Why Lundin Mining (TSX:LUN) Is Up 9.0% After Launching a Major Share Buyback Program

- In December 2025, Lundin Mining Corporation (TSX:LUN) announced a normal course issuer bid to repurchase up to 67,723,868 common shares, or 7.91% of its then 855,770,029 shares outstanding, with all repurchased shares to be cancelled before the program expires on December 15, 2026.

- This sizeable buyback authorization indicates the Board’s intent to return capital and potentially lift per‑share metrics at a time when analysts had been expecting the share count to keep rising over the next few years.

- We’ll now consider how this sizeable share repurchase authorization might alter Lundin Mining’s previously EPS‑dilutive growth narrative and overall investment case.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lundin Mining Investment Narrative Recap

To own Lundin Mining, you need to believe in the long term demand for copper and the company’s ability to grow its South American asset base without eroding returns through excessive dilution or cost overruns. The new buyback plan is supportive for per share metrics, but it does not materially change the near term focus on executing capital intensive projects and managing concentrated exposure to South America, which remain the key catalyst and main risk right now.

The buyback sits alongside Lundin’s recent decision to affirm a regular quarterly dividend of C$0.0275 per share, underscoring an ongoing program of capital returns that runs alongside heavy project spending. For me, the interesting tension is how management balances these shareholder payouts with the funding needs and execution risk around large expansions like Vicuña over the next few years.

Yet investors should still pay close attention to how concentrated South American exposure could affect...

Read the full narrative on Lundin Mining (it's free!)

Lundin Mining's narrative projects $3.6 billion revenue and $364.3 million earnings by 2028.

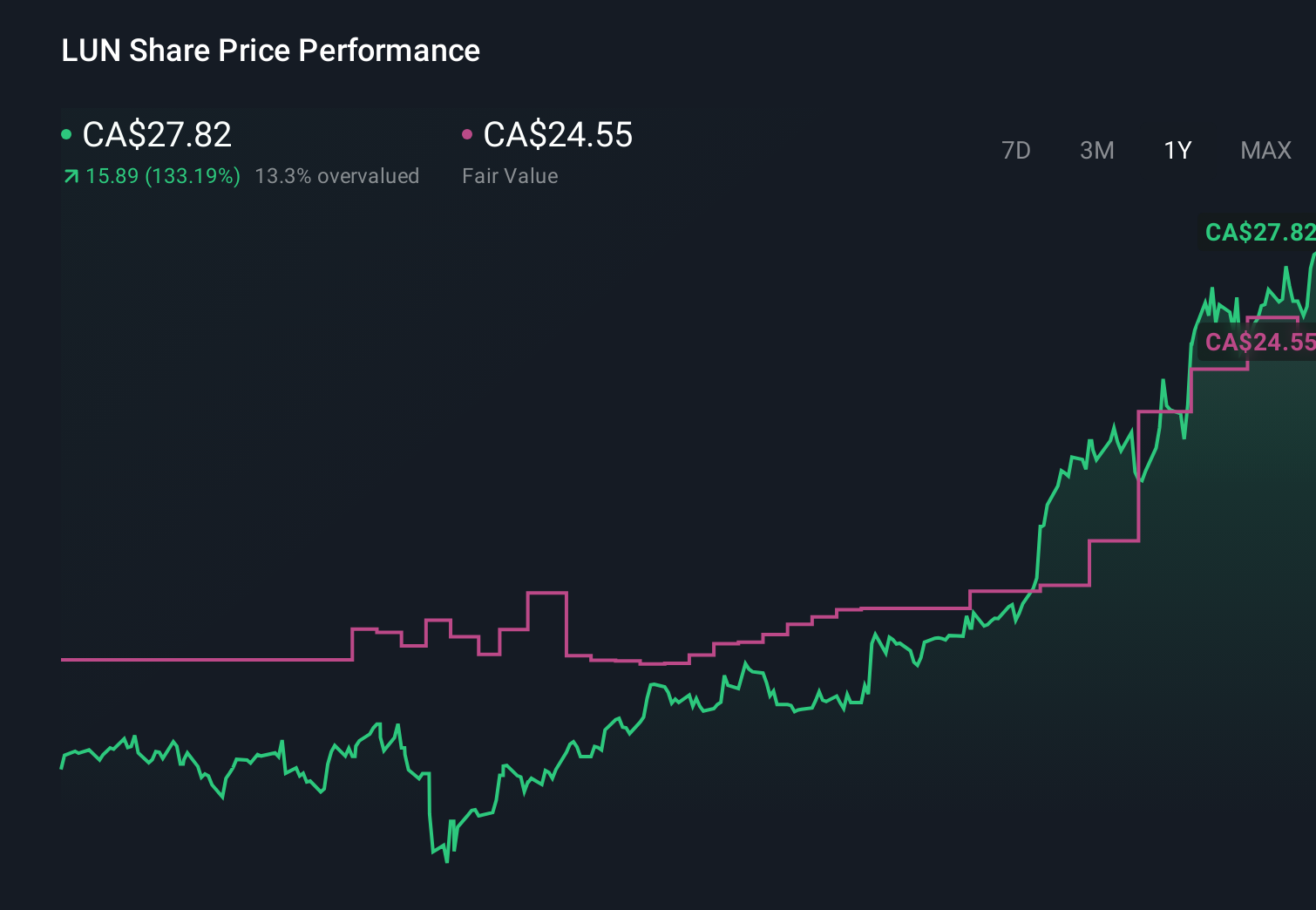

Uncover how Lundin Mining's forecasts yield a CA$24.55 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range widely, from C$1.83 to C$27.39 per share, showing how sharply opinions can differ. Against that backdrop, the concentration of Lundin’s revenues and production in South America remains a central issue for the company’s resilience and is worth comparing across these different views.

Explore 6 other fair value estimates on Lundin Mining - why the stock might be worth less than half the current price!

Build Your Own Lundin Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lundin Mining research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Lundin Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lundin Mining's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报