JetBlue (JBLU) Valuation Check as New BlueHouse Premium Lounge Strategy Targets Higher-Spend Travelers

JetBlue Airways (JBLU) is shaking up its investment story with BlueHouse, a new premium lounge at JFK that signals a clear tilt toward higher spending travelers and potentially higher margin revenue.

See our latest analysis for JetBlue Airways.

These moves come as JetBlue’s 1 month share price return of 17.9 percent has helped claw back a small part of a much tougher year. The 1 year total shareholder return remains firmly negative and longer term performance is weak, suggesting sentiment is improving but the market remains cautious on the turnaround story.

If the BlueHouse strategy has you rethinking where growth could come from next, it might be worth exploring aerospace and defense stocks for other travel and defense names reshaping their businesses.

Against years of weak total returns, but with early signs of a recovery and a discounted intrinsic value, are investors being offered a mispriced turnaround story in JetBlue today, or is the market already baking in BlueHouse led premium growth?

Most Popular Narrative: 6.1% Overvalued

With JetBlue closing at $4.94 against a narrative fair value of $4.65, expectations lean ahead of fundamentals and set a high bar for execution.

The Blue Sky partnership with United, expanded distribution and loyalty integration, and growth of the capital light, high margin Paisly travel products business are expected to open new revenue streams, improve customer retention, and contribute at least $50M in incremental EBIT by 2027, supporting EBITDA and earnings growth.

Want to see what turns today’s losses into tomorrow’s potential profit engine? The narrative quietly leans on accelerating revenue, rising margins, and a compressed future earnings multiple. Curious which moving piece matters most?

Result: Fair Value of $4.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on close-in bookings and rising labor costs could compress margins, undermining confidence in a smooth, premium-led earnings recovery.

Find out about the key risks to this JetBlue Airways narrative.

Another Angle on Value

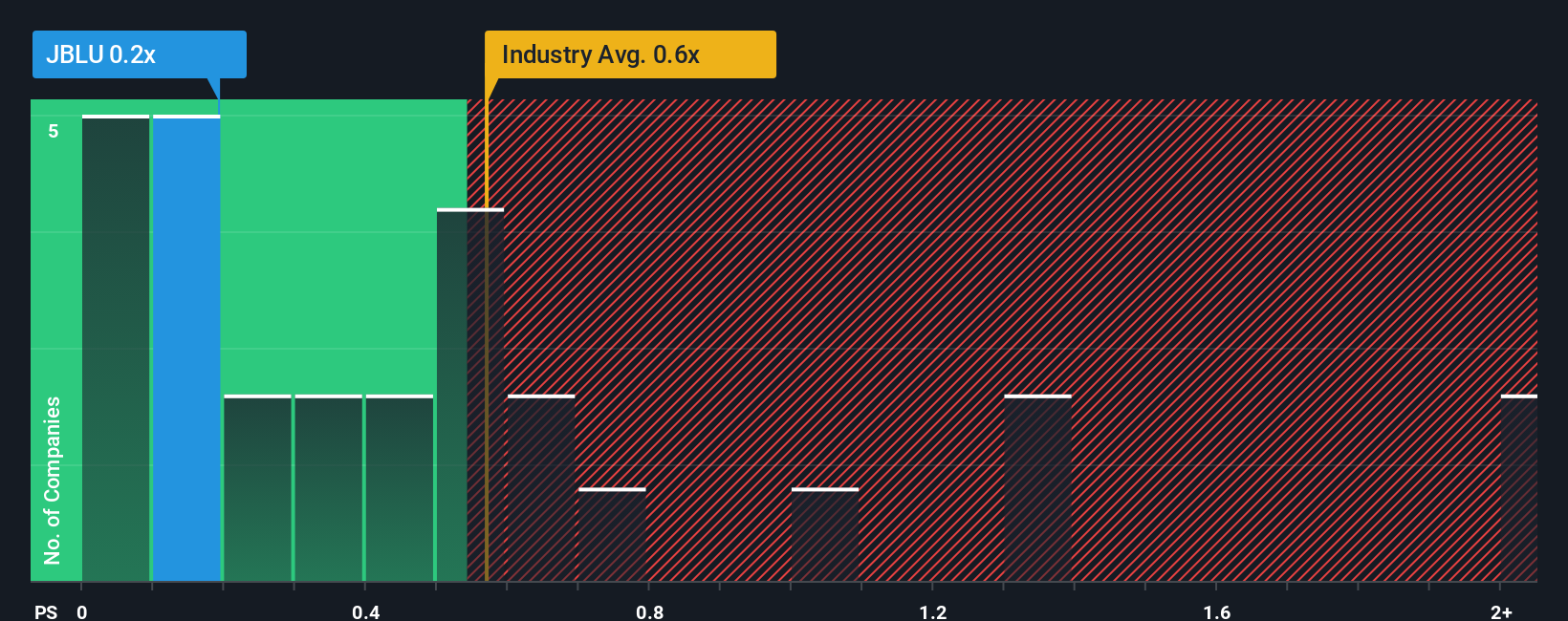

While the narrative fair value of $4.65 suggests JetBlue is 6.1 percent overvalued, its 0.2x price to sales ratio looks cheap versus peers at 0.5x and a fair ratio closer to 0.8x. If sentiment normalizes, could rerating alone drive most of the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JetBlue Airways Narrative

If you see the story differently, or prefer digging into the numbers yourself, you can build a personalized JetBlue view in minutes: Do it your way.

A great starting point for your JetBlue Airways research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before JetBlue’s story moves on without you, put your research to work by scanning fresh opportunities on Simply Wall Street’s Screener and upgrade your watchlist today.

- Capture potential bargains early by reviewing these 915 undervalued stocks based on cash flows that look mispriced relative to their cash flows and long term prospects.

- Position yourself for the next wave of innovation by assessing these 25 AI penny stocks pushing real world applications in automation, data, and intelligent software.

- Strengthen your portfolio’s income engine by focusing on these 13 dividend stocks with yields > 3% that can help support returns even when markets stay volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报