Rocket Pharmaceuticals Leads Our Trio Of Penny Stock Contenders

As the year draws to a close, U.S. markets are experiencing volatility, with major indexes closing lower amid concerns about an AI bubble and looming economic reports. In such a climate, investors often look beyond the large-cap stocks dominating headlines to explore opportunities in lesser-known areas like penny stocks. While the term "penny stocks" may seem outdated, it continues to signify smaller or emerging companies that could offer significant value when backed by strong financials and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.28 | $439.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.13 | $531.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.19 | $1.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.73 | $179.25M | ✅ 5 ⚠️ 0 View Analysis > |

| CI&T (CINT) | $4.80 | $614.03M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.37 | $365.95M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89 | $6.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.96 | $91.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 340 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Rocket Pharmaceuticals (RCKT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rocket Pharmaceuticals, Inc. is a late-stage biotechnology company specializing in developing gene therapies for rare and devastating diseases in the United States, with a market cap of approximately $369.04 million.

Operations: Rocket Pharmaceuticals does not report any revenue segments.

Market Cap: $369.04M

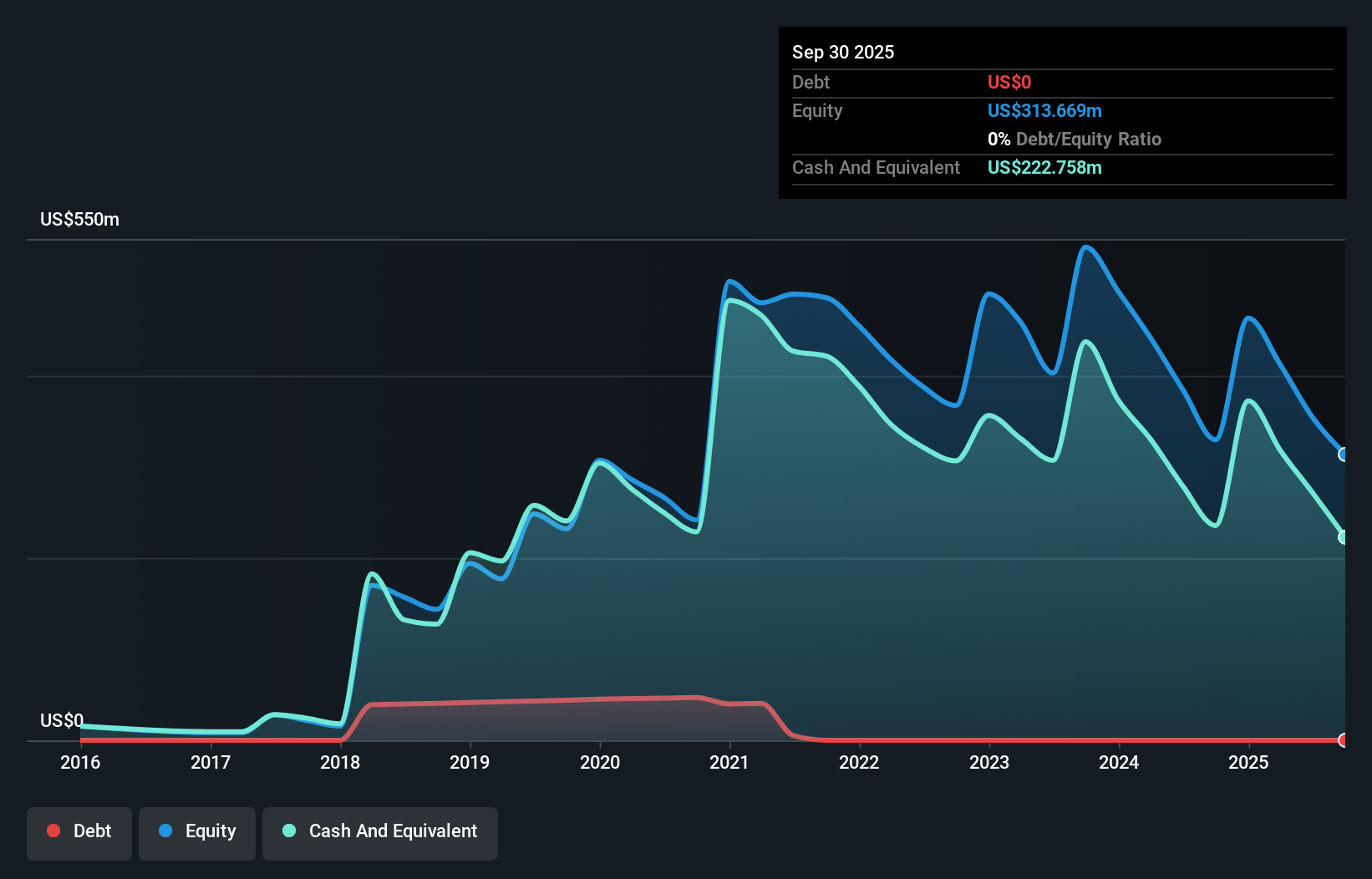

Rocket Pharmaceuticals, with a market cap of US$369.04 million, remains pre-revenue and unprofitable, though it has shown improvement in reducing its losses. The company is debt-free and has a cash runway of over a year. Recent developments include the FDA's acceptance of its BLA for KRESLADI™, with promising Phase 1/2 trial results indicating potential for approval by March 2026. However, Rocket withdrew another BLA for RP-L102 to focus on clearer regulatory paths but maintains the option to revisit this program through partnerships. The board is experienced, but management is relatively new.

- Navigate through the intricacies of Rocket Pharmaceuticals with our comprehensive balance sheet health report here.

- Understand Rocket Pharmaceuticals' earnings outlook by examining our growth report.

Cloopen Group Holding (RAAS.Y)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cloopen Group Holding Limited offers cloud-based communication solutions in the People's Republic of China, with a market cap of $99.35 million.

Operations: The company's revenue is derived from three segments: CPaaS (CN¥189.41 million), Cloud-Based CC (CN¥268.08 million), and Cloud-Based UC&C (CN¥116.08 million).

Market Cap: $99.35M

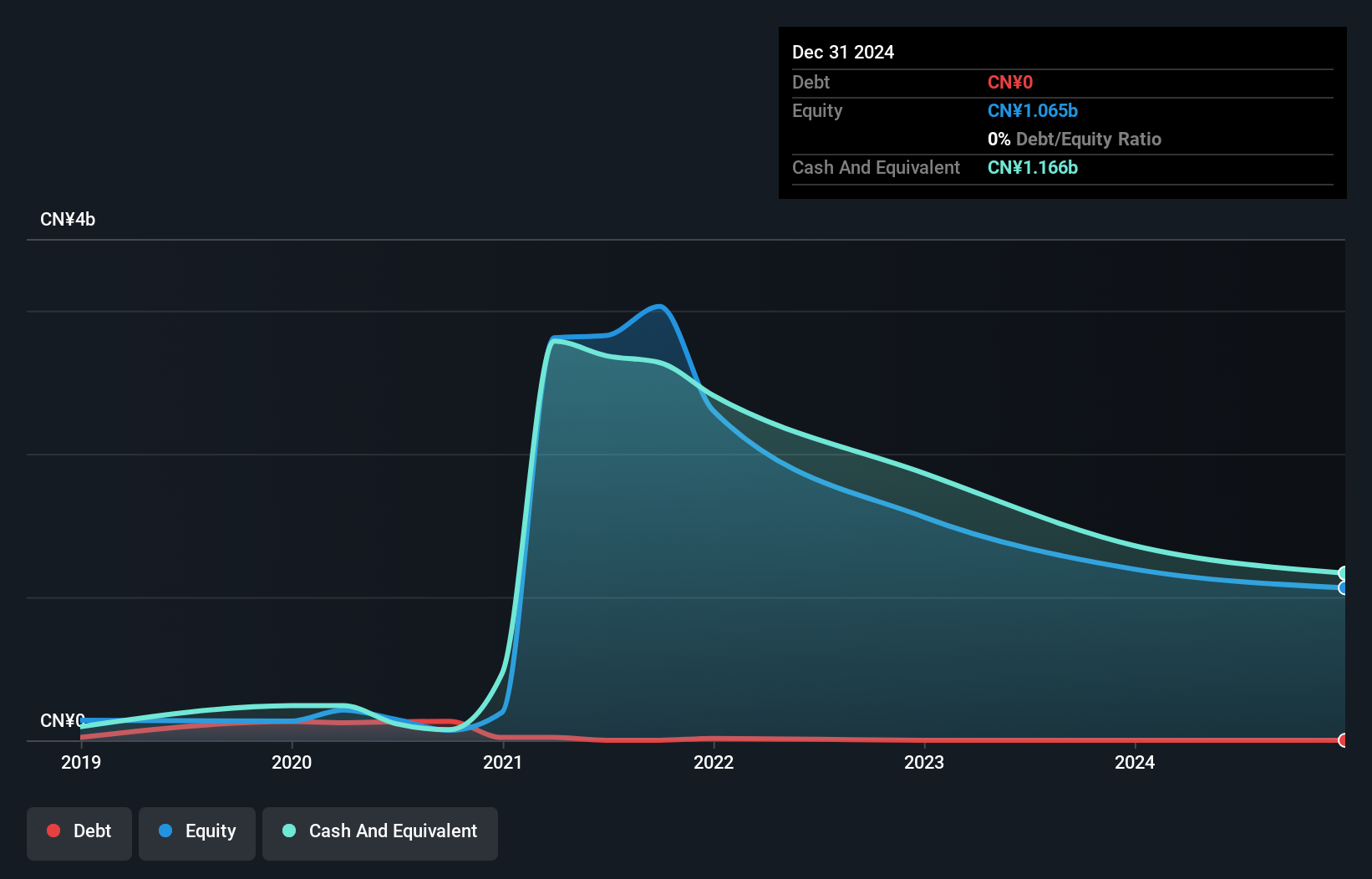

Cloopen Group Holding, with a market cap of US$99.35 million, operates in China's cloud communication sector and is currently unprofitable. The company generates revenue from its CPaaS (CN¥189.41 million), Cloud-Based CC (CN¥268.08 million), and Cloud-Based UC&C (CN¥116.08 million) segments. Despite being debt-free and having short-term assets exceeding liabilities, Cloopen's share price remains highly volatile, with weekly volatility still higher than most US stocks despite recent improvements. The management team is experienced; however, the board's average tenure suggests limited experience at the company level, potentially impacting strategic decision-making amidst ongoing financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Cloopen Group Holding.

- Examine Cloopen Group Holding's past performance report to understand how it has performed in prior years.

Key Takeaways

- Discover the full array of 340 US Penny Stocks right here.

- Ready For A Different Approach? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报