Top Dividend Stocks In Global Market To Consider

Amid a backdrop of fluctuating global markets, where U.S. indices have seen mixed performances and central banks are adjusting interest rates in response to economic signals, investors are increasingly looking towards stable income sources like dividend stocks. In such dynamic conditions, strong dividend stocks can offer a reliable stream of income, appealing to those seeking stability amidst economic uncertainties and evolving market trends.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.64% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.82% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.96% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.62% | ★★★★★★ |

| NCD (TSE:4783) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.76% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.33% | ★★★★★★ |

Click here to see the full list of 1330 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

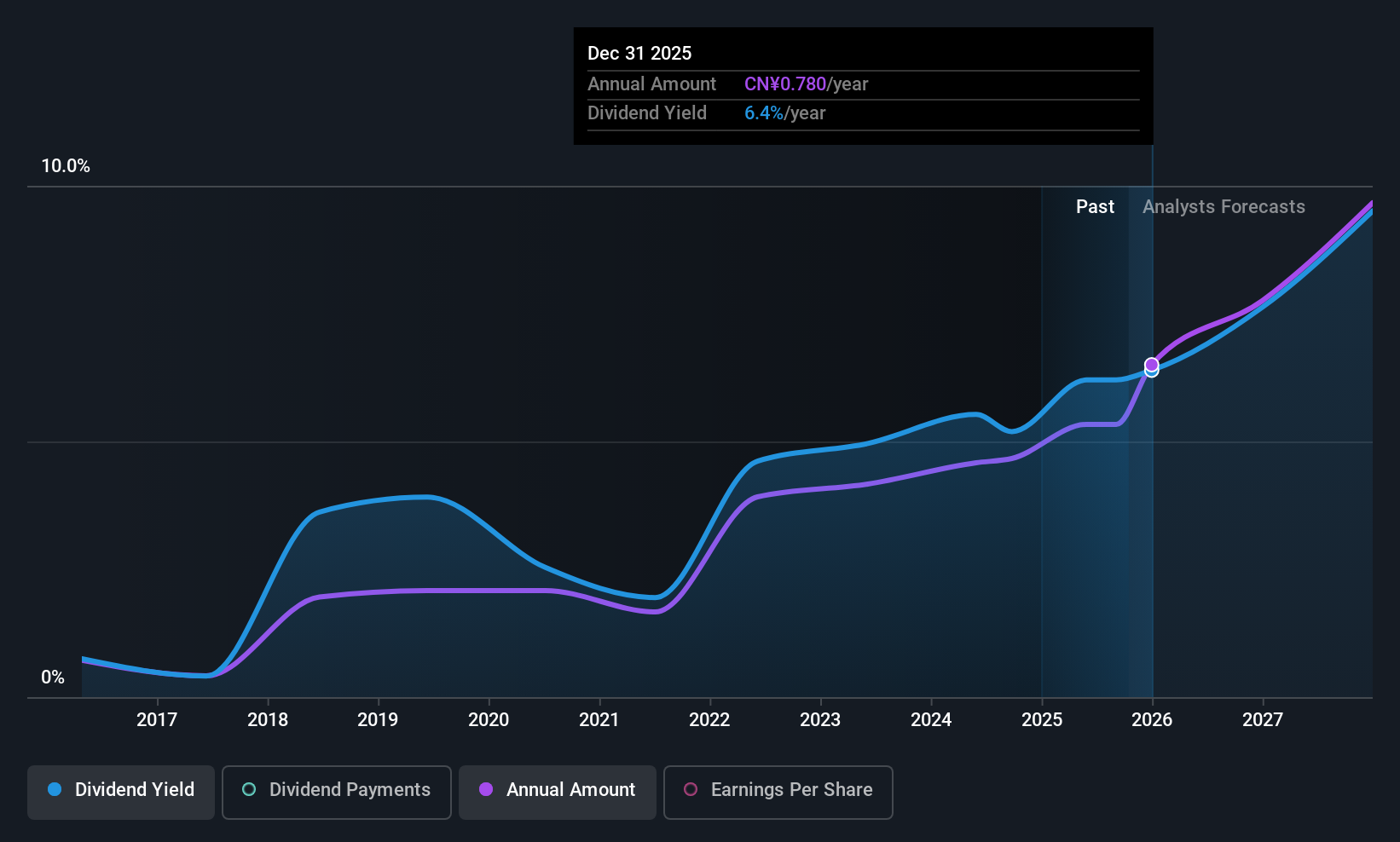

DeHua TB New Decoration MaterialLtd (SZSE:002043)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DeHua TB New Decoration Material Co., Ltd specializes in the production and sale of environmentally friendly furniture panels both within China and internationally, with a market cap of CN¥11.17 billion.

Operations: DeHua TB New Decoration Material Co., Ltd generates its revenue primarily through the production and sale of eco-friendly furniture panels.

Dividend Yield: 4.5%

DeHua TB New Decoration Material Ltd. offers a compelling dividend yield of 4.47%, placing it in the top 25% of CN market payers, with dividends well-covered by earnings (66.4%) and cash flows (48.8%). Despite an unstable dividend history over the past decade, recent earnings growth—net income rose to CNY 629.29 million—supports sustainability prospects. Trading below estimated fair value enhances its appeal for value-conscious investors seeking dividend income amidst volatile payment patterns.

- Unlock comprehensive insights into our analysis of DeHua TB New Decoration MaterialLtd stock in this dividend report.

- Our expertly prepared valuation report DeHua TB New Decoration MaterialLtd implies its share price may be lower than expected.

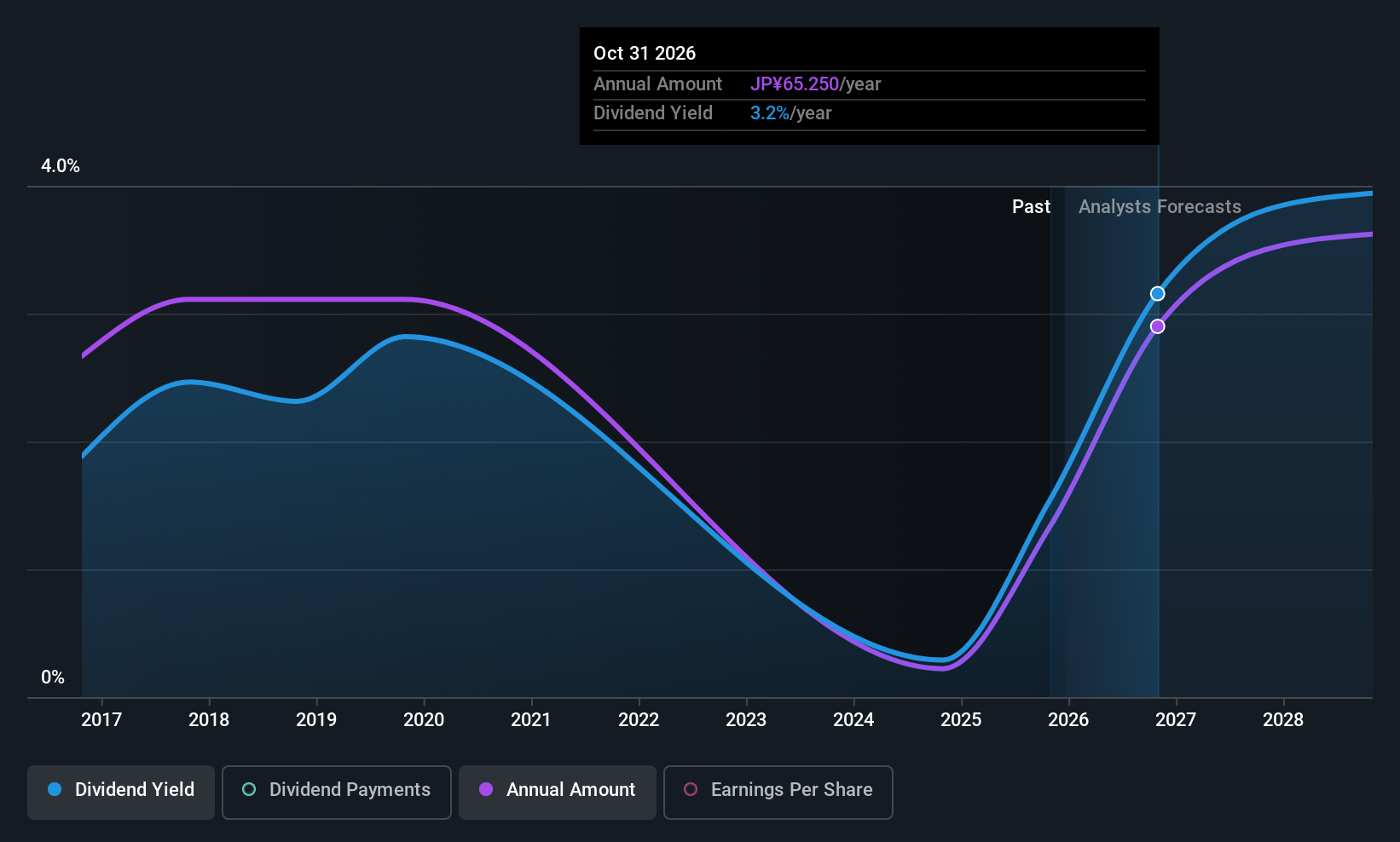

PARK24 (TSE:4666)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PARK24 Co., Ltd. operates and manages parking sites in Japan, the United Kingdom, and internationally, with a market cap of ¥362.07 billion.

Operations: PARK24 Co., Ltd.'s revenue segments include the operation and management of parking sites across Japan, the United Kingdom, and other international locations.

Dividend Yield: 3%

PARK24's dividend yield of 3.05% lags behind the top 25% in Japan, with dividends well-covered by earnings (32.2%) and cash flows (63.8%). Despite a volatile and unreliable dividend history, recent board decisions to repay a ¥50 billion loan may improve financial stability. Analysts expect stock price growth, supported by earnings forecasted to increase by 15.46% annually, although high debt levels remain a concern for potential investors focusing on dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of PARK24.

- Our expertly prepared valuation report PARK24 implies its share price may be too high.

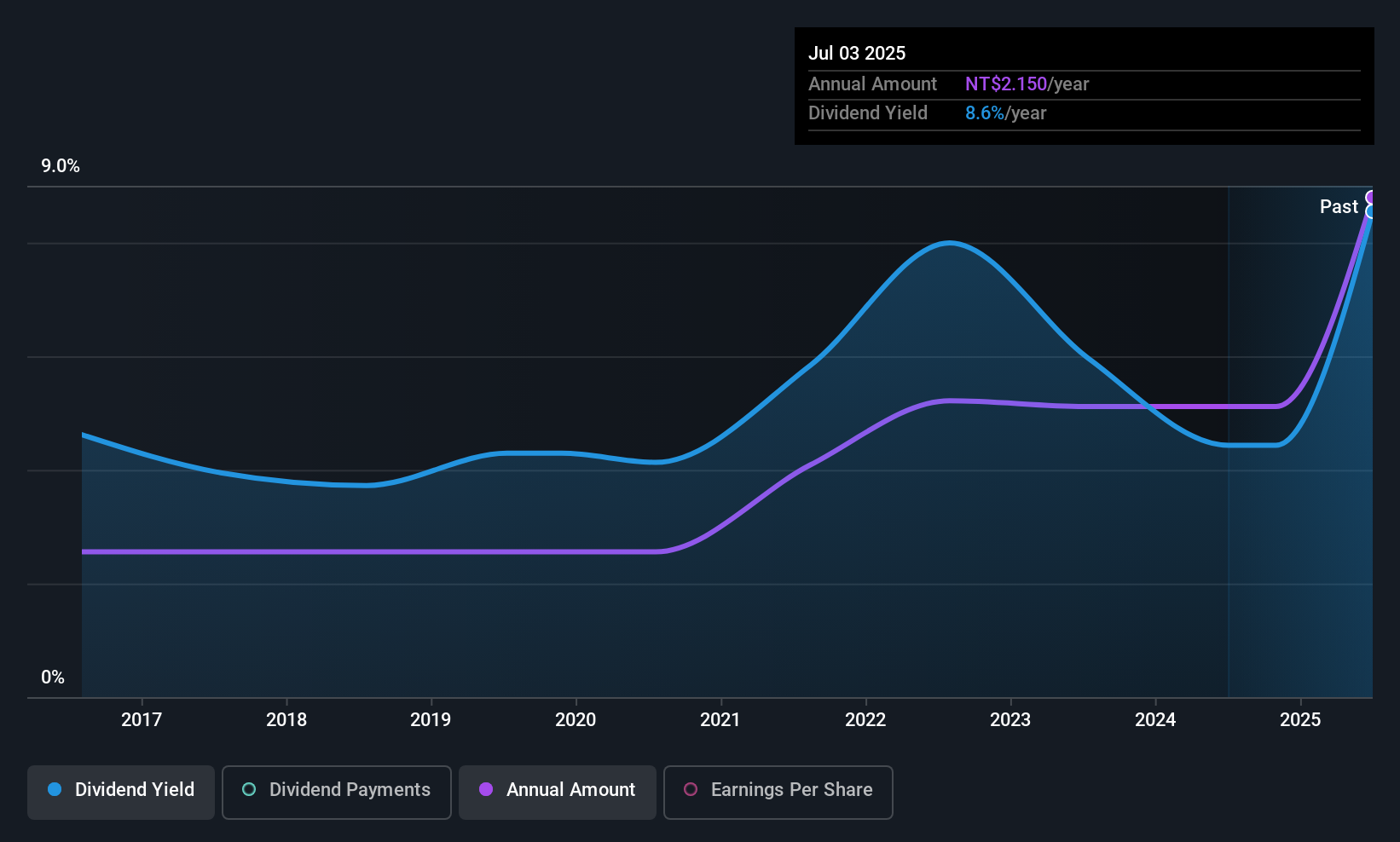

Chien Kuo Construction (TWSE:5515)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chien Kuo Construction Co., Ltd. operates in the construction industry across Taiwan and China, with a market capitalization of NT$6.83 billion.

Operations: Chien Kuo Construction Co., Ltd. generates its revenue from the construction segment, amounting to NT$7.24 billion.

Dividend Yield: 6.1%

Chien Kuo Construction offers a robust dividend yield of 6.07%, placing it in the top 25% of Taiwan's market. The company has maintained stable and growing dividends over the past decade, supported by a payout ratio of 55.4% and cash payout ratio of 54.1%. Recent earnings growth is notable, with third-quarter net income rising to TWD 446.04 million from TWD 157.73 million year-on-year, enhancing dividend sustainability prospects for investors seeking reliable income streams.

- Click here and access our complete dividend analysis report to understand the dynamics of Chien Kuo Construction.

- The analysis detailed in our Chien Kuo Construction valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Gain an insight into the universe of 1330 Top Global Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报