H2O America (HTO): Valuation Check as Long‑Time Chair Plans 2026 Retirement and CEO Walters Becomes Successor

H2O America (HTO) just mapped out its next chapter in boardroom leadership, with long serving non executive chair Eric W. Thornburg set to retire and CEO Andrew F. Walters stepping up.

See our latest analysis for H2O America.

The leadership handover comes as investors reassess the story, with a 7 day share price return of 5.97 percent lifting H2O America to 49.36 dollars, even though the 1 year total shareholder return remains negative and longer term performance has been weak. This suggests that momentum is tentatively rebuilding from a low base.

If this kind of steady utility story appeals to you, it might be worth seeing how it stacks up against other regulated players in healthcare stocks as you look for your next idea.

With earnings growing double digits, the stock still about 26 percent below consensus targets and long term returns lagging, is H2O America quietly undervalued, or is the market already baking in a brighter future?

Most Popular Narrative Narrative: 20.0% Undervalued

With the narrative fair value sitting well above H2O America's last close, the story leans toward upside potential built on steady, compounding fundamentals.

The company's robust five year capital plan is expected to maintain reliable service and high quality water, potentially supporting future earnings growth through strategic investments. The ongoing and planned implementation of advanced metering infrastructure is projected to reduce operational costs and improve billing accuracy, which could positively affect net margins.

Curious how steady tariff backed revenue, rising margins and a richer future earnings multiple all combine into that upside view? Want to see the full playbook behind this fair value math?

Result: Fair Value of $61.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising production costs and ongoing drought in Texas could squeeze margins and slow growth, which may challenge the case for a higher earnings multiple.

Find out about the key risks to this H2O America narrative.

Another Angle On Value

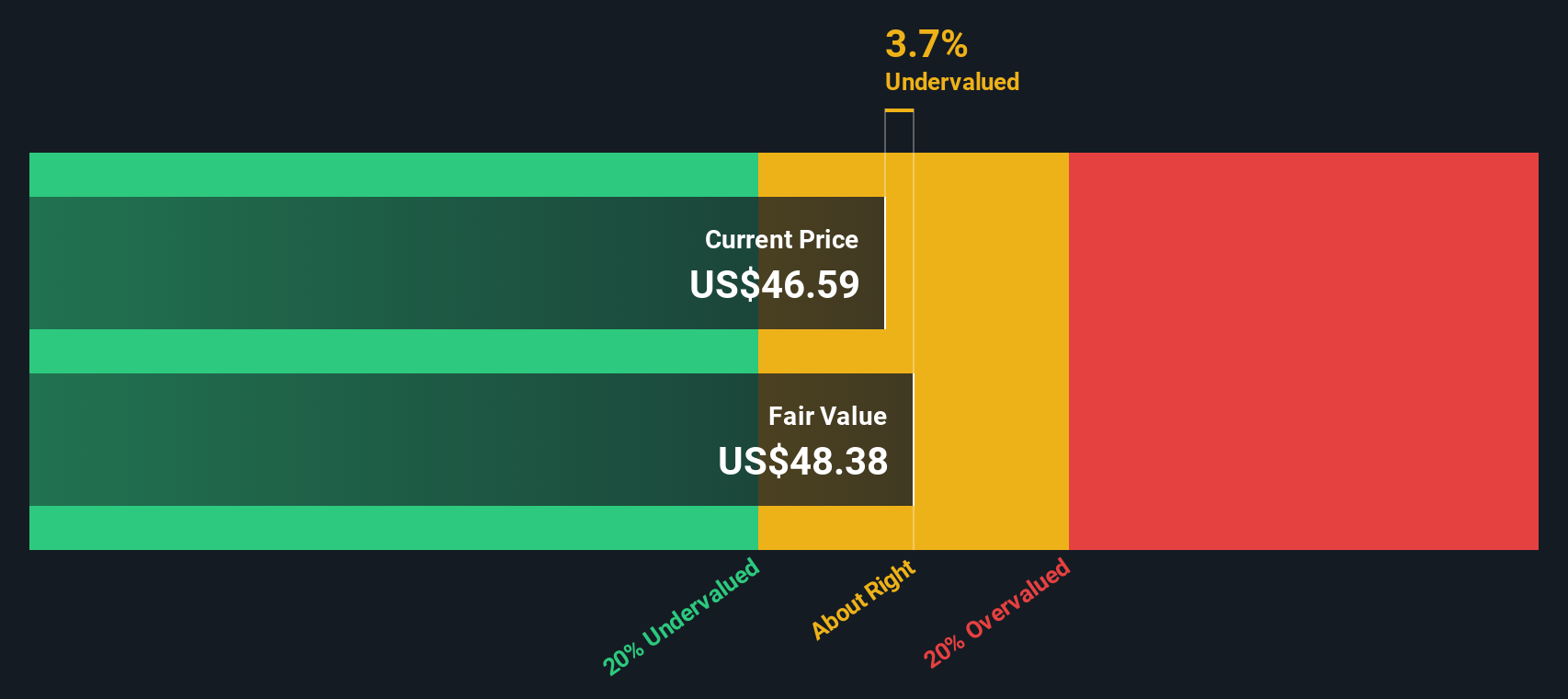

While the narrative fair value points to upside, our SWS DCF model is more cautious, putting fair value around 48.69 dollars versus the 49.36 dollars share price today. This implies H2O America is slightly overvalued. Which story do you trust more, the cash flows or the consensus narrative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out H2O America for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own H2O America Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a fresh view in minutes using Do it your way.

A great starting point for your H2O America research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, line up fresh stock ideas with solid numbers, clear themes and potential catalysts using our Screener.

- Explore potential market mispricing by targeting companies that look inexpensive on cash flows with these 915 undervalued stocks based on cash flows that may be positioned for a rerating.

- Focus on structural developments in medicine by looking at innovators powered by algorithms and data through these 30 healthcare AI stocks.

- Filter for companies with a record of paying dividends using these 13 dividend stocks with yields > 3% that currently offer yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报