Does Zoom’s AI Expansion Justify Its 2025 Valuation After a 78.5% Five Year Slump?

- If you are wondering whether Zoom Communications at around $87.91 is still a post pandemic fad or a quietly mispriced opportunity, this breakdown is for you if you are trying to figure out whether the current share price lines up with the company’s real value.

- Despite a brutal 5 year drawdown of about 78.5%, the stock has crept back into positive territory with a 7.8% gain year to date and a modest 3.9% rise over the last 12 months, which suggests sentiment may be slowly turning.

- Recently, investors have been digesting a mix of headlines around Zoom expanding beyond video calls into broader collaboration tools, AI driven productivity features and tighter integrations with enterprise software ecosystems. At the same time, commentary about rising competition, pricing pressure and the long term durability of remote work has limited how aggressively the market is willing to re rate the stock.

- Right now, Zoom scores a solid 5 out of 6 on our valuation checks. This means most of our traditional metrics point to the shares being undervalued. In the rest of this article we unpack those methods, then finish by looking at a more powerful way to think about valuation that ties the numbers back to Zoom’s evolving story.

Approach 1: Zoom Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Zoom Communications is expected to generate in the future and then discounts those projections back into today’s dollars to estimate what the business is worth right now.

Zoom currently generates about $1.94 billion in free cash flow, and analysts plus Simply Wall St’s extrapolations see this rising to roughly $2.53 billion by 2035. In the near term, analyst forecasts point to free cash flow staying close to today’s levels, with modeled growth gradually compounding over the next decade as the collaboration and AI product stack matures.

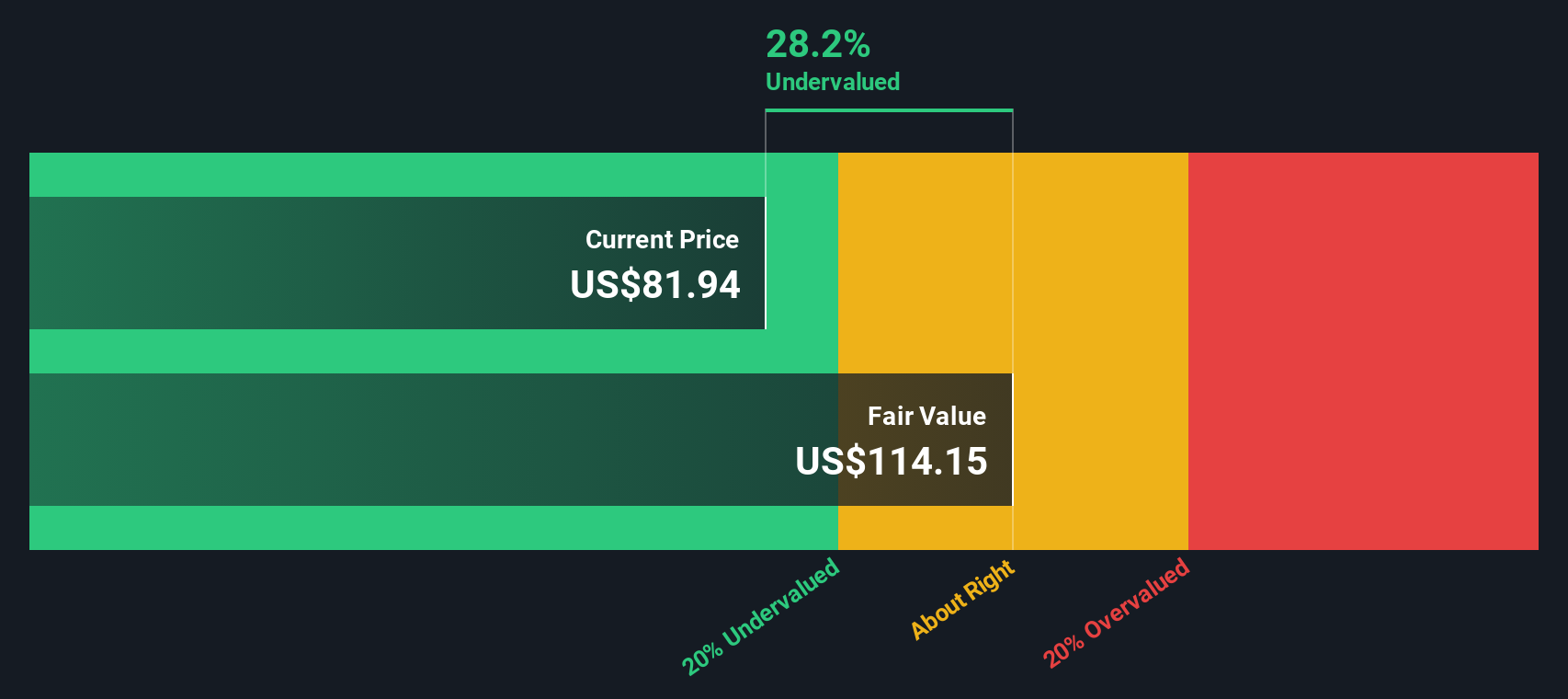

Feeding these cash flow projections into a 2 Stage Free Cash Flow to Equity model produces an estimated intrinsic value of about $123.17 per share. Compared with a recent share price near $87.91, the DCF implies the stock is trading at roughly a 28.6% discount to its modeled fair value, which indicates the market may remain skeptical about the durability of those future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zoom Communications is undervalued by 28.6%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: Zoom Communications Price vs Earnings

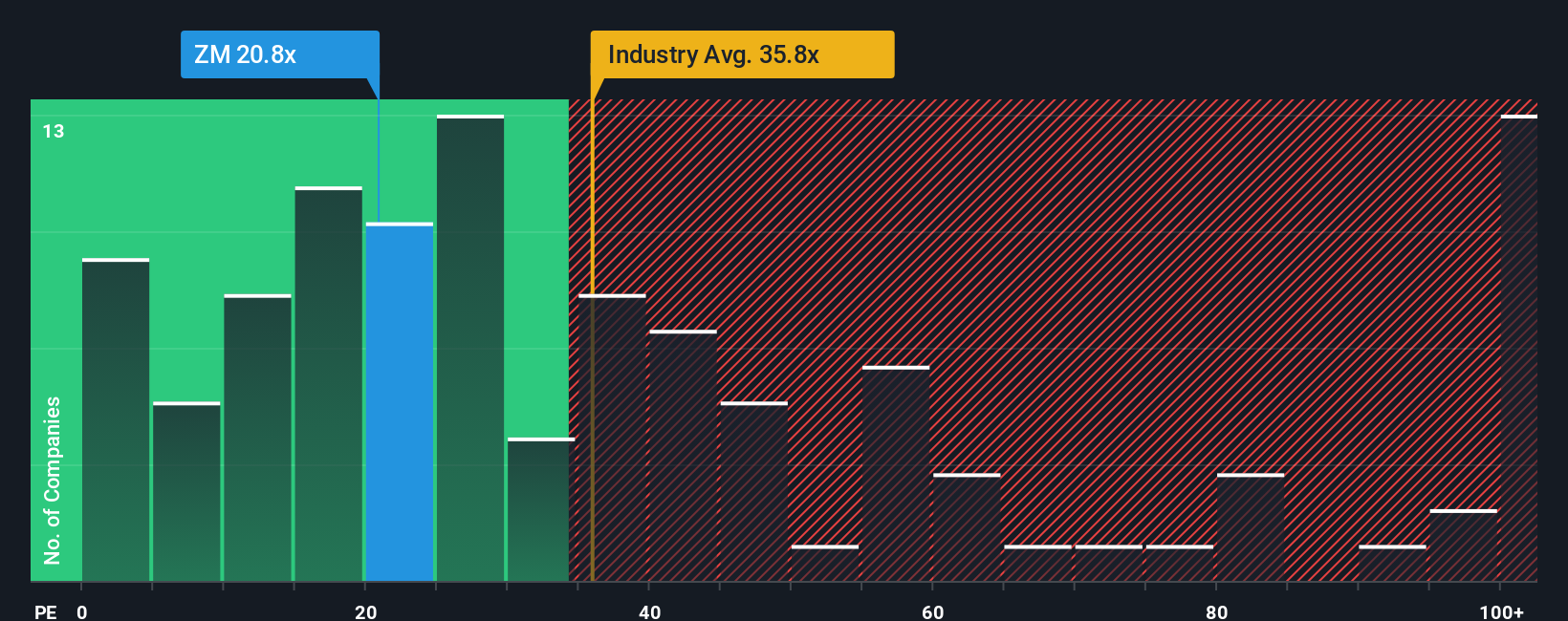

For profitable companies like Zoom Communications, the price to earnings ratio is a practical way to gauge how much investors are willing to pay today for each dollar of current earnings. In broad terms, higher expected growth and lower perceived risk justify a higher PE multiple, while slower growth or more uncertainty usually pull that multiple down.

Zoom currently trades on a PE of about 16.3x, well below both the Software industry average of roughly 32.7x and the broader peer group average near 83.5x. At face value, that gap suggests the market is pricing Zoom more conservatively than many software names. However, simply comparing to peers can be misleading because it ignores differences in growth, profitability, size and risk.

This is where Simply Wall St’s Fair Ratio comes in. For Zoom, the Fair PE Ratio is estimated at around 24.2x, reflecting its specific blend of earnings growth prospects, margins, industry dynamics, scale and risk profile. Because this Fair Ratio is tailored to the company, it offers a more nuanced benchmark than raw peer or industry comparisons. Lining that up against the current 16.3x multiple indicates the shares may be undervalued on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zoom Communications Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, which are simple stories you build around a company that connect your view of its future revenue, earnings and margins to a clear fair value estimate. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to translate their qualitative view of a business into a structured financial forecast, and then compare that fair value with today’s share price to decide whether to buy, hold or sell. Because Narratives are dynamically updated when fresh information like earnings releases, product news or macro shifts comes through, your story and valuation can evolve in real time instead of being locked to a static model. For Zoom Communications, one investor might build a bullish Narrative that leans into accelerating AI adoption, partner first expansion and rising margins to justify a fair value closer to the optimistic 115 dollar target. Another may focus on competition, muted growth and monetization risks to anchor nearer the cautious 67 dollar view, and both perspectives can be tracked and refined as new data arrives.

Do you think there's more to the story for Zoom Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报