock up about 203% this year and roughly 187% over the past year, far outpacing broader markets.

See our latest analysis for Robinhood Markets.

That strength has come despite some choppy weeks, with a recent pullback and rebound leaving the latest share price at $119.40 and the 1 year total shareholder return still signaling powerful, ongoing momentum rather than a one off spike.

If Robinhood’s surge has you rethinking where growth could come from next, this is a good moment to explore high growth tech and AI stocks as potential new leaders for your watchlist.

With triple digit gains, accelerating profits, and a price target still well above today’s level, investors now face a tougher question: is Robinhood still mispriced, or are markets already baking in the next leg of growth?

Most Popular Narrative Narrative: 21.2% Undervalued

With a fair value estimate around $151.55 versus the last close at $119.40, the leading narrative frames Robinhood as materially underpriced and building toward something bigger.

The company's early leadership and innovation in areas such as tokenization of real world assets, integrated global crypto trading, and the development of Robinhood Chain have the potential to attract new user bases both in the U.S. and internationally, opening up entirely new markets and revenue sources that could outpace legacy competitors. The rapid growth of recurring revenue businesses such as Robinhood Gold and the expanding international user base (including through acquisitions like Bitstamp and WonderFi) are indicative of business model resilience, less sensitivity to market cyclicality, and an increasing potential for stable, high margin earnings streams.

Want to see how moderate growth assumptions, rich margins, and a premium future earnings multiple still justify upside from here? The full narrative unpacks the exact revenue and profit path behind that fair value call.

Result: Fair Value of $151.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny of prediction markets and intensifying competition in commission free trading could easily derail the upbeat growth assumptions embedded in this narrative.

Find out about the key risks to this Robinhood Markets narrative.

Another Lens on Valuation

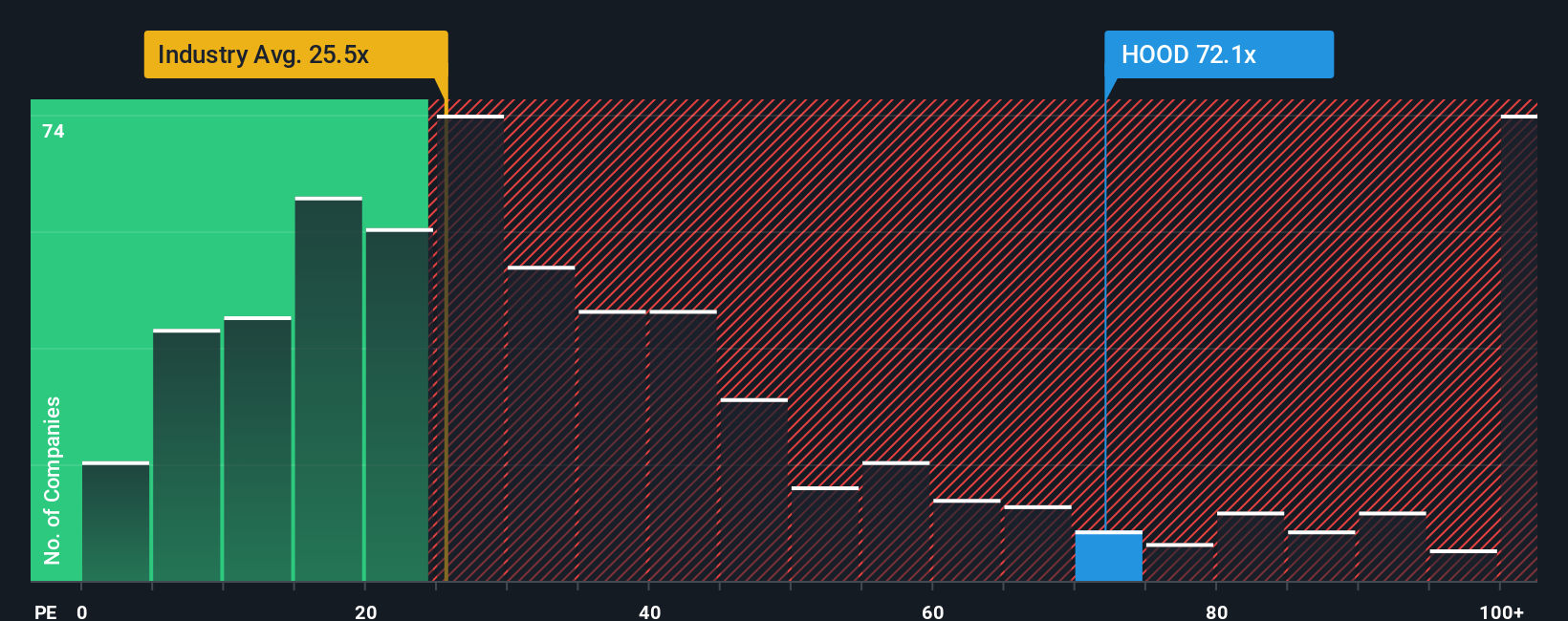

Step away from narratives and Robinhood suddenly looks pricey. Its 48.9x price to earnings multiple towers over the US capital markets industry on 25.5x, peers at 22x, and a fair ratio of 27.1x, suggesting sentiment risk if enthusiasm cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Robinhood Markets Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalized view of Robinhood’s future in just minutes: Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Before you move on, lock in your next opportunity by scanning powerful stock ideas on Simply Wall St’s Screener, tailored to specific themes and financial strengths.

- Target potential multibaggers early by zeroing in on these 3631 penny stocks with strong financials showing robust balance sheets and real fundamentals, not just hype.

- Ride structural tech trends by focusing on these 26 AI penny stocks positioned at the intersection of algorithmic breakthroughs and rapidly expanding real world demand.

- Capture mispriced quality by filtering for these 914 undervalued stocks based on cash flows where strong cash flows and sensible valuations could set up attractive long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报