American Eagle (AEO) Valuation Check After Goldman Sachs Highlights Black Friday Strength and Higher-Income Shoppers

American Eagle Outfitters (AEO) just got a fresh look from Goldman Sachs, and the market noticed, with shares ticking higher as investors weighed its Black Friday momentum and higher income customer base.

See our latest analysis for American Eagle Outfitters.

That fresh interest is landing on a stock that has already been on a tear, with a roughly 60% year to date share price return and a 1 year total shareholder return of about 66%. This suggests momentum is clearly building as investors reassess its earnings power and perceived risk.

If American Eagle’s surge has you thinking about where capital could work harder next, this might be a good moment to discover fast growing stocks with high insider ownership.

But after such a sharp rerating, investors face a tougher question: Is American Eagle still trading below its true earnings power, or has the market already priced in the brand’s next leg of growth?

Most Popular Narrative: 19.6% Overvalued

With American Eagle Outfitters last closing at $27.36 against a narrative fair value of about $22.88, the current setup implies investors are paying up for future execution.

Fair Value Estimate has risen meaningfully from approximately $16.44 to $22.88 per share, reflecting a higher assessed intrinsic value for the stock.

Future P/E Multiple has ticked up modestly from about 9.19x to 9.56x, suggesting a slightly higher valuation being applied to forward earnings.

Want to know what is driving that jump in fair value? Think upgraded growth, fatter margins, and a future earnings multiple that challenges typical apparel norms. Curious which assumptions really move the needle here? Dive in to see the numbers this narrative is quietly betting on.

Result: Fair Value of $22.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer than expected consumer demand and heavier markdowns could quickly squeeze margins and test whether American Eagle’s upgraded profit story can really hold.

Find out about the key risks to this American Eagle Outfitters narrative.

Another Angle on Value

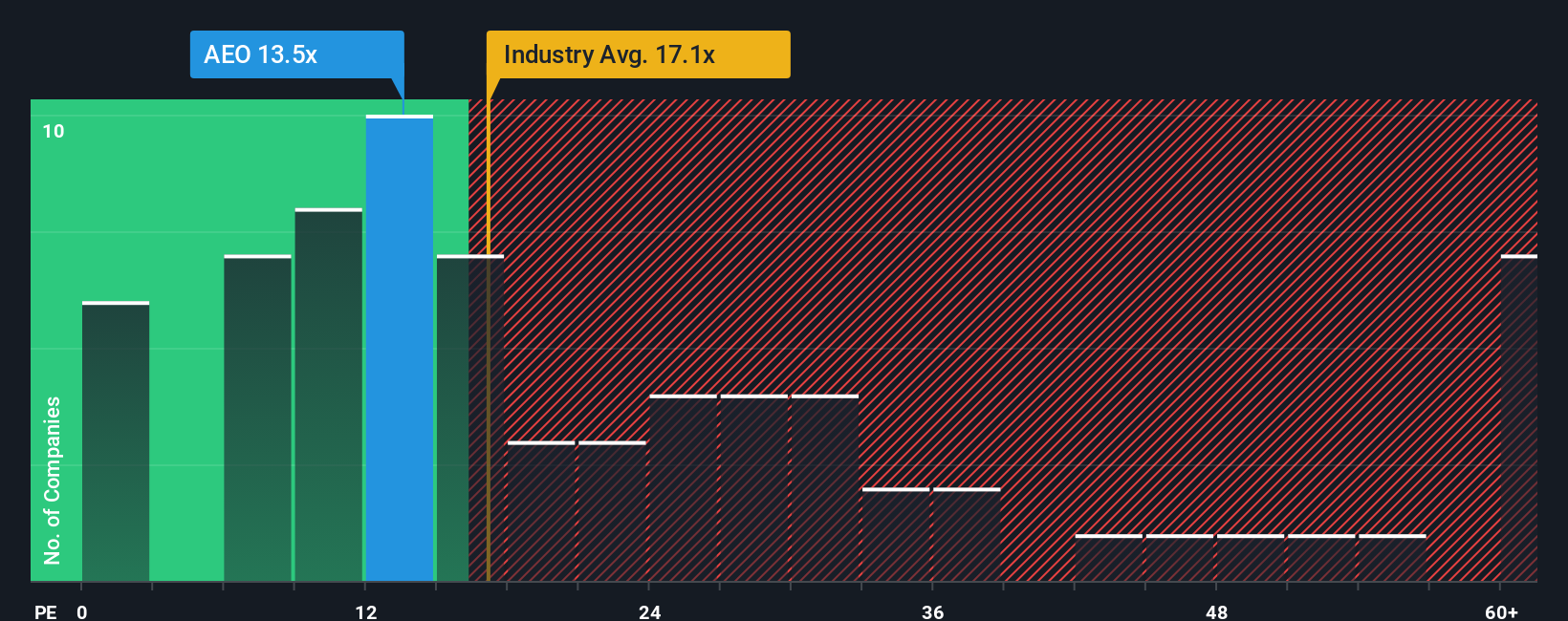

While the narrative fair value suggests American Eagle is 19.6% overvalued, the earnings ratio tells a softer story. At 22.3 times earnings versus a fair ratio of 26.2 times, the market is not paying a full premium yet. Is this cushion enough if growth expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Eagle Outfitters Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your American Eagle Outfitters research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want your next move to count, skip the noise and let targeted stock lists on Simply Wall Street’s Screener surface focused, data-driven opportunities instantly.

- Capitalize on mispriced opportunities by checking these 915 undervalued stocks based on cash flows that the market may be overlooking today but cash flows suggest deserve a closer look.

- Ride powerful technological shifts by scanning these 25 AI penny stocks where real revenue growth and AI adoption are already starting to show up in the numbers.

- Review these 13 dividend stocks with yields > 3% for income-focused ideas that aim to boost your portfolio’s yield while still keeping quality front and center.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报