3 European Growth Companies With Insider Ownership Expecting Up To 123% Earnings Growth

As the European markets navigate a mixed performance, with indices like Germany's DAX showing gains while others like France's CAC 40 experience declines, investors are closely watching economic indicators and central bank policies for guidance. In this environment of cautious optimism and potential rate hikes by the European Central Bank, growth companies with significant insider ownership can be particularly appealing due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

We're going to check out a few of the best picks from our screener tool.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Growth Rating: ★★★★☆☆

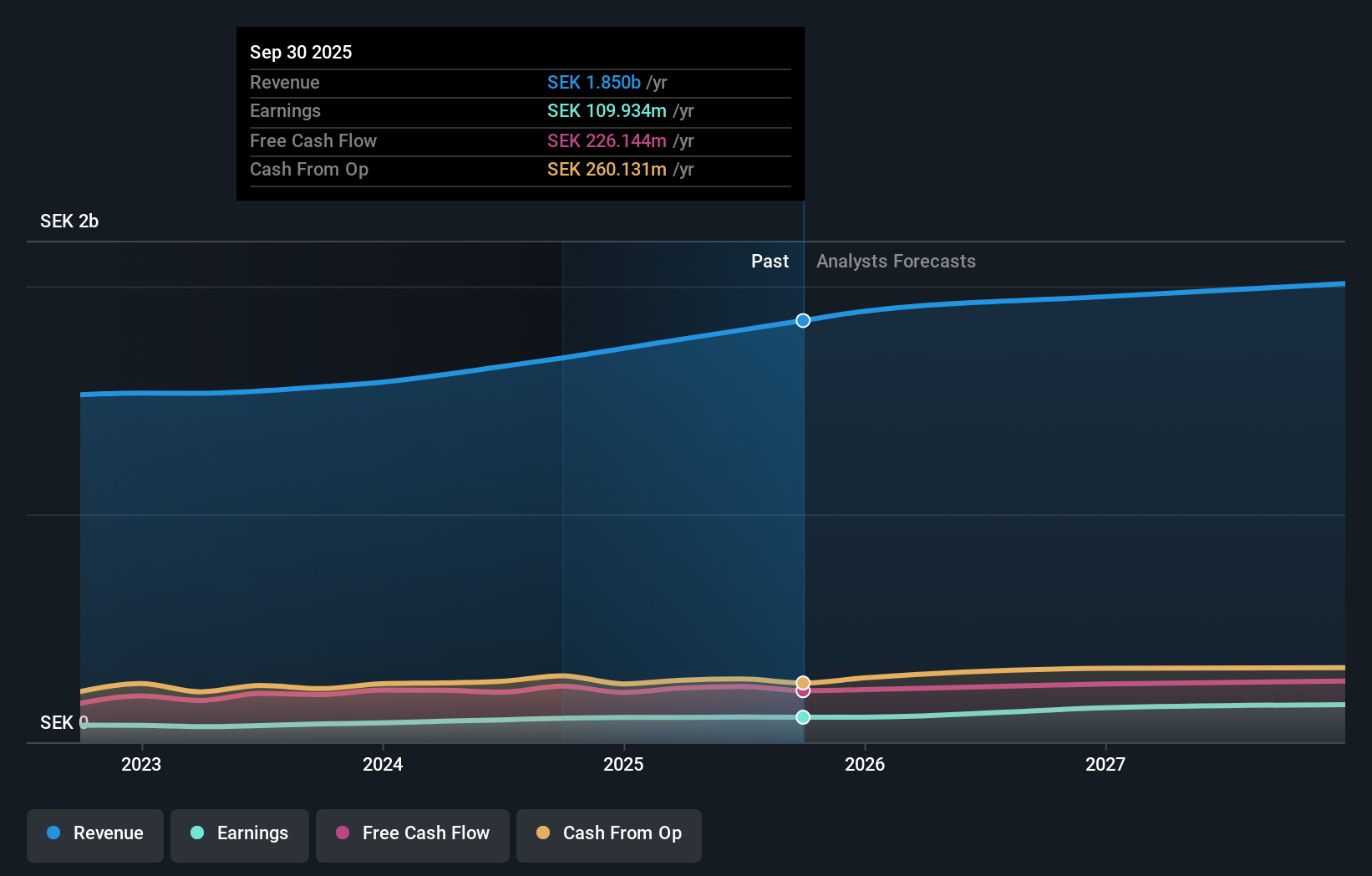

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK2.79 billion.

Operations: The company generates revenue primarily from its National Broadband Service segment, which amounts to SEK1.85 billion.

Insider Ownership: 26.3%

Earnings Growth Forecast: 20.1% p.a.

Bredband2 i Skandinavien demonstrates characteristics of a growth company with high insider ownership, trading significantly below its estimated fair value. Despite a modest recent earnings increase of 4.2%, the company's earnings are forecast to grow significantly at 20.09% annually, surpassing Swedish market expectations. While revenue growth is slower than the broader market, Bredband2 maintains a reliable dividend yield of 3.44%. Recent quarterly results show stable sales growth but slight net income decline year-over-year.

- Take a closer look at Bredband2 i Skandinavien's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Bredband2 i Skandinavien is priced lower than what may be justified by its financials.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hanza AB (publ) offers contract manufacturing solutions across various regions including Sweden, Finland, and North America with a market cap of SEK5.48 billion.

Operations: The company's revenue segments include Main Markets generating SEK3.30 billion, Other Markets contributing SEK2.27 billion, and Business Development and Services adding SEK32 million.

Insider Ownership: 33.4%

Earnings Growth Forecast: 44.4% p.a.

Hanza AB exemplifies growth potential with insider ownership contributing to its strategic direction. Recent earnings surged, with a net income of SEK 78 million in Q3 2025, and forecasted annual profit growth significantly outpacing the Swedish market. The company is expanding its manufacturing capacity in Finland and has secured a substantial order from the defense sector. Despite high debt levels and share price volatility, Hanza trades at a significant discount to its estimated fair value.

- Get an in-depth perspective on Hanza's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Hanza shares in the market.

Deutsche Beteiligungs (XTRA:DBAN)

Simply Wall St Growth Rating: ★★★★★☆

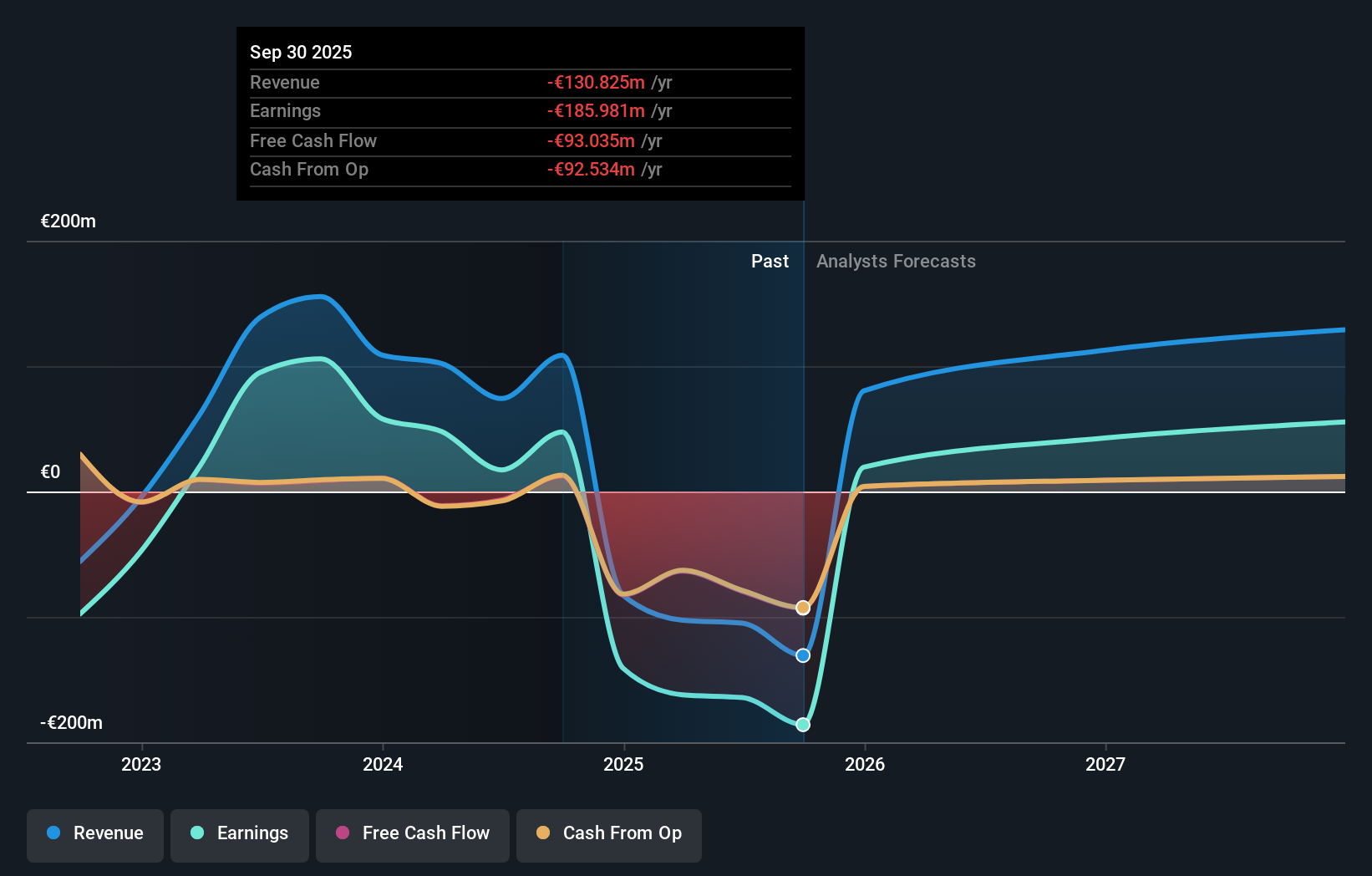

Overview: Deutsche Beteiligungs AG, based in Frankfurt am Main, Germany, is a private equity and venture capital firm with a market cap of €436.19 million.

Operations: The firm's revenue segments include Fund Investment Services generating €54.35 million and Private Equity Investments contributing -€185.42 million.

Insider Ownership: 30.5%

Earnings Growth Forecast: 123% p.a.

Deutsche Beteiligungs AG is positioned for growth, with forecasts indicating revenue expansion at 86.8% annually, significantly outpacing the German market. Despite recent earnings declines—reporting €54.84 million in revenue for nine months ending September 2025—the company is expected to become profitable within three years. However, its dividend yield of 4.04% isn't well-supported by current earnings or cash flows, and Return on Equity remains low at a forecasted 7.5%.

- Unlock comprehensive insights into our analysis of Deutsche Beteiligungs stock in this growth report.

- In light of our recent valuation report, it seems possible that Deutsche Beteiligungs is trading behind its estimated value.

Next Steps

- Investigate our full lineup of 211 Fast Growing European Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报