Nano Dimension And 2 Other Penny Stocks With Promising Potential

As the U.S. stock market experiences a pullback, with major indices like the Dow Jones and S&P 500 facing consecutive losses amid tech sector concerns, investors are increasingly looking for opportunities outside the mainstream. Penny stocks, though often overlooked, continue to present intriguing possibilities for those willing to explore smaller or newer companies that could offer unique growth potential. In this article, we will examine three penny stocks that stand out due to their financial strength and potential for long-term success in today's challenging market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.28 | $439.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.13 | $531.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.19 | $1.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.73 | $179.25M | ✅ 5 ⚠️ 0 View Analysis > |

| CI&T (CINT) | $4.80 | $614.03M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.37 | $365.95M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89 | $6.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.96 | $91.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 340 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nano Dimension (NNDM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nano Dimension Ltd. offers industrial manufacturing solutions for electronics and mechanical parts globally, with a market cap of $393.05 million.

Operations: The company's revenue is derived from its Printers & Related Products segment, totaling $69.66 million.

Market Cap: $393.05M

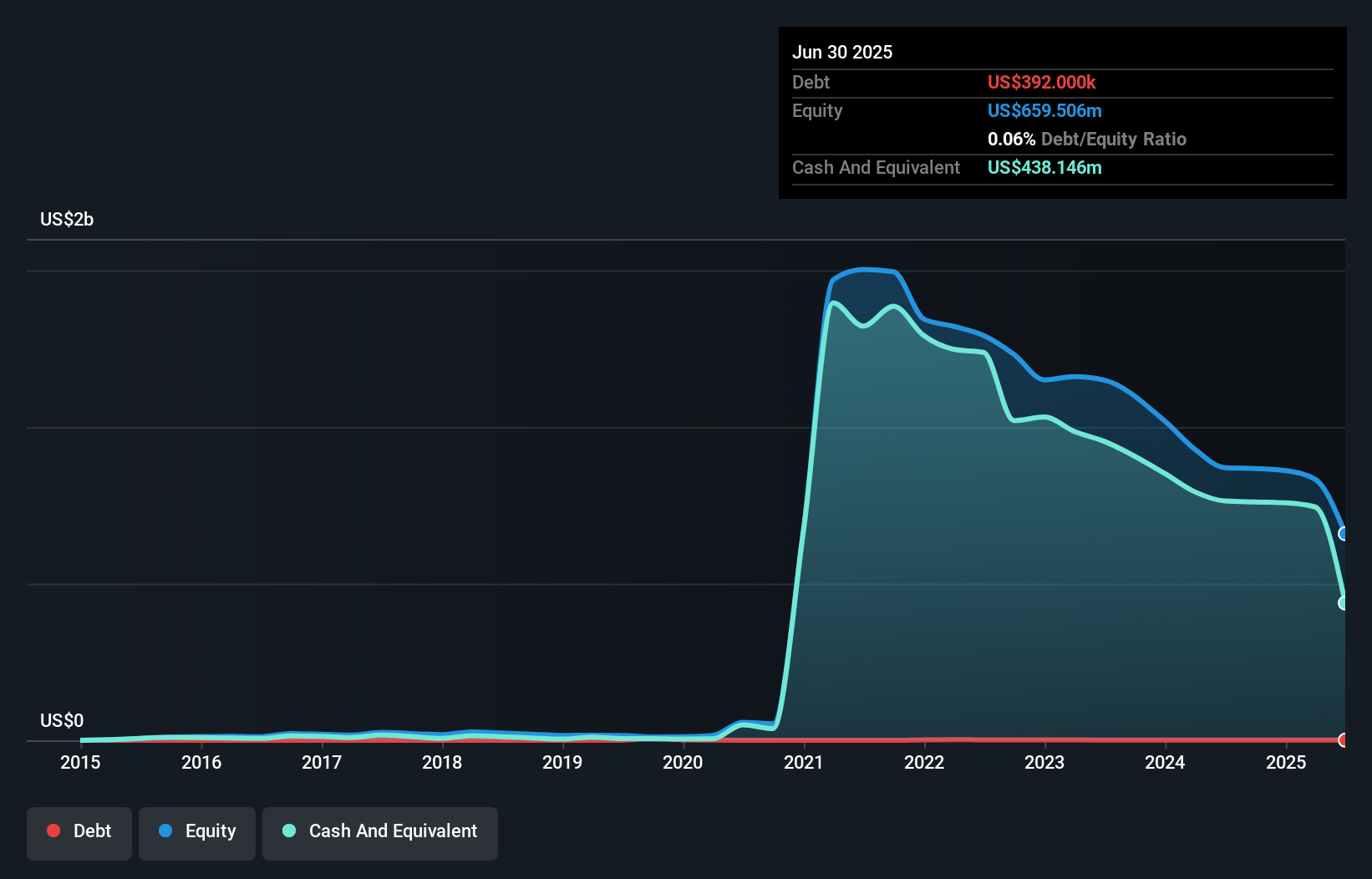

Nano Dimension Ltd., with a market cap of US$393.05 million, is navigating the penny stock landscape by leveraging its industrial manufacturing solutions for electronics and mechanical parts. Despite being unprofitable with a negative return on equity, the company maintains strong liquidity, as short-term assets significantly exceed liabilities. Recent strategic moves include board changes and a CFO transition to enhance governance and financial oversight. The company has also completed a share buyback program worth US$17.1 million, indicating confidence in its long-term value proposition amid moderate revenue growth expectations driven by recovery in defense, aerospace, and automotive sectors.

- Click here and access our complete financial health analysis report to understand the dynamics of Nano Dimension.

- Explore historical data to track Nano Dimension's performance over time in our past results report.

Atea Pharmaceuticals (AVIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atea Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, and commercializing oral antiviral therapeutics for serious viral infections, with a market cap of $246.10 million.

Operations: Atea Pharmaceuticals, Inc. has not reported any revenue segments.

Market Cap: $246.1M

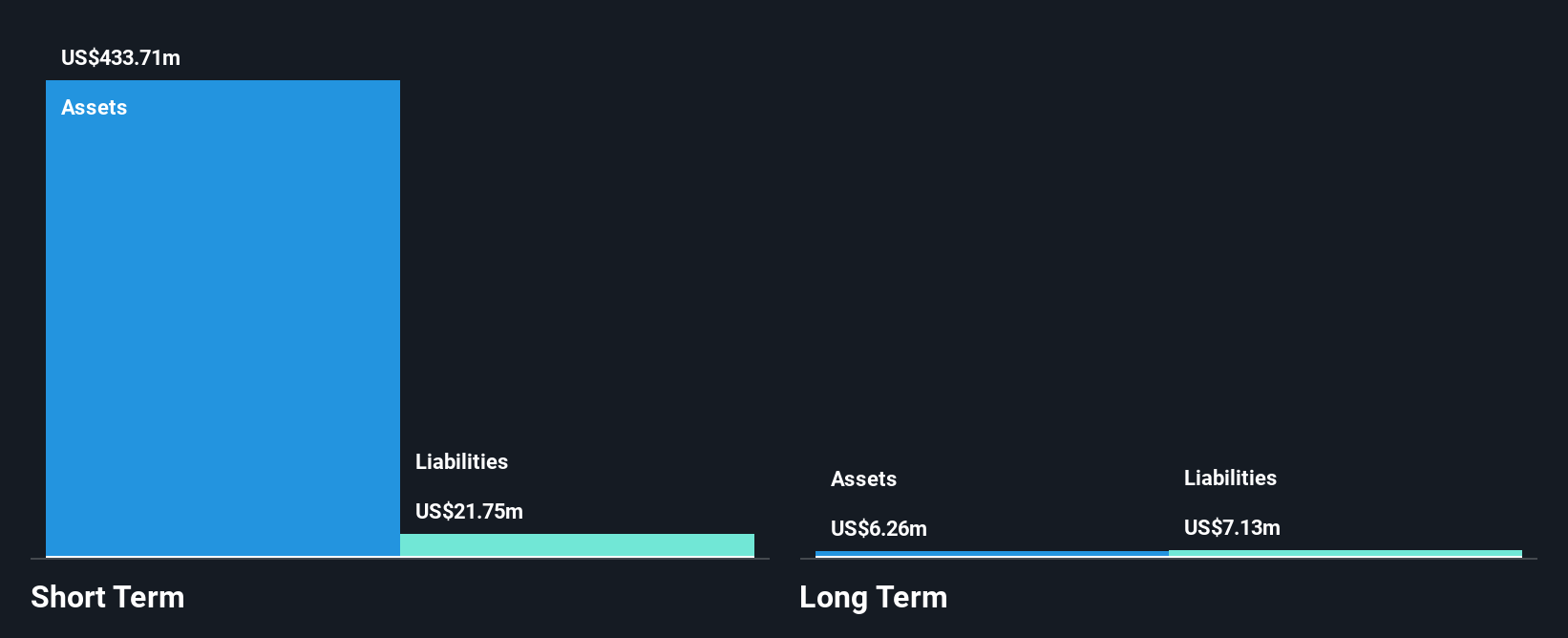

Atea Pharmaceuticals, Inc., with a market cap of US$246.10 million, is pre-revenue and focuses on developing antiviral therapeutics. The company has no debt and maintains sufficient cash runway for over two years, which supports its ongoing clinical programs. Recent developments include promising Phase 3 trials for hepatitis C treatments using bemnifosbuvir and ruzasvir, showing high efficacy and a strong resistance profile. Additionally, Atea is expanding into hepatitis E virus research with new candidates demonstrating potent antiviral activity in vitro. Despite increasing losses reported in recent earnings, the management team remains experienced with strategic focus on advancing their pipeline.

- Take a closer look at Atea Pharmaceuticals' potential here in our financial health report.

- Evaluate Atea Pharmaceuticals' prospects by accessing our earnings growth report.

TrueCar (TRUE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TrueCar, Inc. operates as an internet-based information, technology, and communication services company in the United States with a market cap of approximately $194.78 million.

Operations: The company generates revenue of $181.22 million from its Internet Information Providers segment.

Market Cap: $194.78M

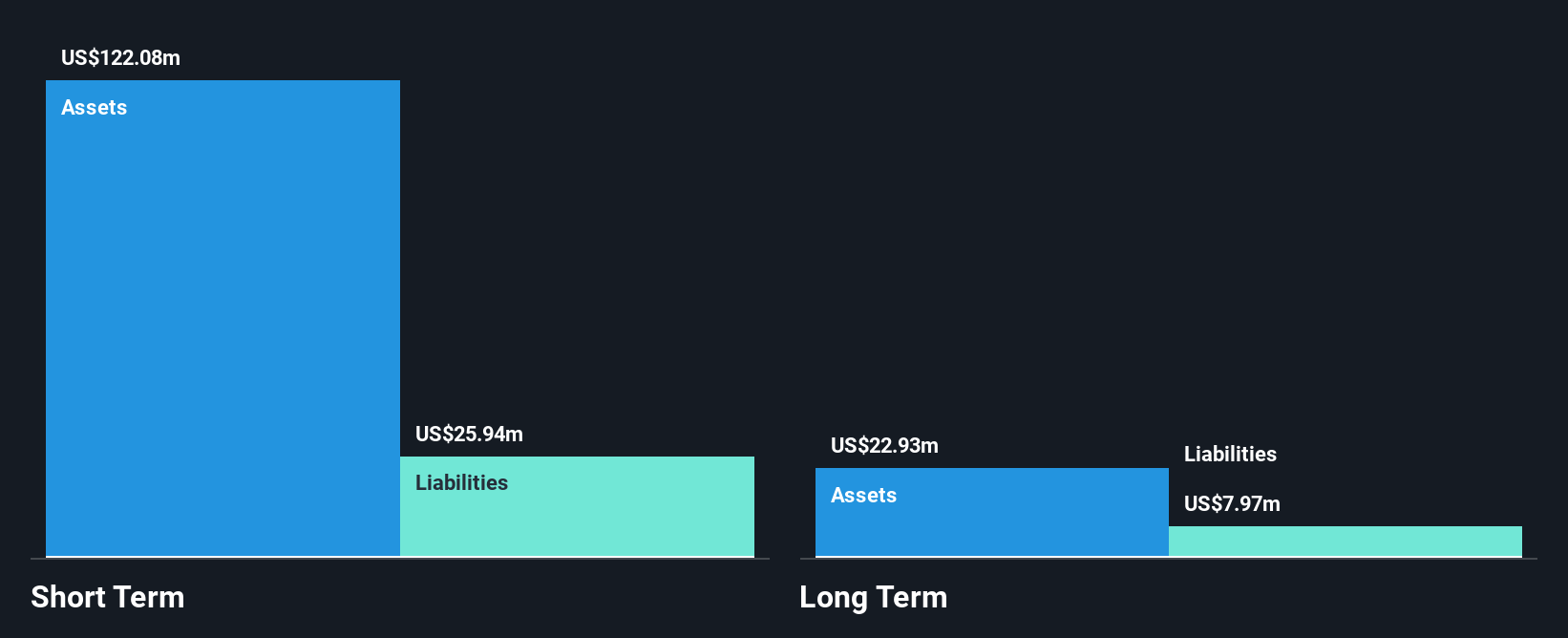

TrueCar, Inc., with a market cap of US$194.78 million, remains debt-free and has sufficient cash runway for over three years despite being unprofitable. The company recently reported improved earnings for the third quarter of 2025, transitioning from a net loss to net income compared to the previous year. TrueCar's short-term assets significantly exceed both its short and long-term liabilities, indicating financial stability amidst high share price volatility. A significant development is Scott Painter's agreement to acquire TrueCar for approximately $260 million, which could lead to strategic changes and delisting from Nasdaq upon completion in late 2025 or early 2026.

- Jump into the full analysis health report here for a deeper understanding of TrueCar.

- Explore TrueCar's analyst forecasts in our growth report.

Next Steps

- Navigate through the entire inventory of 340 US Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报