Reassessing ACV Auctions (ACVA) Valuation After Jefferies’ Downgrade to Hold

Jefferies Downgrade Nudges Investors to Reassess ACV Auctions

Jefferies just moved ACV Auctions (ACVA) from Buy to Hold, a shift that cools the tone around the stock even as broader analyst sentiment stays positive on the company’s long term potential.

See our latest analysis for ACV Auctions.

The Jefferies downgrade comes after a volatile stretch for ACV Auctions, with a 30 day share price return of 28.21 percent but a steep year to date share price decline of 61.8 percent, suggesting momentum is trying to rebuild after a tough year.

If this kind of rebound story has your attention, it could be a good moment to explore fast growing stocks with high insider ownership as you look for other high potential ideas.

With the stock now trading well below both its recent highs and the Street’s average price target, investors face a key question: Is ACV Auctions undervalued after this selloff, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 23.0% Undervalued

With ACV Auctions closing at $8 against a narrative fair value near $10.38, the story hinges on whether its digital flywheel really scales.

The ongoing integration of advanced AI and machine learning into ACV's vehicle inspection, pricing, and guarantee products positions the platform to further differentiate itself by offering real-time, highly accurate, and transparent transaction solutions, this is expected to continue driving above-industry growth in auction volumes, increase take rates, and support margin expansion.

Curious how ambitious growth, rising margins, and a premium future earnings multiple can still point to upside from here? The narrative numbers may surprise you.

Result: Fair Value of $10.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer dealer volumes and a slower ramp up of new initiatives could delay revenue acceleration and pressure margins, which would challenge the upside case.

Find out about the key risks to this ACV Auctions narrative.

Another Lens On Value

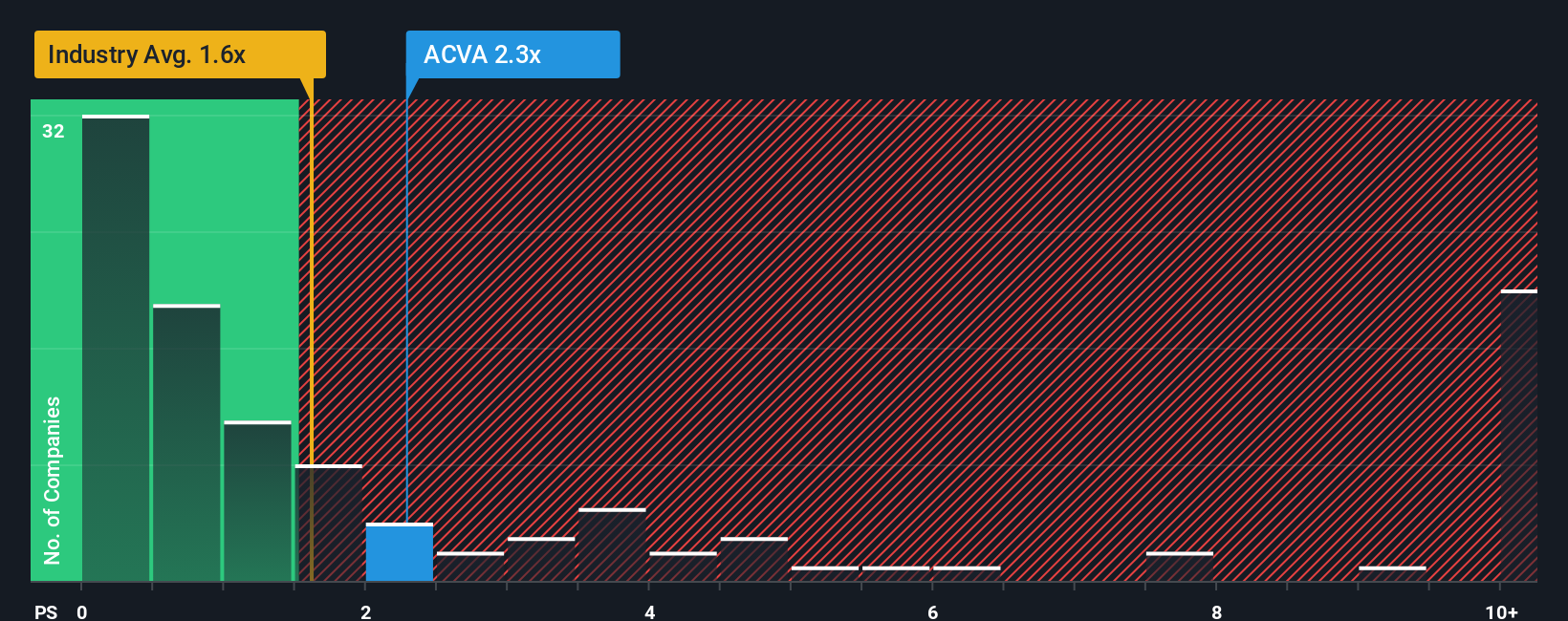

On sales based metrics, ACV Auctions looks pricey, trading at 1.9 times revenue versus about 1.2 times for both peers and the wider Commercial Services group, and above a 1.1 times fair ratio that the market could drift toward. Is investors’ growth optimism really worth that premium risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If you see things differently or want to stress test the assumptions yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want to stay ahead of the next move, not chase it? Use the Simply Wall St screener now to uncover stocks that match your exact strategy.

- Capture early-stage growth stories before the crowd by scanning these 3625 penny stocks with strong financials with improving fundamentals and real business traction.

- Tap into the AI revolution in medicine by targeting these 30 healthcare AI stocks that blend clinical impact with scalable software economics.

- Focus on these 13 dividend stocks with yields > 3% delivering income potential above 3 percent yields to seek reliable cash returns while markets stay choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报