Weyerhaeuser (WY) Valuation Check After Aymium Biocarbon Venture and New 2030 Growth Plan

Weyerhaeuser (WY) just gave investors a fresh storyline by pairing its ambitious 2030 growth plan with a new Aymium partnership to supply sustainable biocarbon for metals production, a diversification play tightly linked to global decarbonization trends.

See our latest analysis for Weyerhaeuser.

Even with all this strategic activity, Weyerhaeuser’s share price at $23.28 reflects a tough stretch, with a year to date share price return of negative 16.8 percent and a one year total shareholder return of negative 18.1 percent, though the recent seven day share price gain above 5 percent hints that sentiment may be stabilizing rather than sliding further.

If you like the mix of hard assets and long term growth themes here, it could be worth exploring fast growing stocks with high insider ownership as potential next candidates for your watchlist.

With the stock trading at a double digit discount to both analyst targets and some intrinsic value estimates, despite clear 2030 growth ambitions, is this simply a lagging timber REIT or a mispriced decarbonization and housing recovery play?

Most Popular Narrative Narrative: 22.9% Undervalued

With Weyerhaeuser closing at 23.28 dollars versus a narrative fair value of 30.18 dollars, the valuation case leans heavily on future earnings power.

The analysts have a consensus price target of $33.083 for Weyerhaeuser based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.0, and the most bearish reporting a price target of just $29.0.

To unpack why slower revenue growth, thinner margins and a much richer future earnings multiple still point to upside potential, you can explore the full valuation playbook.

Result: Fair Value of $30.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated macro uncertainty and weaker housing activity, combined with China’s log import ban, could pressure lumber pricing and undercut the margin recovery narrative.

Find out about the key risks to this Weyerhaeuser narrative.

Another Angle on Valuation

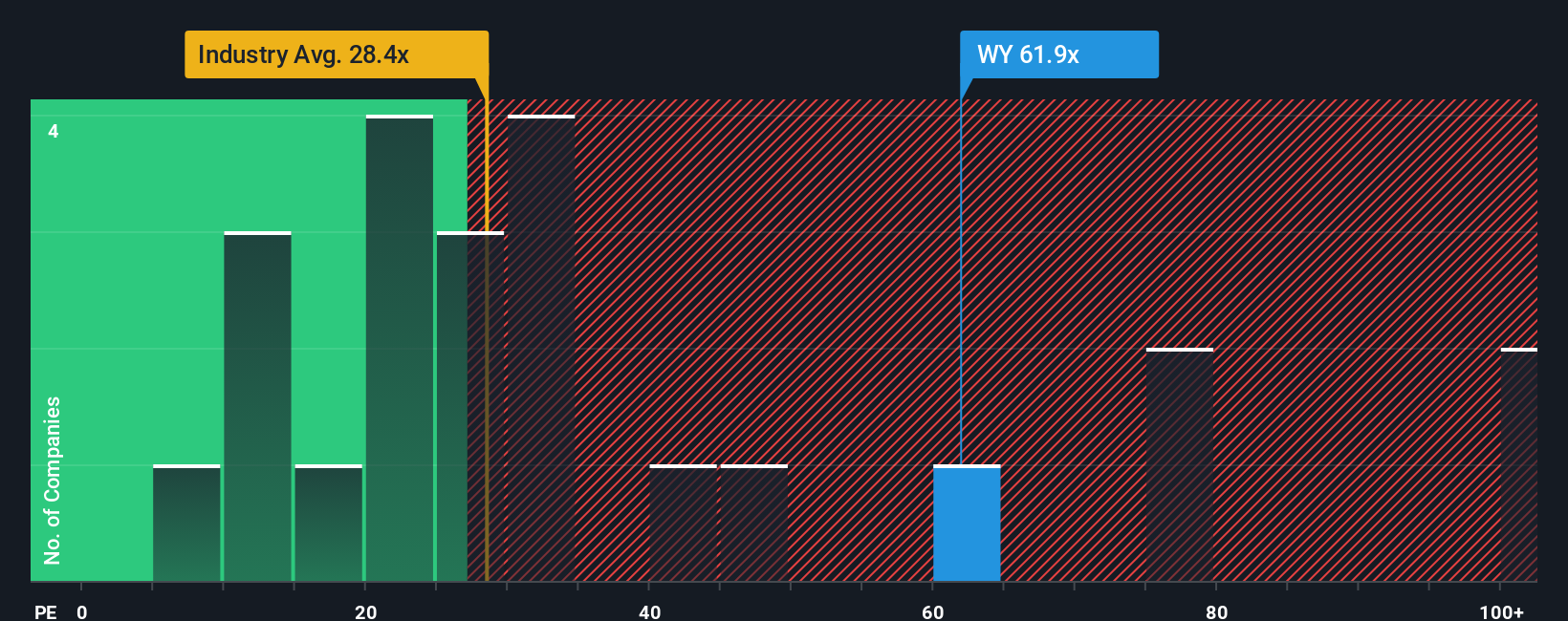

On earnings, the picture flips. Weyerhaeuser trades on a steep 50.7 times earnings versus 28.5 times for the US Specialized REITs industry and a fair ratio of 36.5 times, which highlights meaningful downside risk if sentiment normalizes faster than profits recover.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Weyerhaeuser Narrative

If this take does not quite match your view, or you would rather test the numbers yourself, you can build a custom storyline in minutes: Do it your way.

A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall Street Screener to uncover focused ideas that match your strategy before the market moves without you.

- Capture potential bargains early by scanning these 908 undervalued stocks based on cash flows that the market has yet to fully price in.

- Ride powerful digital trends by targeting these 80 cryptocurrency and blockchain stocks positioned at the front line of blockchain innovation and adoption.

- Strengthen your income stream by filtering for these 13 dividend stocks with yields > 3% that can support reliable cash returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报