Assessing XtalPi Holdings (SEHK:2228) Valuation After New AI–Genomics Cancer Detection Partnership

XtalPi Holdings (SEHK:2228) just signed a two year memorandum of understanding with Mirxes Holding, aiming to fuse Mirxes genomics database with XtalPi's AI plus robotics platform for earlier gastrointestinal cancer detection and intervention.

See our latest analysis for XtalPi Holdings.

The MOU lands at an interesting moment, with XtalPi’s share price at HK$9.26 after a weak 1 month share price return but still a strong year to date share price return and solid 1 year total shareholder return. This suggests that longer term momentum remains constructive even as near term sentiment wobbles.

If this kind of AI plus healthcare story appeals to you, it could be a good time to scan other innovative names across healthcare stocks.

With revenue growing fast but profits still negative and the stock trading only modestly below analyst targets, is XtalPi an underappreciated AI healthcare play, or has the market already priced in much of the future upside?

Price-to-Book of 5.2x: Is it justified?

XtalPi Holdings trades at a price-to-book ratio of 5.2 times based on the last close of HK$9.26, pointing to a premium valuation versus peers.

The price-to-book multiple compares a company’s market value to its net assets, a common yardstick for asset heavy and research driven life sciences businesses where profits can be volatile.

For XtalPi, paying 5.2 times book value suggests investors are already factoring in strong future growth and successful scaling of its AI enabled drug discovery platforms despite the current lack of profitability.

That premium looks even starker against the Asian Life Sciences industry, where the average price-to-book sits at 2.5 times, indicating the market is assigning XtalPi more than double the asset based valuation of its typical regional peer.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.2x (OVERVALUED)

However, sustained losses and a valuation already near analyst targets mean any slowdown in revenue growth or setbacks in key collaborations could quickly pressure the shares.

Find out about the key risks to this XtalPi Holdings narrative.

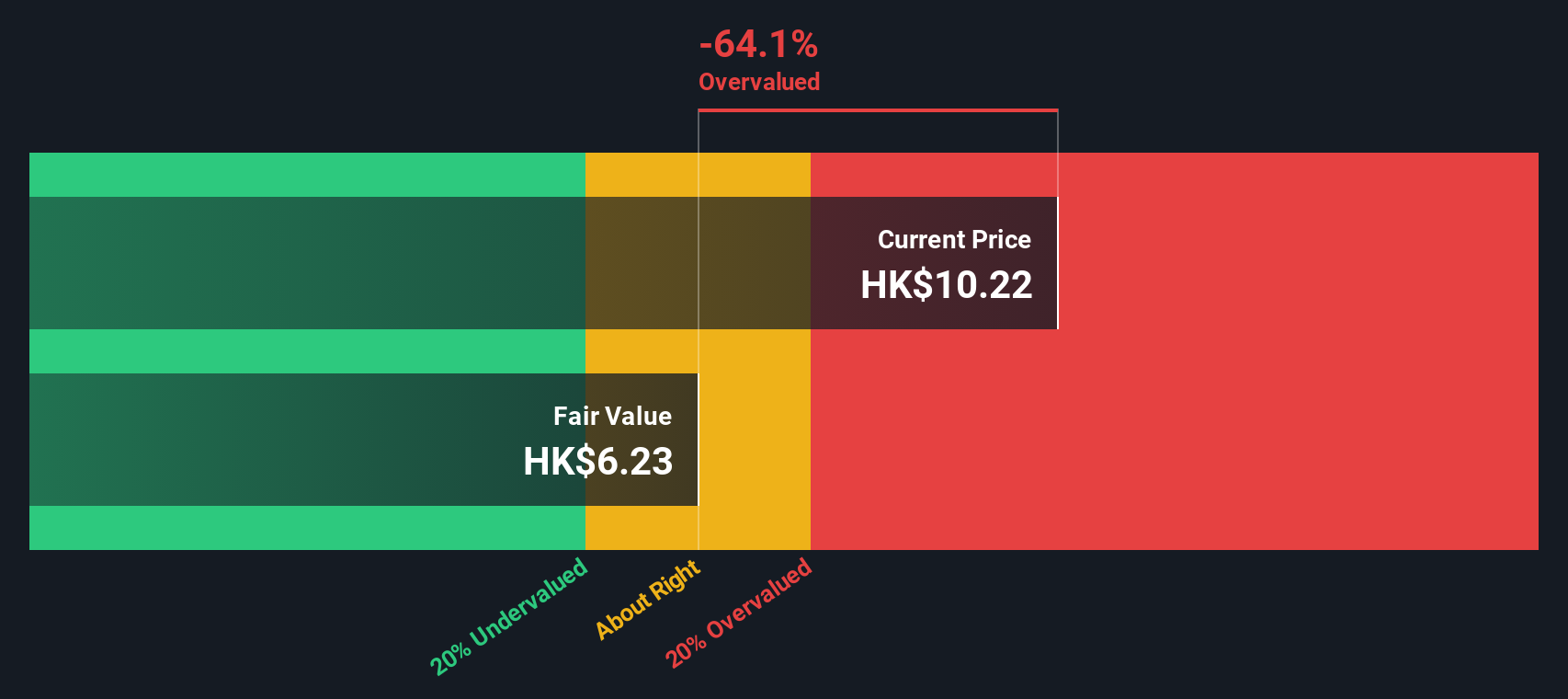

Another View: Our DCF Model Paints a Harsher Picture

On our DCF model, XtalPi screens as overvalued, with a fair value estimate of around HK$5.63 compared with the current HK$9.26 share price. That implies downside risk rather than upside optionality, raising the question of whether the market is overpaying for growth that may take years to realise.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out XtalPi Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own XtalPi Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your XtalPi Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity; use the Simply Wall St Screener to quickly spot fresh, data backed ideas that other investors may be overlooking.

- Capture potential early movers by scanning these 3632 penny stocks with strong financials that already show strong balance sheets and improving fundamentals before the wider market notices.

- Ride structural growth trends by focusing on these 26 AI penny stocks positioned at the intersection of automation, data, and scalable software driven business models.

- Lock in both income and resilience by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio with consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报