Kohl’s (KSS) Valuation Check After Third-Quarter Earnings Beat and Upgraded Analyst Outlook

Kohl's (KSS) just surprised the market with a stronger than expected third quarter, topping revenue and earnings forecasts and sending the stock sharply higher as investors reassess what this retailer is really worth.

See our latest analysis for Kohl's.

That upbeat quarter is now feeding into a powerful rebound story, with a roughly 37% 1 month share price return and a 67.8% 1 year total shareholder return suggesting momentum is clearly rebuilding around Kohl's turnaround efforts.

If this kind of retail rebound has your attention, it might be a good moment to explore fast growing stocks with high insider ownership as a way to spot other potential comeback stories.

Yet with the share price now above some analyst targets but still trading at a steep discount to intrinsic value estimates, investors face a key question: is Kohl's genuinely undervalued or already priced for a full recovery?

Most Popular Narrative Narrative: 5.2% Overvalued

With Kohl's last closing at $22.95 against a most popular narrative fair value of about $21.82, expectations are running slightly ahead of that storyline, which leans on disciplined execution and modestly improving fundamentals.

Inventory discipline, cost controls (including a 5% reduction in inventory, 4% SG&A decrease, and lower interest/depreciation expense), and cash flow strength have enabled Kohl's to reduce debt and fund growth initiatives, which may protect or expand net margins and support long-term earnings improvement.

Curious how a slow growing retailer earns a higher future earnings multiple? The answer sits in the balance between margin repair and cautious growth assumptions. Want to see exactly how those moving parts add up to this fair value call?

Result: Fair Value of $21.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several upside risks remain, including stronger than expected Sephora driven traffic and continued margin gains from private label expansion and disciplined cost controls.

Find out about the key risks to this Kohl's narrative.

Another Angle on Value: Earnings Multiple Signals Opportunity

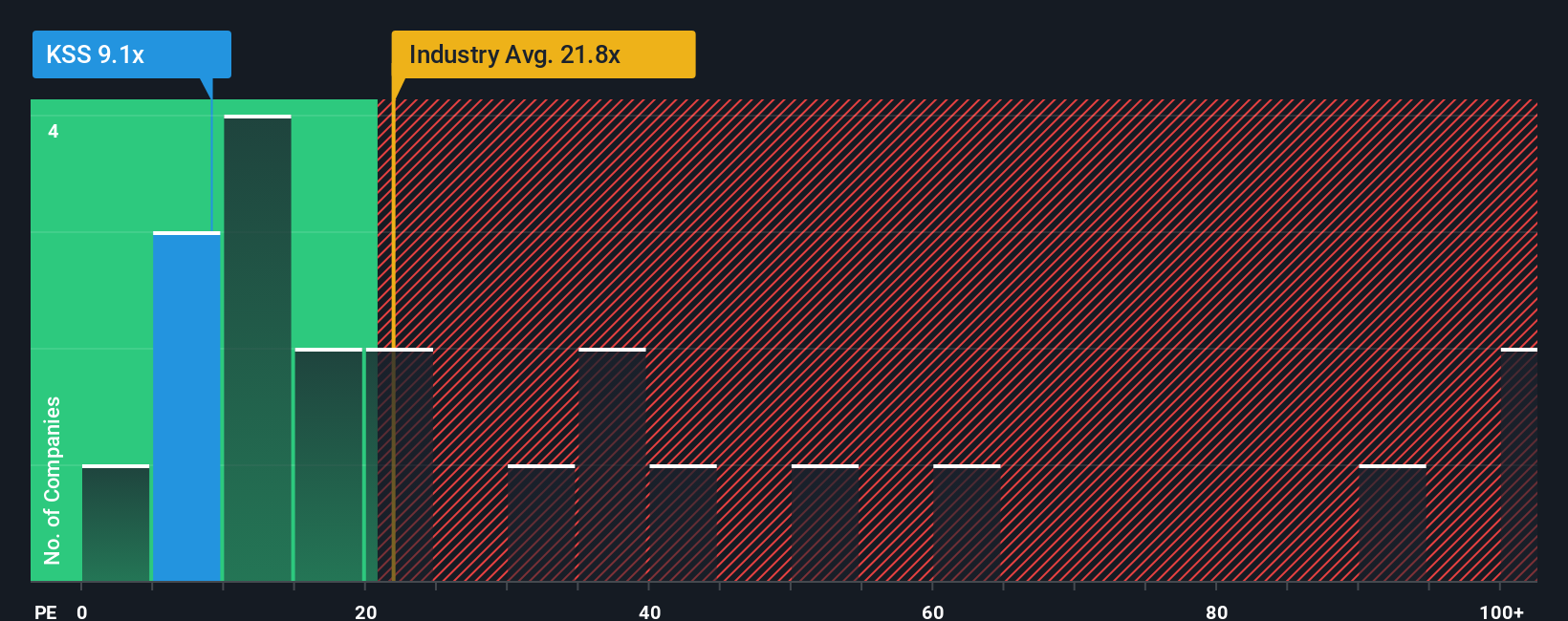

While the popular narrative sees Kohl's as about 5% overvalued, the earnings multiple paints a different picture. At 13.2 times earnings versus 19.7 times for the global multiline retail industry and a 19.9 times fair ratio, the gap suggests potential upside if sentiment keeps normalizing. Is the market still pricing Kohl's like a broken story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kohl's Narrative

If this perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom thesis in under three minutes: Do it your way.

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before momentum shifts again, take a few minutes to uncover fresh opportunities on Simply Wall St's screener so your capital is always working its hardest.

- Capture potential bargains early by targeting companies trading below cash flow estimates through these 915 undervalued stocks based on cash flows before the market fully wakes up to them.

- Tap into cutting edge innovation by focusing on next generation opportunities across these 25 AI penny stocks that could reshape entire industries.

- Identify income focused opportunities by scanning these 13 dividend stocks with yields > 3% that can strengthen your portfolio with dependable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报