Innovative Industrial Properties (IIPR): Assessing Valuation After Dividend Reaffirmation and Tenant Risk Concerns

Innovative Industrial Properties (IIPR) just reaffirmed its shareholder payout, declaring a fourth quarter 2025 common dividend of $1.90 per share along with its regular Series A preferred dividend, even as tenant stress and revenue headwinds linger.

See our latest analysis for Innovative Industrial Properties.

The reaffirmed dividend lands after a sharp rebound, with a 20.05 percent 1 month share price return and 13.64 percent 7 day share price return. However, the 1 year total shareholder return of negative 34.75 percent shows longer term sentiment is still cautious.

If this dividend story has you reassessing risk and reward, it might be a good moment to explore fast growing stocks with high insider ownership for other potential opportunities on your radar.

With IIPR trading just above analyst targets yet at a steep discount to some intrinsic value estimates, are investors overlooking a contrarian income play here, or is the market already bracing for weaker growth ahead?

Most Popular Narrative: 2% Overvalued

With Innovative Industrial Properties last closing at $58.14 against a narrative fair value of $57, the story hinges on modest downside and muted growth expectations.

The analysts have a consensus price target of $57.0 for Innovative Industrial Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $43.0.

Curious what kind of shrinking revenues, tighter margins, and future earnings multiple still add up to that fair value, and why analysts think the math holds? Click through and see the full breakdown powering this narrative.

Result: Fair Value of $57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several upside risks remain, including resilient long term cannabis demand and IIPR’s expanding life sciences footprint, which could bolster earnings and diversify cash flows.

Find out about the key risks to this Innovative Industrial Properties narrative.

Another View: Earnings Multiple Sends a Different Signal

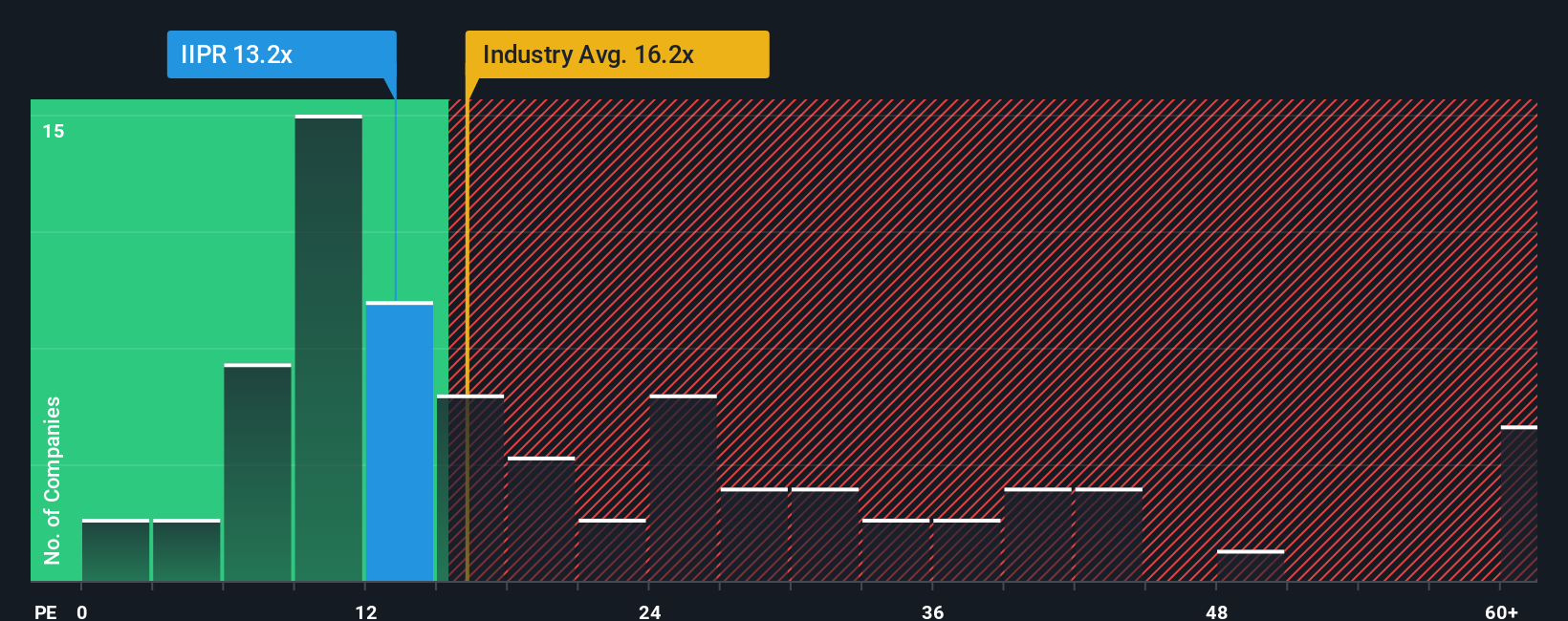

While the narrative fair value suggests IIPR is about 2 percent overvalued, its 13.5x price to earnings ratio looks cheap next to peers at 20.1x, the Industrial REITs industry at 16.3x, and a 31.9x fair ratio. Is the market underpricing a messy turnaround or rightly discounting shrinking growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Innovative Industrial Properties Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Innovative Industrial Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart opportunity?

Before you move on, consider your next potential opportunity by using the Simply Wall St Screener to uncover ideas that match your strategy and risk appetite.

- Target value upside by scanning these 915 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Explore powerful technology shifts by zeroing in on these 25 AI penny stocks shaping the next wave of AI driven innovation.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with characteristics that may support long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报